Aftermaket Thoughts March 14

Trying something new again, let's see how this goes. I will simply give my thoughts on the day and share some stocks iam in.

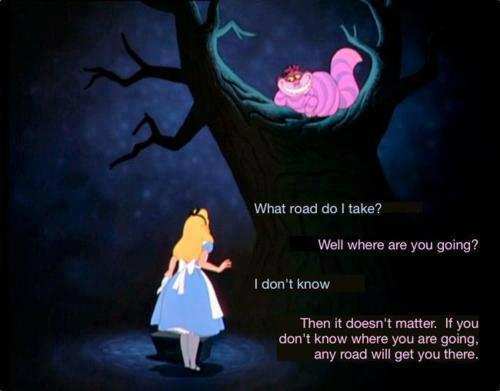

A thought so good it's worth sharing again (plus you can correlate it to my earlier post by picture 😆)

If you don't know where you want to go, you're already lost. And money is not a destination. It's a result of work. It doesn't always have to be hard work. You could be lucky, but I'd rather put in the work with increased odds of success.

■ My thoughts on the markets today

Rough! 🐶 that was brutal if you were in almost anything, not energy

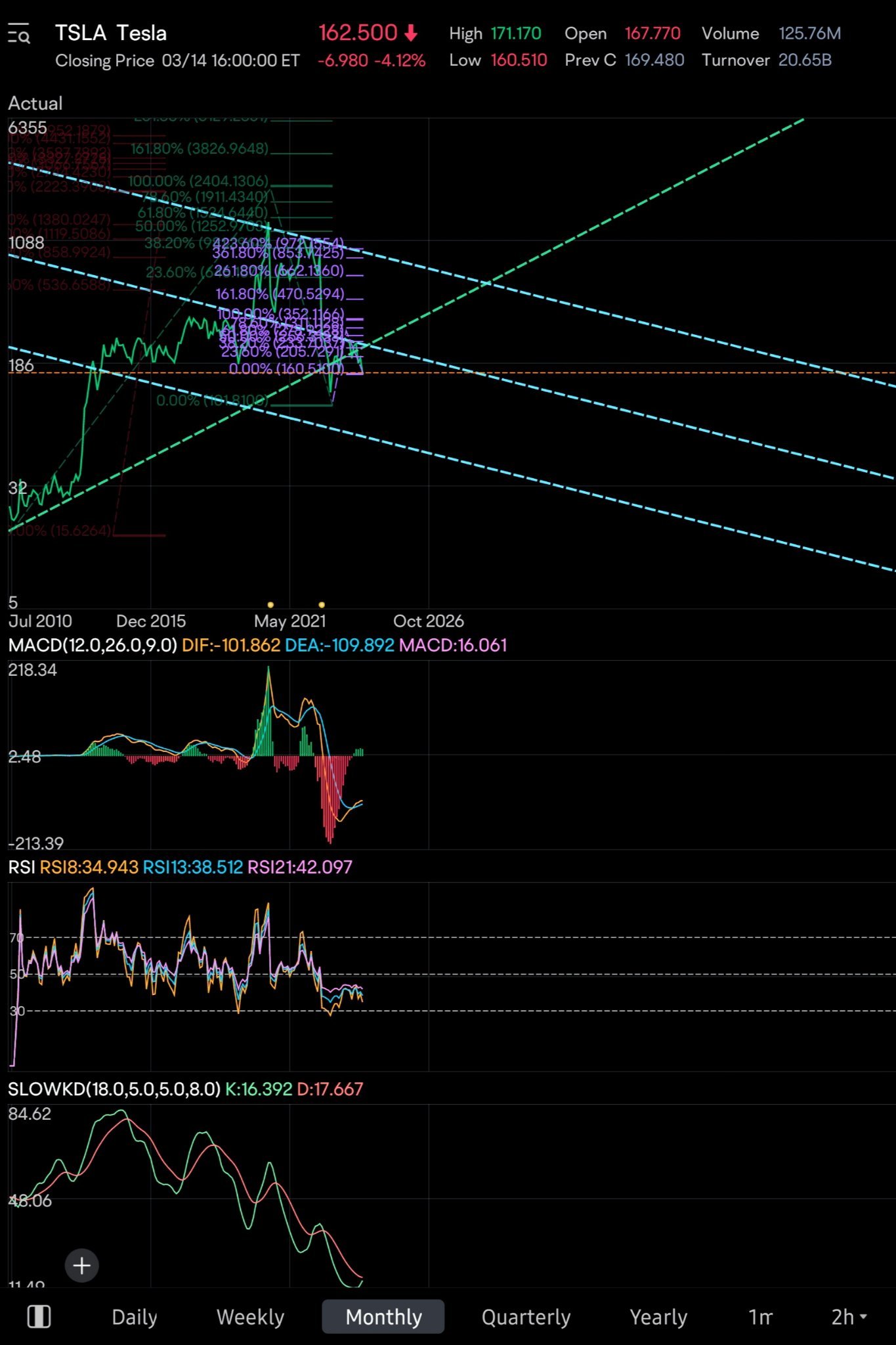

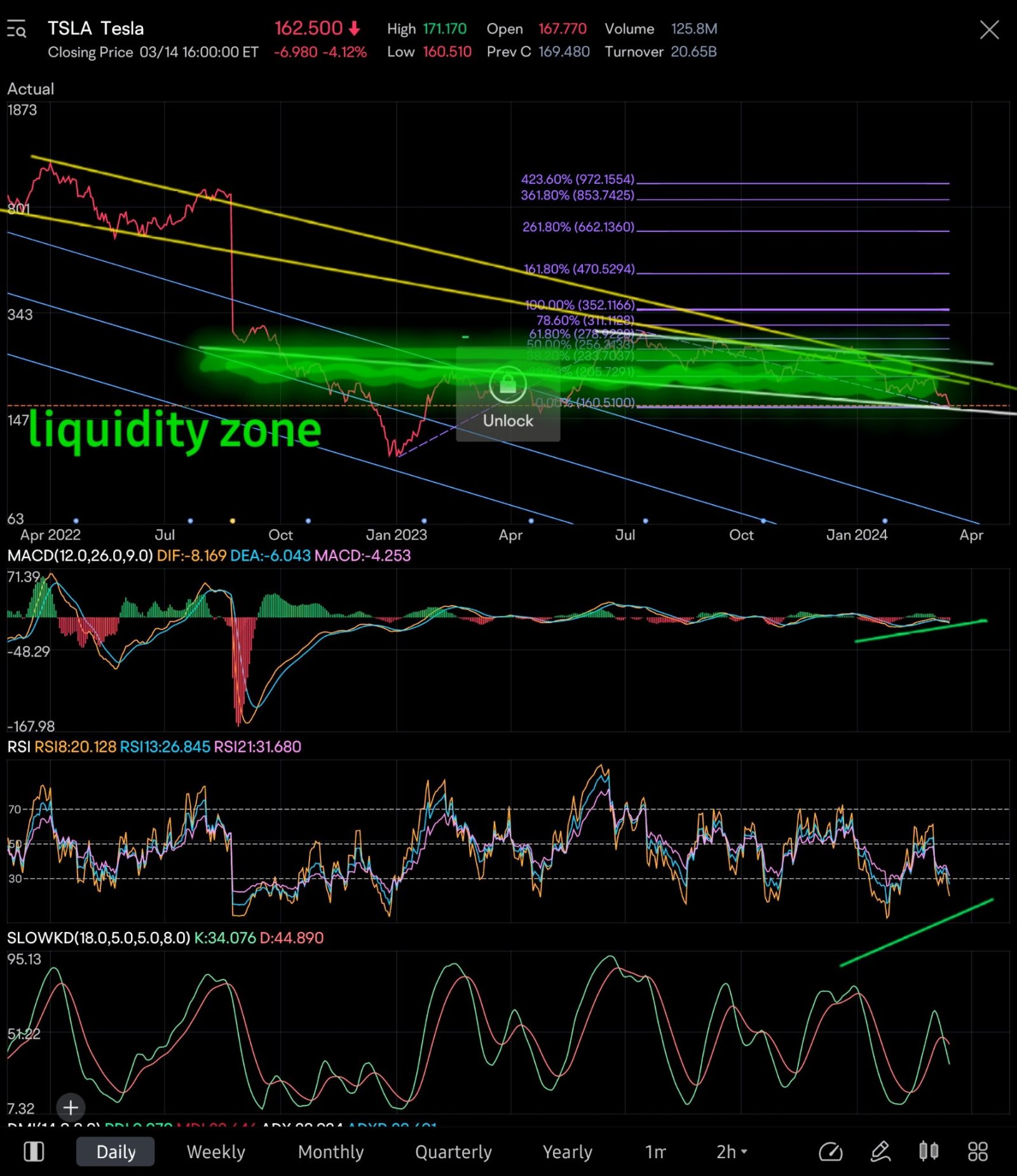

But it wasn't oh s* rough. Sure, we lost the 5 MA. but not enough to frighten me, yet. We dropped down, and I couldn't help it. I gobbled it up 🦃 I don't know why. 😕 🤷 I just wasn't sold on this movement. Plus, if you are going to offer me Tesla at 160s, I'm going to bite.

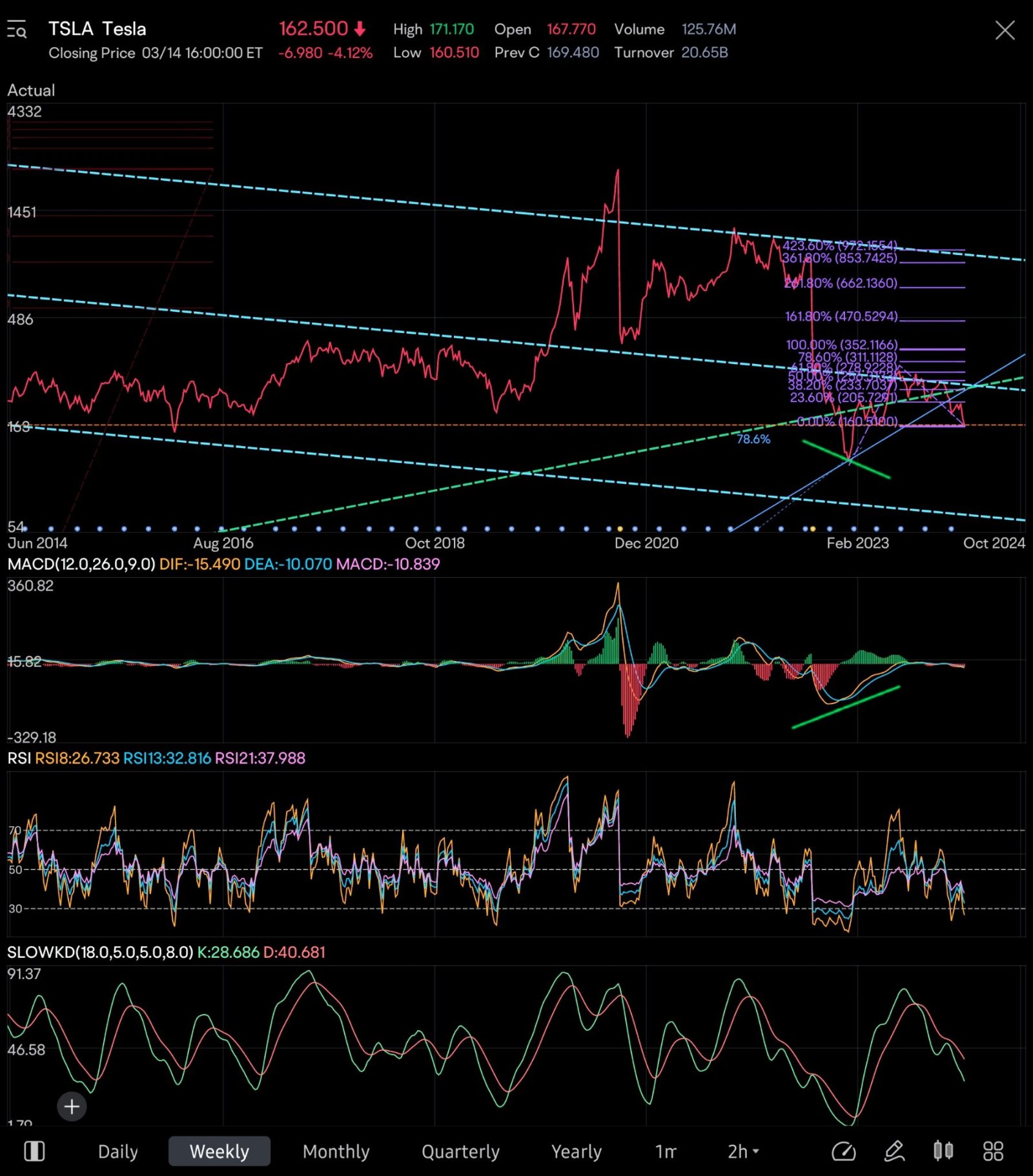

So let's start off with Tesla since obviously I bought more today.

I love Tesla. And i don't give a flying rip about the cars. Don't talk to me about them, i don't care. I have no issues with them, my friends have no issues. Plus, IT'S NOT a CAR COMPANY. It's an Elon company. It's the same reason I bought appl in the 90s, 2000s and 2008 during the crash

any time it dropped on anything bad or negative as long as Jobs was alive. "It's a computer company, and no one uses them anymore.", "All Jobs does is recycle bad ideas", "Jobs is too neurotic to be CEO", "Jobs has too many projects"

I was a fan of Jobs, then. im a fan of Elon now. They can have my money as long as I believe in them.

I have a substantial long position in tesla. I added to it. As with Apple and Jobs, I don't know or care what any catalyst may be. I know I want a part of whatever rabbit 🐇 comes out of that hat 🎩. It's called investing, and it can take time. ⏳️

Now, since there was a brief glimpse of appl (which I do NOT own) let's take a long look at the Qs

Weekly

We can keep squeezing up. And even with a pullback, another run is possible.

□ Some other stocks I bought today

I wanted to even out my Haliburton holdings. i trimmed some Haliburton and bought SLB and BKR.

