AI in High Demand! What is the current investment value of Microsoft?

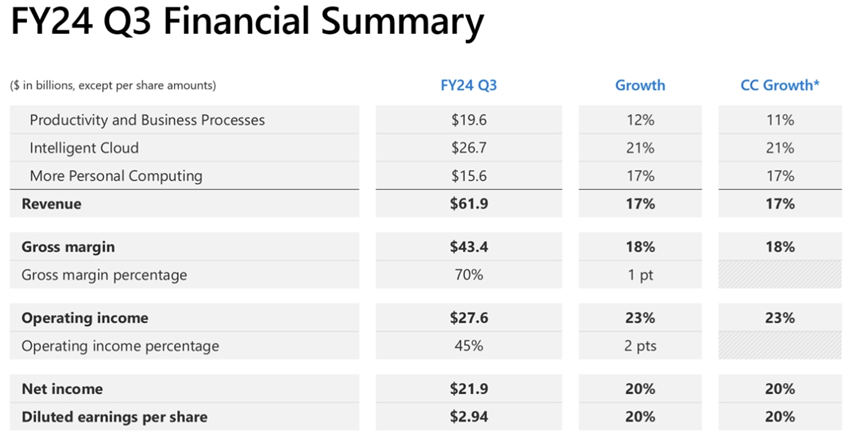

On Thursday, April 25th, after the U.S. stock market closed, $Microsoft (MSFT.US)$announced its financial results for the third quarter of fiscal year 2024 (which corresponds to the first calendar quarter of 2024), exceeding expectations across the board. The company reported a 17% year-over-year increase in revenue to $61.9 billion and a diluted EPS (earnings per share) of $2.94, up 20% from the previous year. Following the earnings release, Microsoft's stock price surged by more than 4%.

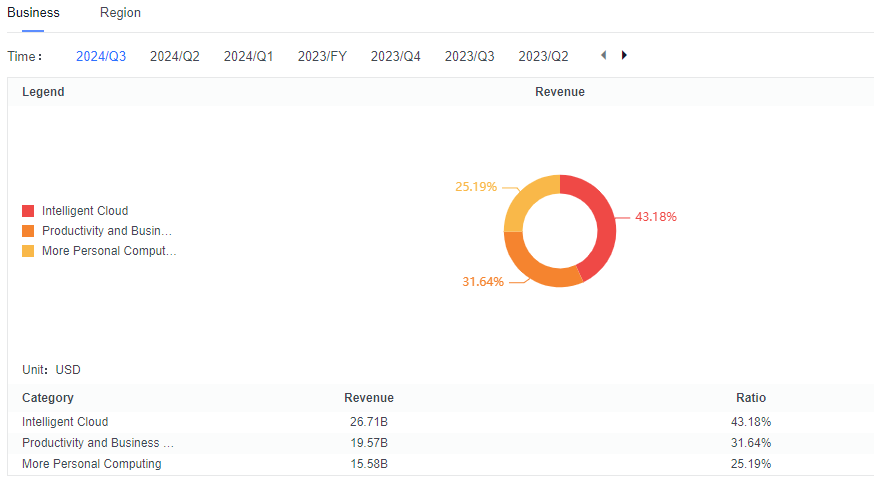

Looking at the specific composition of the company's businesses, Microsoft's revenue primarily comes from three segments: Intelligent Cloud, Productivity and Business Processes, and More Personal Computing, which account for 43.18%, 31.64%, and 25.19% of the revenue, respectively. Among them, the Intelligent Cloud business has become the main driver of the company's growth and is also the segment that receives the most attention from the market.

How did Microsoft's latest earnings report perform? And what is the company's current investment value?

I. AI products are in short supply; Intelligent Cloud is the main driver of the company's earnings growth.

The Intelligent Cloud business has become the primary driver of the company's earnings growth. In FY24 Q3, the Intelligent Cloud segment grew by 21% year-over-year to $26.7 billion, propelling the company's revenue to a 17% year-over-year increase.