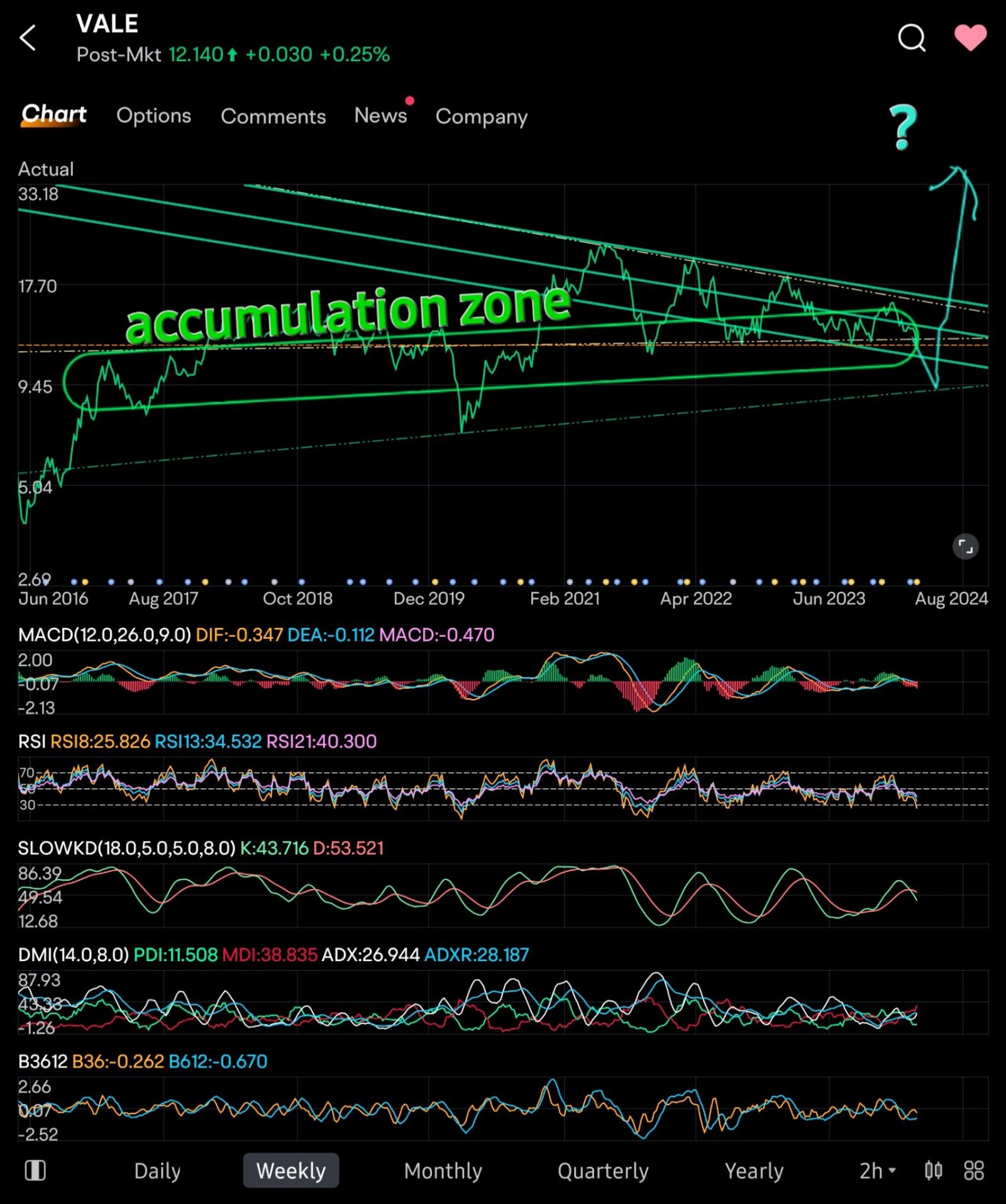

ON RED DAYS I buy

🇧🇷

it was RED when I was buying 😄

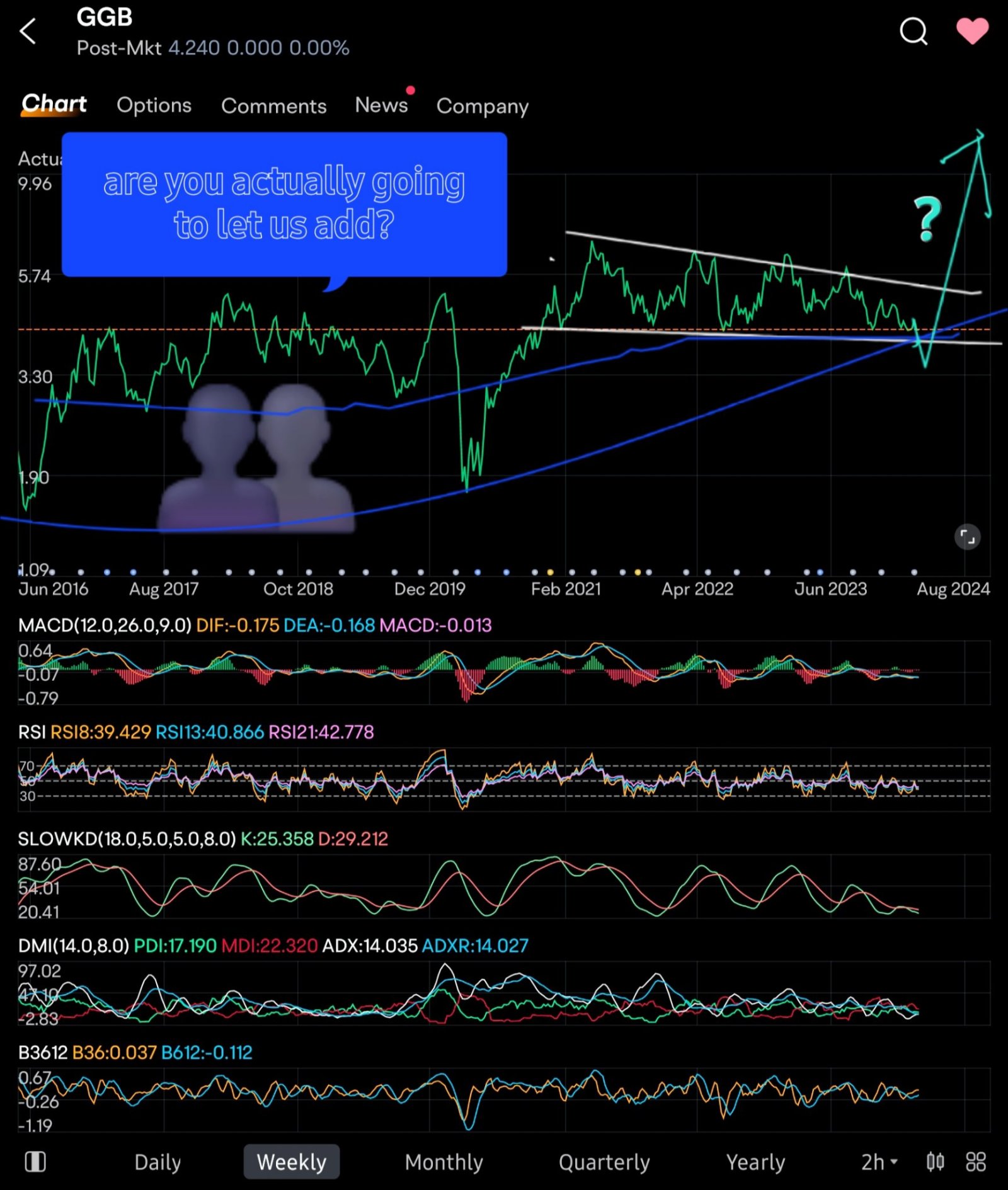

Weekly

Monthly

Weekly

Weekly

Not Brazil 😆

Weekly

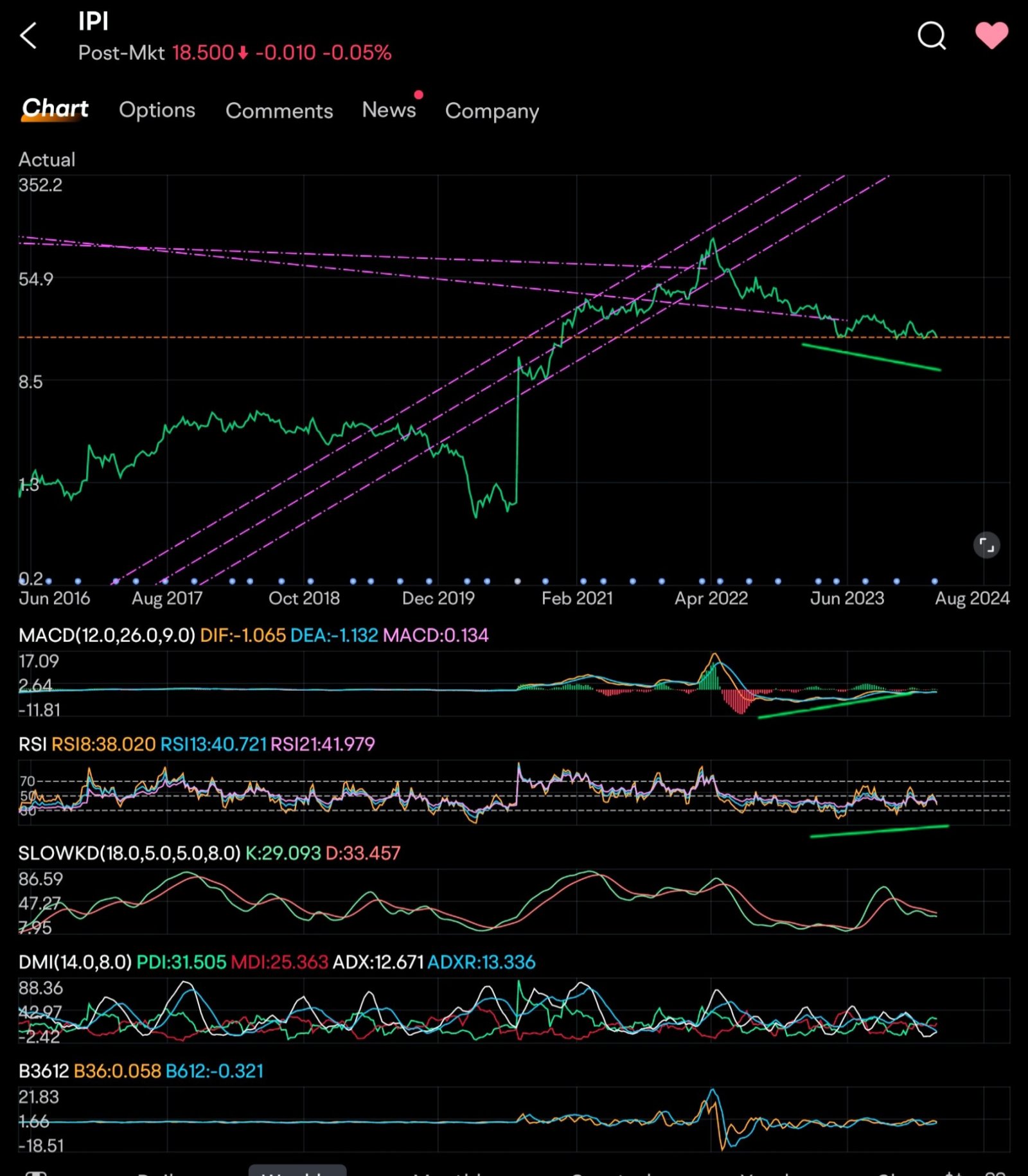

Potash/Fertilizer

Weekly

Heavily involved in russia, but they are the only PURE platinum and palladium miner.

Weekly

Weekly

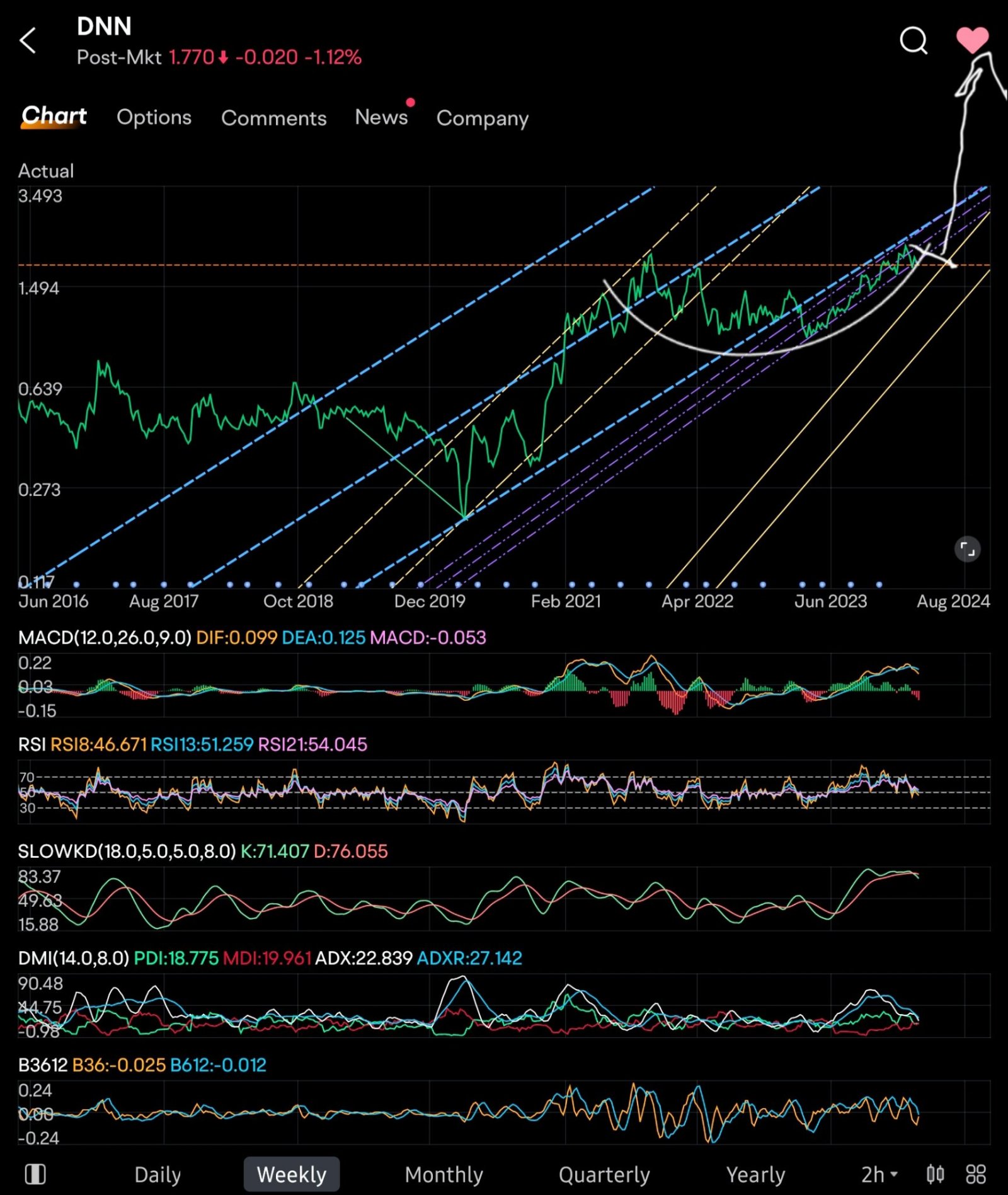

Uranium

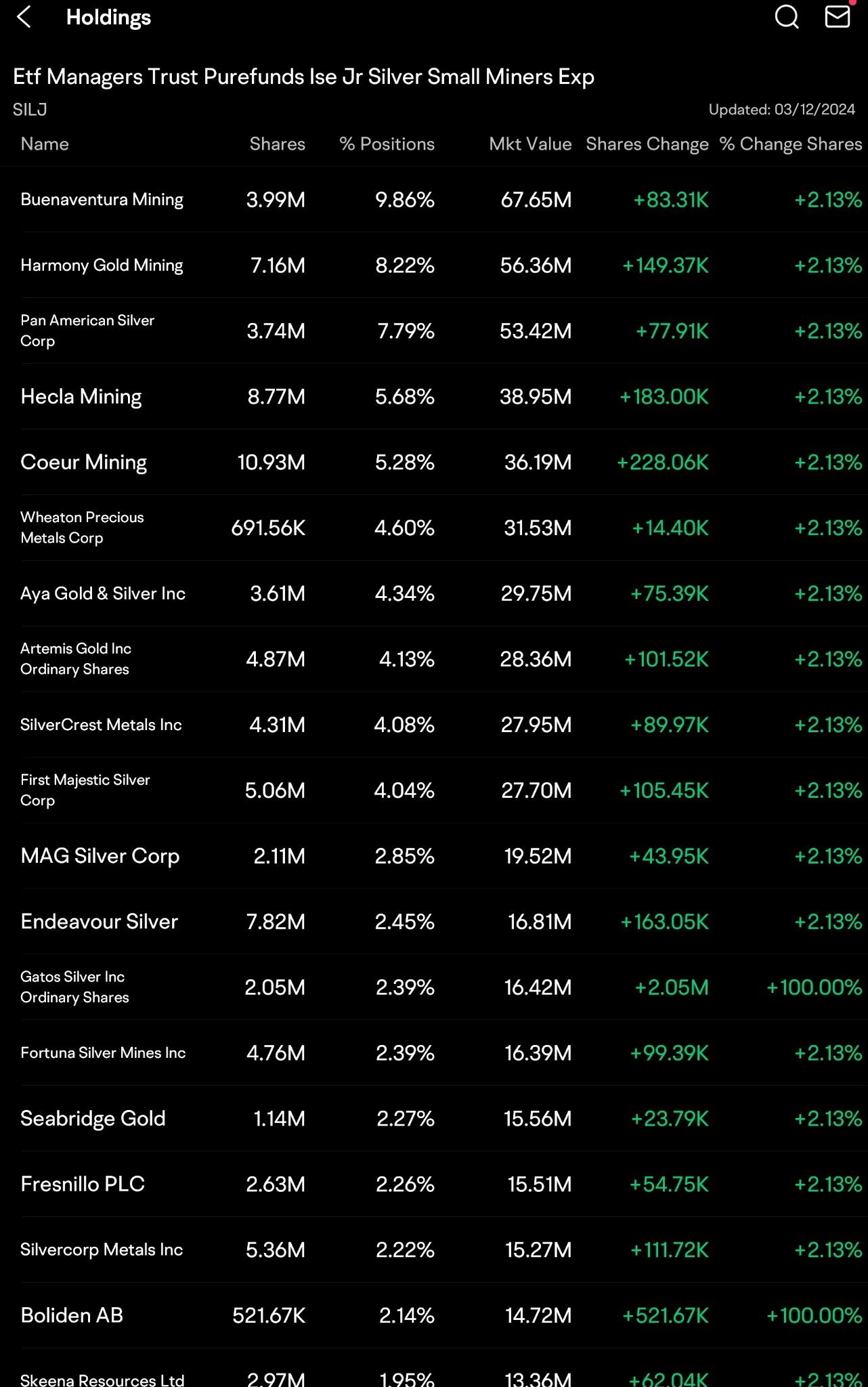

IF I were an investor, and good thing iam, I would be buying miners.

Jr miners = small cap miners

Here are the holdings. See all the green shares change? That's investment money coming in.

● That's what I bought. Here are positions I'm in and monitoring.

Here is one I purchased on moomoo so that I could use it as an example

loading...

Unsupported feature.

Please use the mobile app.

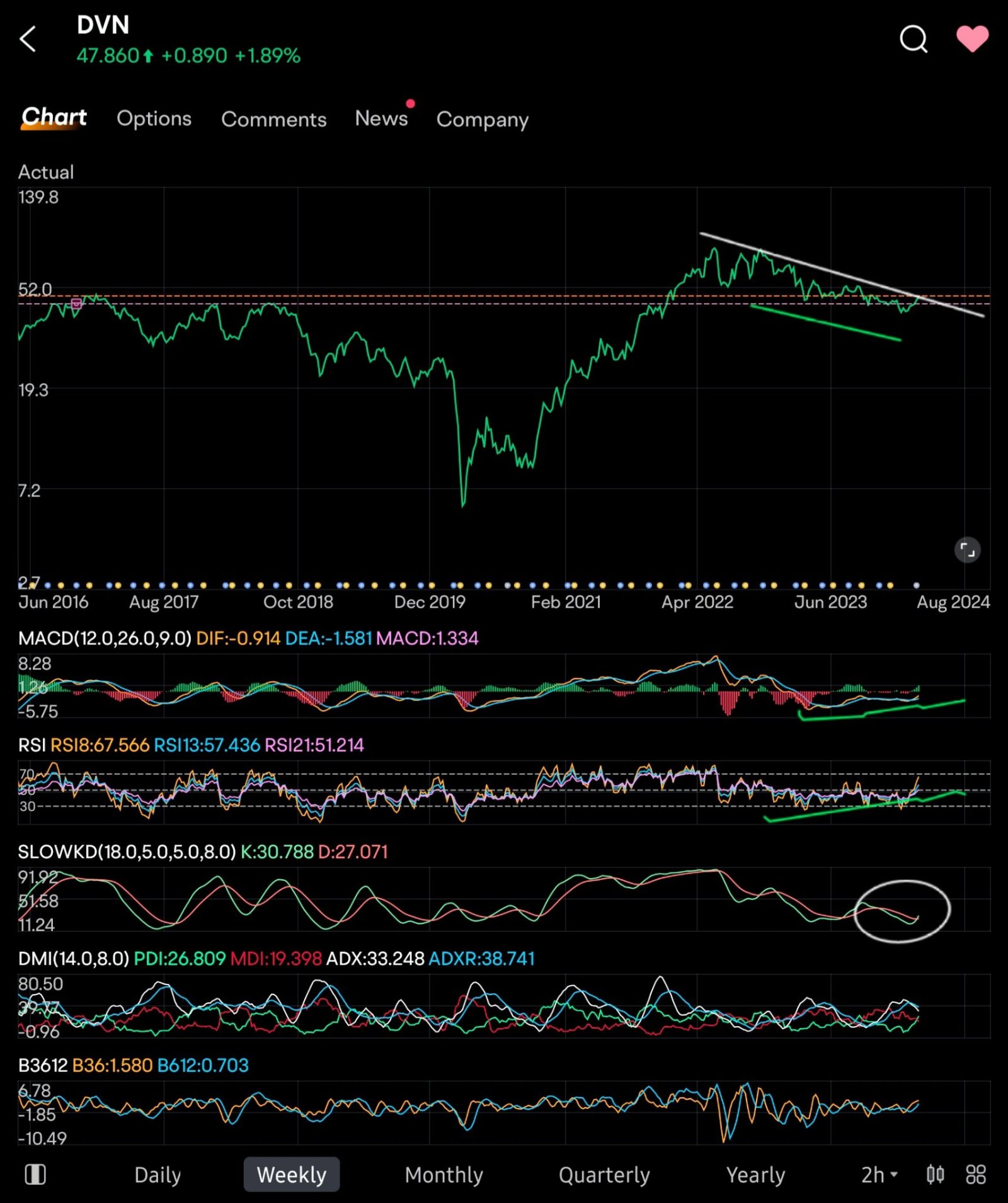

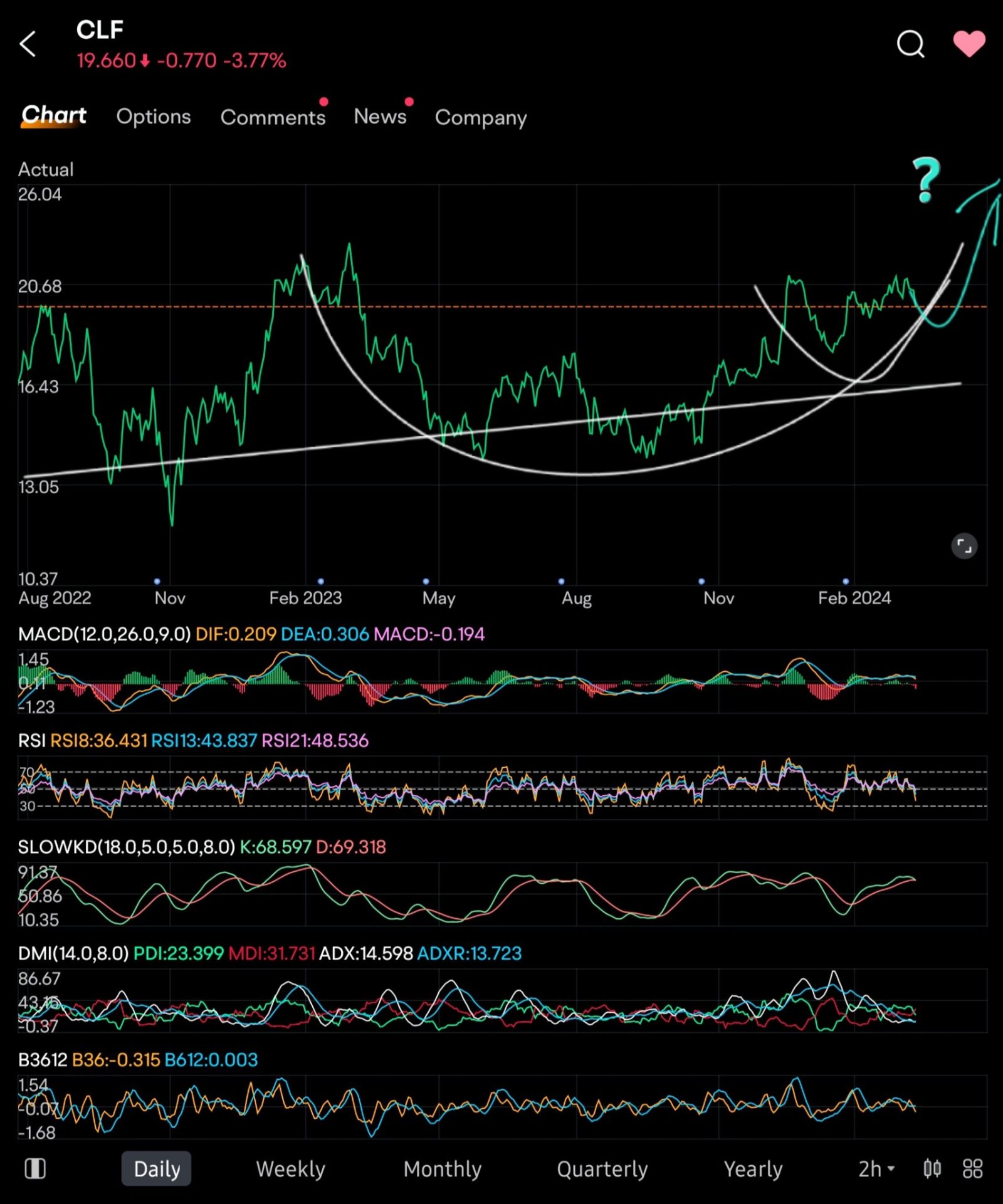

Let's see if this is a massive triangle breakout 🤞

from my morning post. watching it build

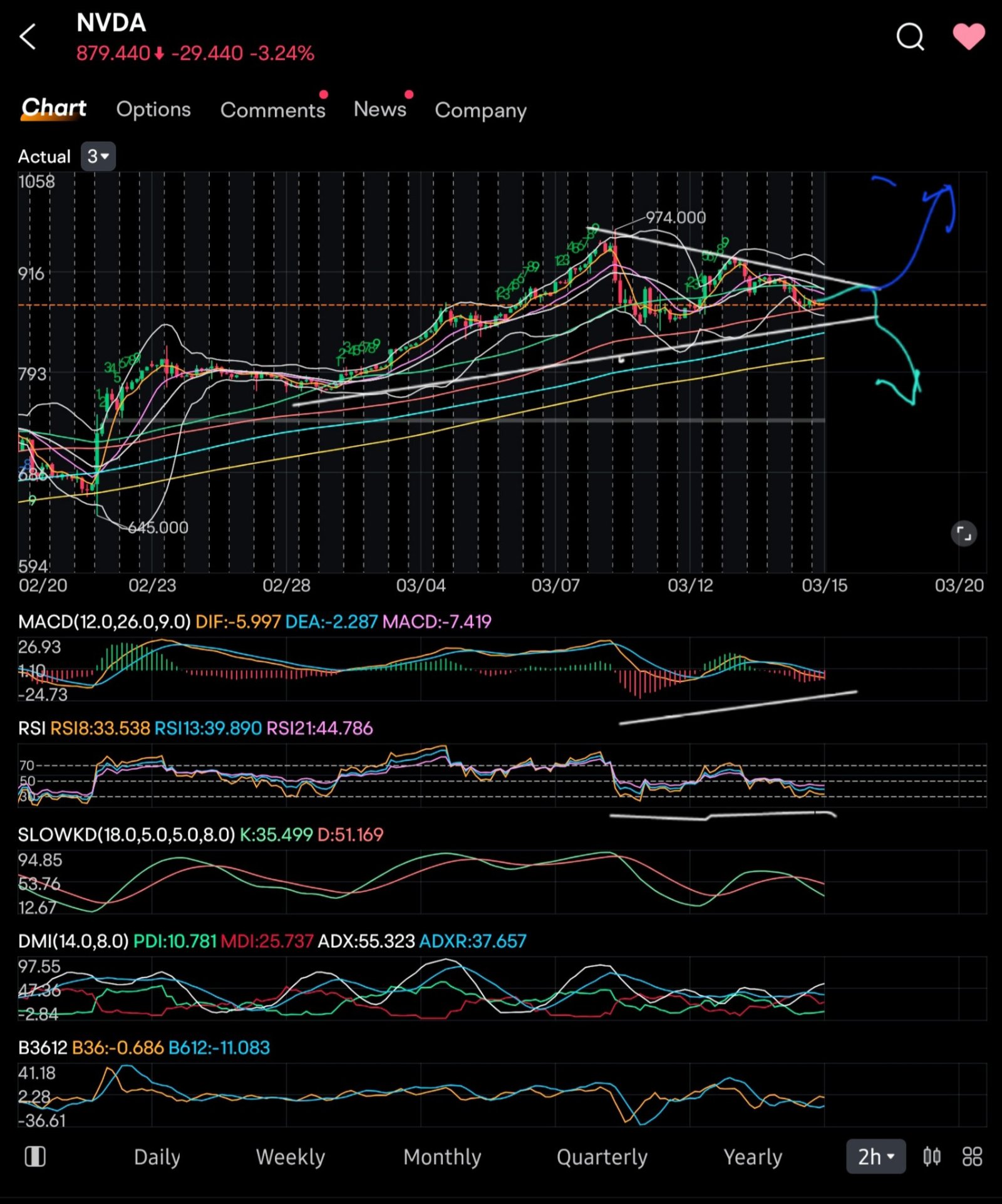

Here is today's 2 hr chart. See anything scary ? 👻

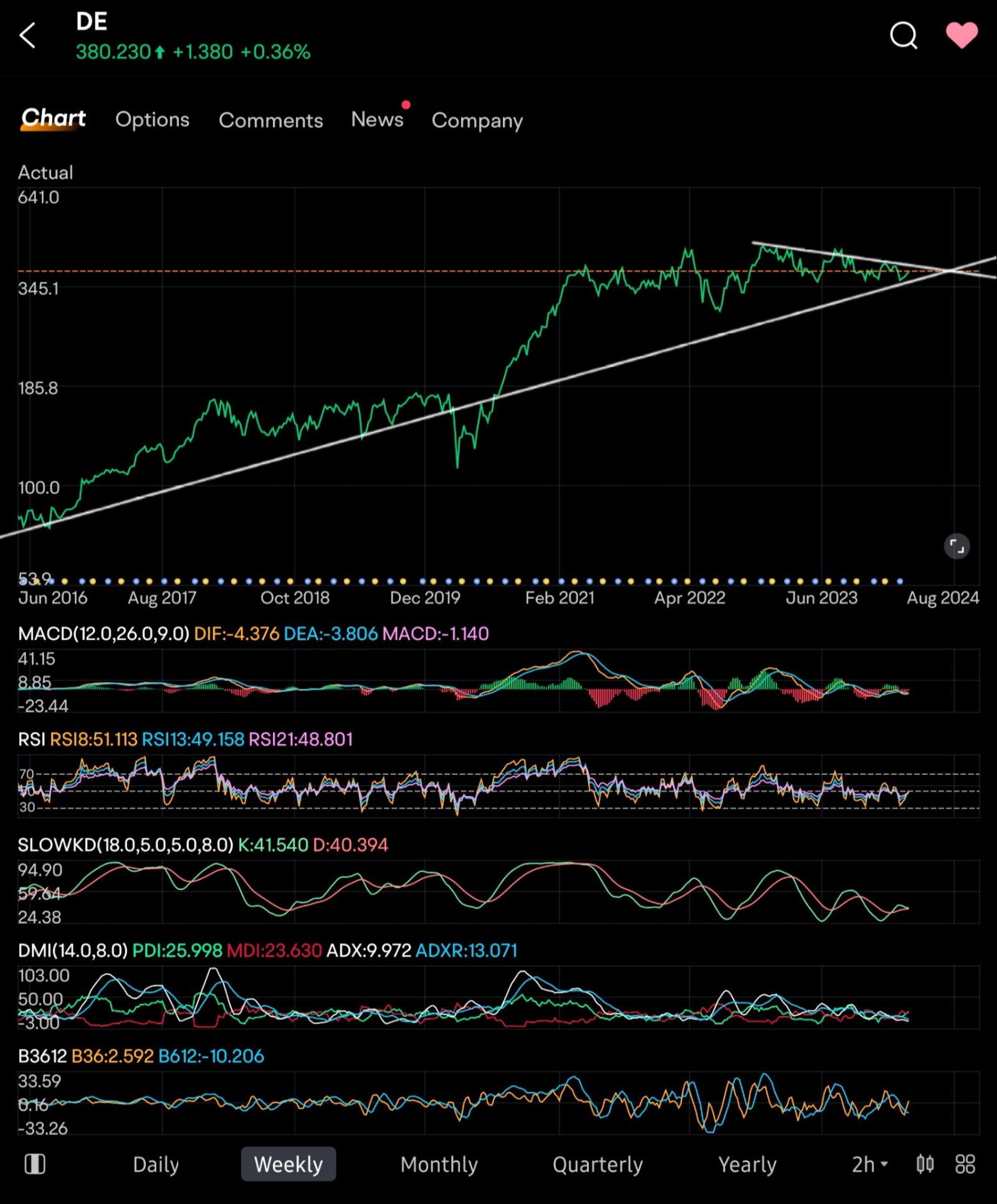

Monthly

Weekly

Daily

○ The stocks that the market cares about

I already showed apple. it's still in its bounce.

I like at least a bounce up into the lower 900s again.

Broke out of cup and handle, upside to 445

upside of a breakout is ~190

looking to get to 151

triangle. triangles lead to breaks. out or down.

I ended my positions in ETH

out at 4014, looking around 3800 maybe 3300 to get back in

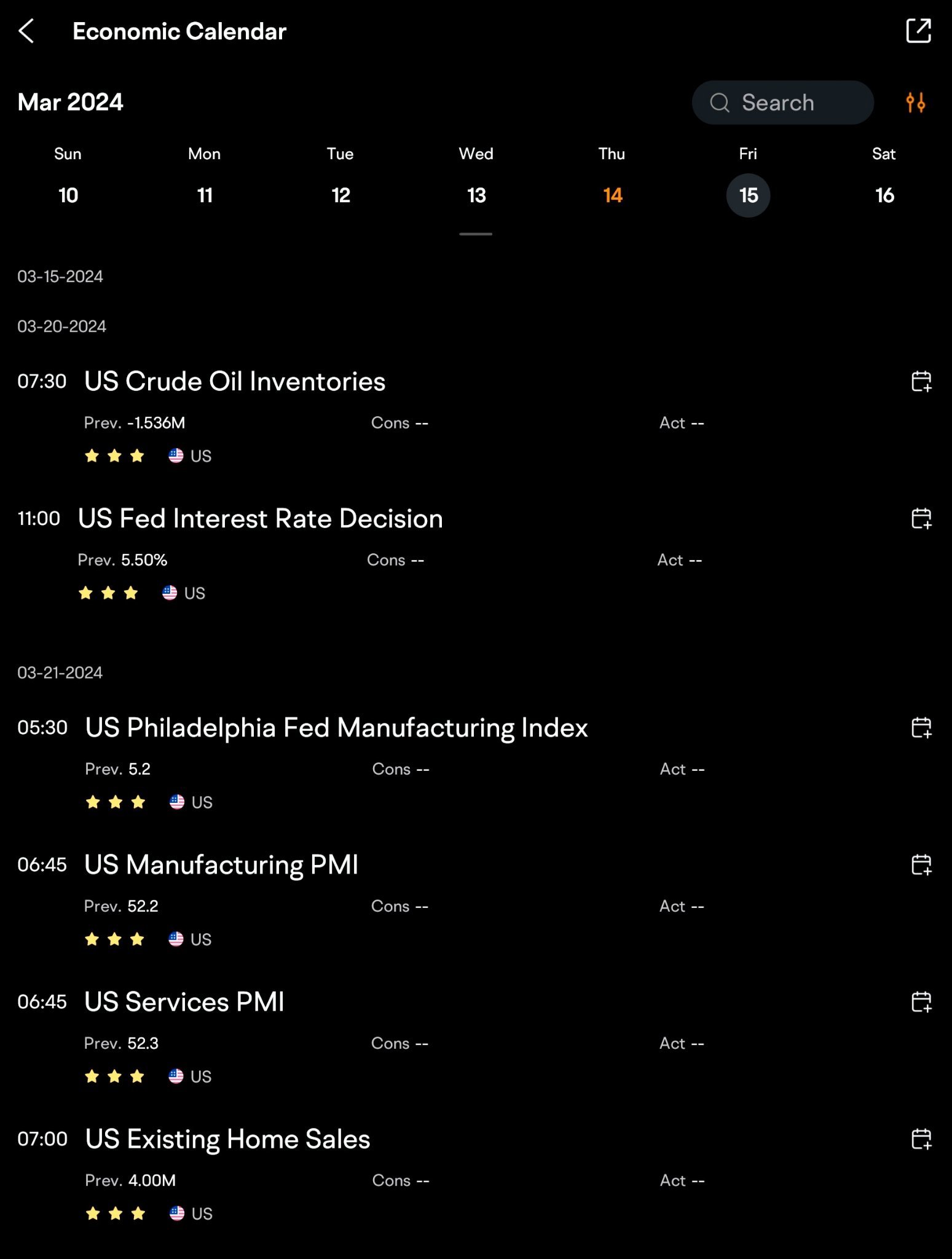

Where are the markets going?