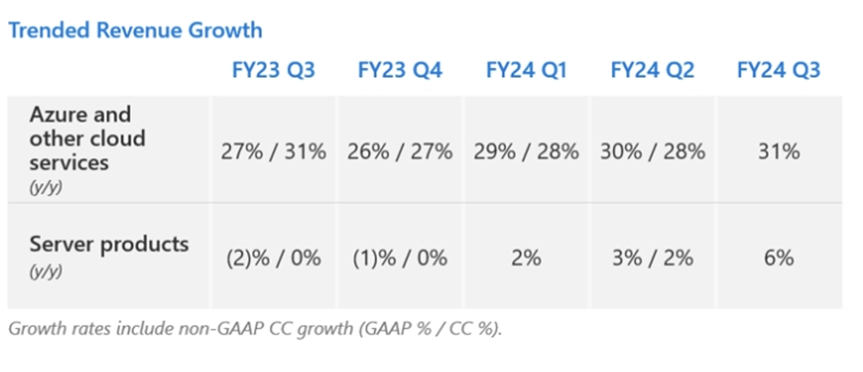

The Intelligent Cloud business includes Azure, server products, and services such as GitHub. Within this segment, Microsoft Azure and other cloud services saw a revenue increase of 31%, outpacing Google Cloud's 28% growth, thereby maintaining a clear lead. Azure's growth benefited from robust demand for AI, contributing 7% to the growth this quarter (up from 6% in the previous quarter), indicating an even stronger AI-driven momentum. According to company management, despite a significant increase in capital expenditures, the recent demand for AI still exceeds the company's existing capacity, resulting in a supply shortfall. Data shows that the number of Azure AI customers is continuously growing, along with an increase in average spending. Azure Arc now has 33,000 customers, more than doubling year-over-year; the number of Azure transactions exceeding $100 million has increased by 80% year-over-year, while the number of transactions over $10 million has more than doubled.

In addition to Azure, the application of Copilot has improved code quality and production efficiency, continuously driving the growth of the GitHub platform. Currently, GitHub Copilot has 1.8 million paid users, with a quarter-over-quarter growth rate exceeding 35% and a year-over-year revenue increase of over 45%. By leveraging GitHub, anyone can become a developer using AI capabilities, making it easier to build applications, automate workflows, and more.

The company has very strong competitive barriers in cloud computing. Despite trailing behind AWS, which has the first-mover advantage in market share, Microsoft Cloud's growth rate has consistently been at the forefront, driven by AI. The competitive advantages of Microsoft Cloud include, but are not limited to:

(1) A full range of software products: Customers are already using Microsoft products such as Windows Server, Office 365, Dynamics 365, etc., and Microsoft Cloud Azure can integrate seamlessly with the existing IT environment of customers.

(2) Integration with Open AI: Gaining a leading edge in the current AI technology wave, enabling customers to deploy and apply large AI models more quickly, which is highly attractive to customers.

(3) Azure offers a comprehensive and advanced range of IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and SaaS (Software as a Service), supporting both hybrid and multi-cloud environments.

Overall, the current demand for AI remains strong, with downstream customers still having a substantial need for data inference, model training, AI applications, etc. It is expected that with strong competitive advantages, Microsoft Cloud is likely to further increase the penetration rate of AI services, sustaining high growth in its cloud business.