My thoughts, because that's what this is 😆. I don't think we are done going up for this sequence. I still think 450. but I have reservations. The NQ and the QQQ are way off. The NQ futures went above 18500, but the QQQs merely went to 443. Also, the put to call ratio was loaded to the put side. and not smartly. They were buying way out of the money puts expecting a crash. I don't think they get it, at least not without their puts getting burnt up first. The rate decision is released at 10 am est tomorrow, so half an hour after open. After that, there is no data until next Thursday.

....*edit* as some can see (I could not 😆) the date on the fed rate decision is the 20th, next week. The Friday was highlighted, so I thought it was showing me tomorrow 🙃 and couldn't figure out what would be releasing tomorrow, and next week 🤦disregard 😆 I will give myself 20 lashings 😂 that doesn't change how I feel the market may move. "News" only allows the market to go where it wants to anyway....

I think they could push it down util 10. maybe even push it to 435. or 432 to really hurt both parties when they run it up after "no decision" or keeping rates unchanged. i think they are happy with higher inflation. Either way, I do not think we are done going up. THAT BEING SAID. QQQ is below the 5 MA. Nothing good happens under the 5 MA, except getting back over it. If price breaks below the 18 MA, then that is very bad. And when the 5 MA crosses the 18 MA, that's worse. If pric3 rises above the 5 MA overnight, it's possible they could just run up until 10 or longer. I don't like OPEX days. in the past, more often than not, they swing both ways at open and then kill volatility and go flat. But they did have the one where it ran up almost 3%. Basically I don't trust it.

Here is the chart zoomed in

Be Safe, Be Careful, Be Wise

and as always

Good Luck ![]()

you could mess with tech and the markets. But I'd rather have that BIG GREEN ENERGY 🤣 and cheap cheap miners 🐦 miners of anything in the ground 😉

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

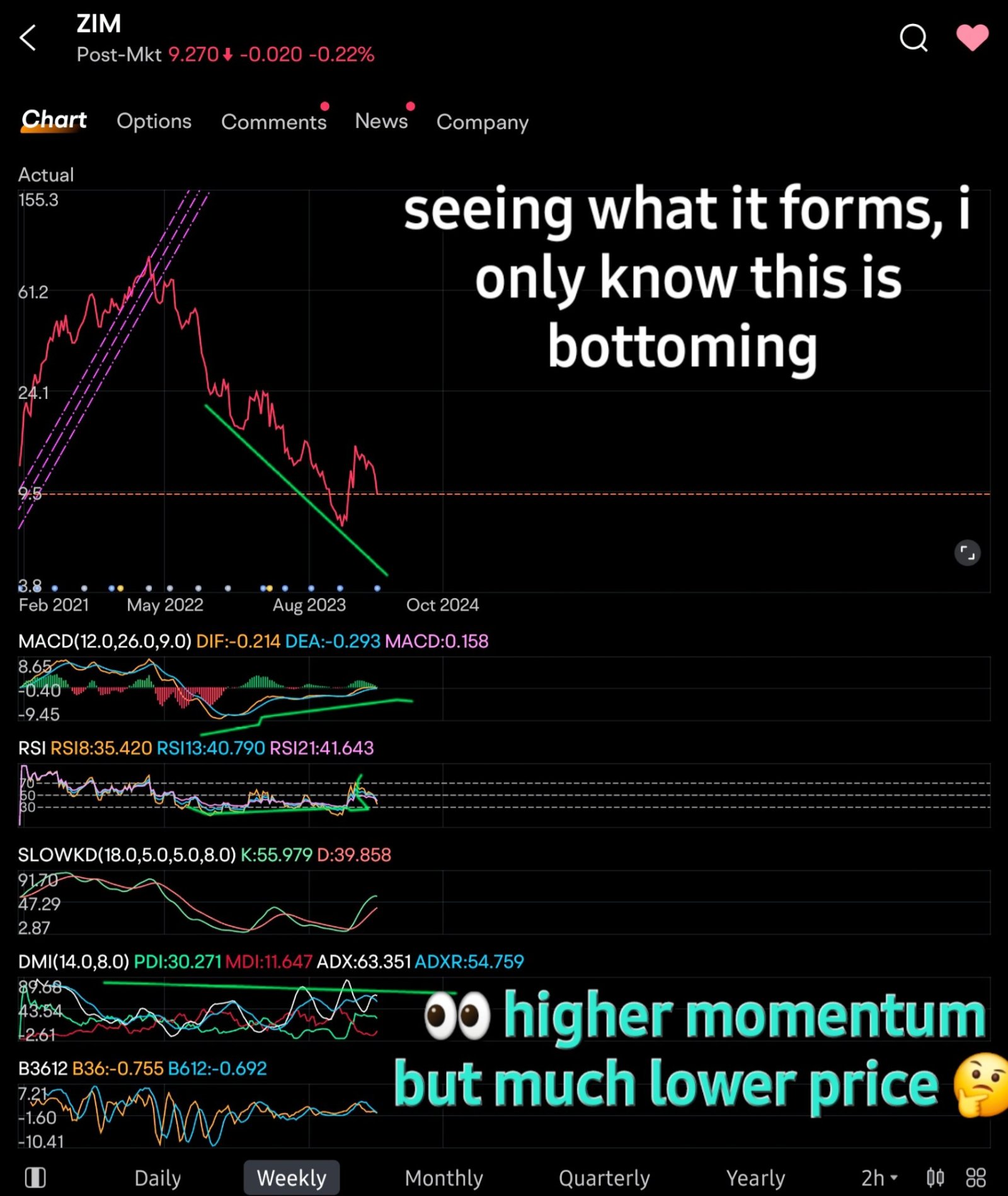

101633546 : For Zim higher momentum at lower price what does this mean? Big money is accumulating ?

iamiam OP 101633546 : it means that more investors or more money but less price rise. it's churning over ownership.

Liiii : I added more ipi today, do u think that is a good time? Thanks

101633546 iamiam OP : is churning over ownership means investor trying buying more shares at this price range instead of bidding higher and higher?

iamiam OP Liiii : I added

iamiam OP 101633546 : it just means that once the turnover is complete, this will take off. it's eating all the sellers here.

101633546 iamiam OP : thank you for your time explaining.

daydayup : Hi iam, you seem to be looking at the wrong time, the rate decision is next week.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

iamiam OP daydayup : Ha, that's what I thought and couldn't figure it out. we have no data until next week. thanks for catching that.

S Punt iamiam OP : Interest rates will hold, unlikely to dip.

View more comments...