II. Productivity and Business Processes business achieves both volume and price growth

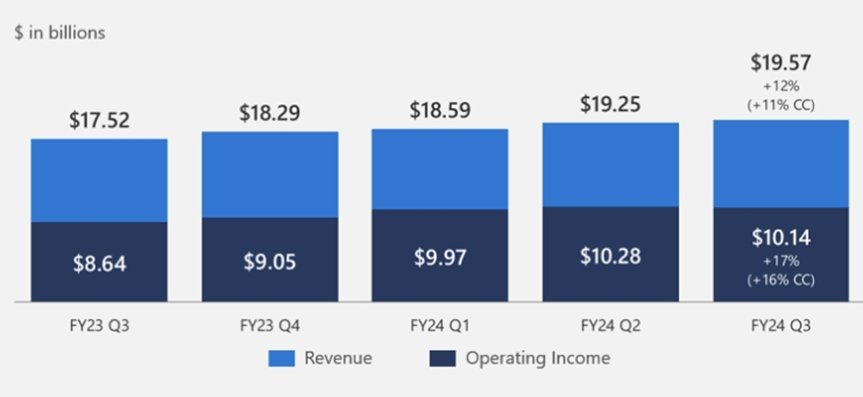

Benefiting from the growth of Office 365, in FY24 Q3, Microsoft's Productivity and Business Processes business saw a year-over-year increase of 12% to $19.6 billion. This business includes traditional office software products, as well as subscription-based products like Office 365, Microsoft 365, Dynamics 365, LinkedIn, and other SaaS products, with the most core revenue source being Office 365.

Office 365 products achieved both volume and price growth, benefiting from the continuous shift of Office customers to subscription-based SaaS products and the significant boost in productivity from the application of Copilot, which continuously increased the ARPU value under AI-driven software and system upgrades. Among them, commercial Office revenue grew by 15%, mainly due to an 8% increase in paid Office 365 commercial seats driven by small and medium-sized businesses and frontline workers, continued growth in E5 driving higher per-user revenue contribution, and growth driven by Microsoft 365 Copilot. Consumer Office revenue grew by 5% year-over-year, with Microsoft 365 Consumer subscribers increasing by 14% to 80.8 million.

The application of Copilot significantly increased the speed of information flow, promoting the optimization of decision-making, collaboration, and efficiency. According to the company, about 30,000 customers are customizing their use of Microsoft 365 Copilot, with a quarter-over-quarter increase of 175%. The usage intensity of early users has increased, with nearly 50% more Copilot interactions per user.

Overall, Microsoft holds a strong market position and user stickiness in the office software and ERP systems domain. As customers progressively move to the cloud and the penetration rate of Microsoft 365 Copilot gradually increases, the Productivity and Business Processes business is expected to achieve both volume and price growth, gaining new momentum for growth.

III. More Personal Computing business still benefits from the acquisition of Activision Blizzard

The More Personal Computing segment includes the Windows operating system, Surface hardware, Xbox gaming consoles, and the newly acquired gaming company Activision Blizzard, with a focus on traditional PC business.

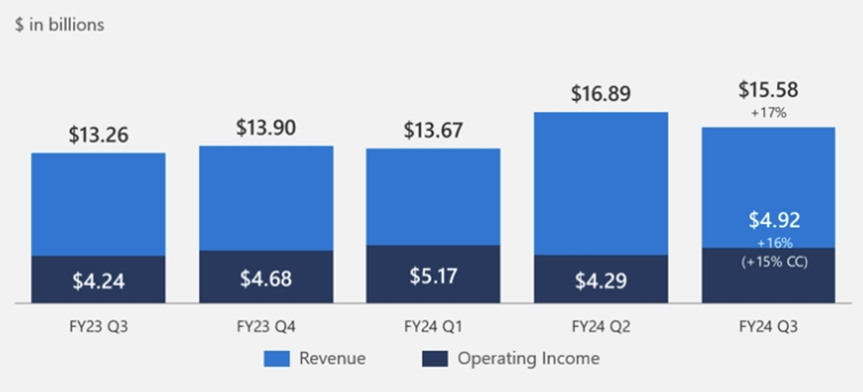

This fiscal quarter, the More Personal Computing business still benefited from growth attributed to the acquisition of Activision Blizzard. In FY24 Q3, Microsoft’s More Personal Computing business revenue increased by approximately 17% year-over-year to $15.6 billion, with the completed acquisition of Activision Blizzard contributing 15% to this growth. Additionally, following the acquisition of Activision Blizzard, there was a significant 51% increase in gaming business revenue, resulting in a 62% year-over-year increase in Xbox content and services revenue.

Benefiting from the rebound in the PC market and strong consumer spending in the United States supporting the advertising market, Microsoft's Windows OEM revenue increased by 11% year-over-year, exceeding expectations; search and news advertising revenue grew by 12% year-over-year, surpassing market expectations, with increased penetration of Bing and Edge, where Bing's daily active users surpassed 140 million.

The fiscal quarter still benefited from the acquisition of Activision Blizzard, and the impact of the acquisition is expected to continue for two more quarters. Assuming that U.S. consumer spending remains strong and the PC market gradually recovers, the More Personal Computing business is expected to maintain steady growth.

IV. Capital expenditures are expected to continue to grow significantly, making shareholder returns unattractive

The company maintains high levels of profit growth. This fiscal quarter, with the continuous optimization of Azure and Office 365, and an increased share of higher-margin businesses, the company's gross margin increased by one percentage point year-over-year to 70%. Operating expenses grew by 10%, of which 9% was due to the acquisition of Activision Blizzard. Thanks to strict cost control, the company's operating profit margin increased by 2 percentage points year-over-year to 45%, and diluted EPS grew by 20% year-over-year.

Strong profitability has allowed the company's cash flow to continue to grow, with capital expenditures expected to increase significantly in succession. This fiscal quarter, the company's free cash flow was $21 billion, an 18% increase year-over-year. Capital expenditures were $14 billion, primarily for substantial infrastructure construction to meet the development needs of cloud and AI. Considering the still very strong demand for AI, the company expects future capital expenditures to continue to grow significantly.

Shareholder returns are low and lack attractiveness. This fiscal quarter, the company returned $8.4 billion to shareholders through dividends and buybacks, consistent with the previous quarter, with an expected total annual return to shareholders of $33.6 billion, a shareholder return rate of 1.1%. This is unattractive compared to other tech giants or the US risk-free rate.

V. So, what is Microsoft's current investment value?

Regarding performance guidance, for FY24 Q3, the company's Intelligent Cloud business is expected to grow by 19%-20% year-over-year to $28.4-$28.7 billion, with Azure expected to grow by 30%-31%; Productivity and Business Processes are expected to grow by 9%-11% year-over-year to $19.9-$20.2 billion; More Personal Computing is expected to grow by 10%-13% year-over-year to $15.2-$15.6 billion.

The company's Azure cloud is expected to continue to benefit from the strong demand for AI, ensuring a leading high growth rate under strong competitive advantages, and further driving revenue growth; meanwhile, the further integration and application of Copilot are expected to provide new growth momentum for the company.

Moreover, although the company's capital expenditures have increased significantly, the company still expects an operating profit margin increase of 2% year-over-year for FY24, with a 1 percentage point decline in FY25 due to further increases in capital expenditures.

Therefore, we expect the company's revenue and EPS to maintain double-digit growth in FY24, FY25, and FY26.

However, there is a significant issue: Microsoft's shareholder returns are too low, and the safety margin is average. According to the analysis above, with the current market value, Microsoft's annualized shareholder return rate is only 1.1%, much lower than that of tech giants like Meta, Google, Apple, Netflix, and also far below the risk-free rate of around 4.6%, making the safety margin average. Microsoft's current valuation is PE (TTM) 36.08x, which is high among its peers, and only very strong earnings growth can continue to drive stock price growth. If the company's earnings growth slows down, or a black swan event occurs, the company's current very low shareholder returns will not provide a safety cushion for the stock price.

In summary, we can hypothesize a few scenarios to judge subsequent investment strategies:

• Scenario 1: The company maintains double-digit EPS growth and announces increased shareholder returns, expecting the stock price to break upwards. Investors are advised to buy stock or call options to go long.

• Scenario 2: The company continues to maintain double-digit EPS growth, with stable growth in free cash flow, and shareholder returns remain unchanged, causing the company's stock price to fluctuate around $400, with little upside potential. Investors holding stock are advised to employ a covered call investment strategy.

• Scenario 3: If the company's earnings growth slows and shareholder returns remain at 1.1%, then the stock price will face a significant correction. Investors are advised to go short or buy put options.

Currently, Scenario 2 seems most likely, and investors may want to employ a covered call strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment