AI semiconductor crash! 6 specially selected brands that are out of the shelf! Is the “AI boom” immortal even with “export restrictions to China”?!

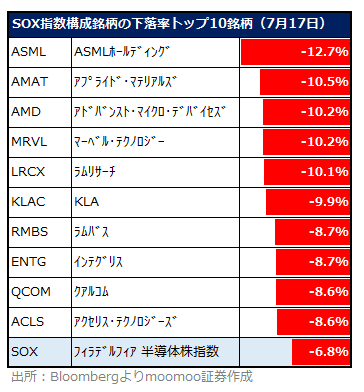

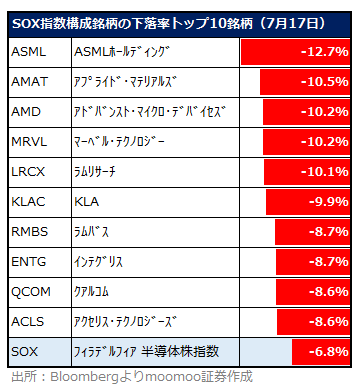

AI semiconductor stocks crashedI'm being hit by.Report on the tightening of semiconductor regulations against China by the US governmentYaTrump's remarks about Taiwan are on saleconnected. On July 17, when the two news overlapped, NVIDIA shares fell 6.6%, and TSMC fell 8.0%. ASML, which revealed a rapid increase in order balances due to the AI boom in financial results announcements on the same day, also fell 12.7%. This is because the company was picked up in reports of tightening export restrictions to China.

Looking back,The pattern of “export restrictions to China” vs. “AI boom” continues when it comes to semiconductor stocks. The sharp drop on July 17thCurrently, it shows that concerns about the former have won over benefit expectations from the latter. What is this movementIs it short-term, or does it indicate the end of the AI boom。Examine future prospects based on past experiences and recent performance trendsI'll do it. Benefits apply when either momentum of the two winsPick up “Top 3 Shelf Bottoms” and “3 Hot Buys”I did it.

Looking back,The pattern of “export restrictions to China” vs. “AI boom” continues when it comes to semiconductor stocks. The sharp drop on July 17thCurrently, it shows that concerns about the former have won over benefit expectations from the latter. What is this movementIs it short-term, or does it indicate the end of the AI boom。Examine future prospects based on past experiences and recent performance trendsI'll do it. Benefits apply when either momentum of the two winsPick up “Top 3 Shelf Bottoms” and “3 Hot Buys”I did it.

●Short-term: “export restrictions to China” > “AI boom”?

Bloomberg reported on 7/17 that the US government is considering stricter semiconductor regulations against China. According to that, “the US Biden administration told allies that if companies such as Tokyo Electron, a major semiconductor manufacturing equipment company, and ASML in the Netherlands continue to provide access to advanced semiconductor technology, they are considering using the strictest trade restriction measures that can be used.” In response to that, the 17th $Tokyo Electron (8035.JP)$fell 7.5%, $ASML Holding (ASML.US)$fell 12.7%. It is representative of AI semiconductors $NVIDIA (NVDA.US)$It also fell 6.6%, and the constituent stocks of the SOX Index (Philadelphia Semiconductor Stock Price Index) depreciated almost completely.

ASML announced financial results on July 17. Financial results generally exceeded market expectations, but stock prices were more wary of geopolitical risks.

ASML financial results: generally strong

ASML financial results: generally strong

◆ASML's sales for the second quarter (2Q) increased 18% compared to the previous quarter, and order balances increased 54%, both of which exceeded market expectations. In particular, the balance of orders greatly exceeded market expectations. Sales guidance for the 3rd quarter was 6.7 billion euros to 7.3 billion euros, which was slightly lower than the market forecast of 7.46 billion euros.

◆The CEO of the company stated at the financial results briefing that “strong development of AI is expected to drive most of the recovery and growth of the industry, and 2024 will be a year of transformation,” showing a positive outlook for the future.

It has been pointed out that geopolitical risks and declining 3Q sales guidance forecasts were factors for the sharp decline in ASML stocks on the 17th. Meanwhile,What analysts place more importance on is the balance of orders that indicate medium- to long-term earnings forecaststhat's it. After ASML announced order balances that exceeded expectations due to the AI boom,Several analysts raised target share prices for the company's shares. Considering geopolitical risks, it is no wonder that there are analysts who lower target stock prices, but that number was “zero.”

Past “export restrictions to China” versus “AI boom” battles over semiconductor stocks suggest that analysts' judgments make sense.Based on past experience, adjustments due to “export restrictions to China” > “AI boom” are short-termThere are many cases where it's enough,In the medium to long term, semiconductor stocks traded upward due to the “AI boom” > “export restrictions to China” structureI'm taking it back.

●Medium to long term: “AI boom” > “export restrictions to China”?

When checking the SOX trend, there were situations where semiconductor stocks were adjusted in response to the strengthening of US export restrictions to China and geopolitical risks surrounding Taiwan, but all of these were temporary.The performance of semiconductor stocks led by NVIDIA expanded due to the bottoming out of semiconductor market conditions and the generative AI boom that began at the end of 2022That's because I did.

In other words, when checking trends since “export regulations to China” were introduced, the latter was overwhelmingly large when comparing the adverse effects on business performance due to “export regulations to China” with the effects of boosting performance due to the “AI boom.” For example, earnings per share (EPS) of the SOX index have rapidly expanded since “ChatGPT” was disclosed in 2022/11. Needless to say, the contribution of NVIDIA, which is the largest constituent of the SOX Index, is outstanding and significant.

●Medium to long term: “AI boom” > “export restrictions to China”?

When checking the SOX trend, there were situations where semiconductor stocks were adjusted in response to the strengthening of US export restrictions to China and geopolitical risks surrounding Taiwan, but all of these were temporary.The performance of semiconductor stocks led by NVIDIA expanded due to the bottoming out of semiconductor market conditions and the generative AI boom that began at the end of 2022That's because I did.

In other words, when checking trends since “export regulations to China” were introduced, the latter was overwhelmingly large when comparing the adverse effects on business performance due to “export regulations to China” with the effects of boosting performance due to the “AI boom.” For example, earnings per share (EPS) of the SOX index have rapidly expanded since “ChatGPT” was disclosed in 2022/11. Needless to say, the contribution of NVIDIA, which is the largest constituent of the SOX Index, is outstanding and significant.

Therefore, what is important in forecasting the medium to long term is the sustainability of the “AI boom” rather than “export restrictions to China,” and this is the predicted EPS trend that appears as a result. It is shown on the far right side of the graph aboveIf you check the predicted EPS for the SOX index, it is expected that the upward trend will continue in the futureThat's it.

7/18's $Taiwan Semiconductor (TSM.US)$The financial results also suggest that the “AI boom” continues. The results of TSMC, which has an almost monopoly position in the production of AI semiconductors, made me think “next to NVIDIA.” In other words, in response to already high market expectations, the company has shown a track record and outlook that exceeds them.

TSMC's financial results: strong due to the AI boom

7/18's $Taiwan Semiconductor (TSM.US)$The financial results also suggest that the “AI boom” continues. The results of TSMC, which has an almost monopoly position in the production of AI semiconductors, made me think “next to NVIDIA.” In other words, in response to already high market expectations, the company has shown a track record and outlook that exceeds them.

TSMC's financial results: strong due to the AI boom

◆Sales for the April-6 fiscal year (2Q) increased 40% from the same period last year, and net profit increased 36%, both of which exceeded market expectations. The 3Q sales guidance also surpassed market expectations.

◆For the full fiscal year 2024, the sales growth rate forecast was revised upward from the conventional mid-20% range to the latter half of the 20% range, and the lower limit of capital investment was raised from the conventional 28 billion dollars to 32 billion dollars to 30 billion dollars to 32 billion dollars.

◆The company's CEO said at the financial results briefing, “Over the past 3 months, when compared to 3 months ago, demand related to AI and high-end smartphones from customers has increased, and the operating rate of cutting-edge 3nm and 5nm process technology is expected to rise in the latter half of 2024. We anticipate that 2024 will be a year of strong growth for TSMC.” When asked about demand surrounding AI semiconductors, they stated that “demand is extremely high,” and “supply will probably remain extremely tight until 2025.” It was suggested that strong demand would continue for the time being.

After the results were announced,Several analysts raised TSMC's target share price。

If you look at it comprehensivelyFor semiconductor stocks“Export restrictions to China” are a risk factor, but if the benefits of the “AI boom” can sufficiently offset it, it can be said that there is a high possibility that stock price adjustments will remain in the short term. Recent financial results of TSMC and ASML, which are in an important position in the AI semiconductor market, suggest that the benefits from the “AI boom” will continue. On the other hand, the US presidential election is ahead in November this time, and there is a possibility that both Mr. Biden (or other Democratic Party candidates) and Mr. Trump will show a hardline stance against China until the election, which may push the upper price of semiconductor stocks.

Based on the above, in the composition of “export regulations to China” vs. “AI boom,” we picked up “3 shelf hits,” which benefit when “export regulations to China” are made stricter, and “3 recommended purchases” that are cheap despite the fact that the benefits of the “AI boom” are far greater than the adverse effects of “export regulations to China.”

★“Top 3 Shelf Bottoms” ★

The Biden administration's restrictions on semiconductor exports to China and Mr. Trump's remarks about Taiwan have the aspect of expressing a strong stance against China for the November election. On the other hand, the aim is at the root of the government to accelerate the “domestic return” of semiconductor production in the US in the medium to long term. So, about the “Top 3 Shelves,”3 companies that have semiconductor manufacturing capabilities in the US and can be expected to benefit from a “domestic return”I chose.

Based on the above, in the composition of “export regulations to China” vs. “AI boom,” we picked up “3 shelf hits,” which benefit when “export regulations to China” are made stricter, and “3 recommended purchases” that are cheap despite the fact that the benefits of the “AI boom” are far greater than the adverse effects of “export regulations to China.”

★“Top 3 Shelf Bottoms” ★

The Biden administration's restrictions on semiconductor exports to China and Mr. Trump's remarks about Taiwan have the aspect of expressing a strong stance against China for the November election. On the other hand, the aim is at the root of the government to accelerate the “domestic return” of semiconductor production in the US in the medium to long term. So, about the “Top 3 Shelves,”3 companies that have semiconductor manufacturing capabilities in the US and can be expected to benefit from a “domestic return”I chose.

◆ Vertically Integrated Device Manufacturers (IDM). Whereas many US semiconductor companies are fabless without factories, Intel consistently performs everything from design to manufacturing as IDM.

◆Intel has been robbed of its market share by other companies in the same industry due to delays in miniaturization, but it launched a revival plan 2 years ago in order to recover. Strengthening the “foundry business” is included as part of this. Microsoft became the first customer in the foundry business and has begun to produce certain results. In the foundry business, it may be difficult to take market share from TSMC, which has almost monopolized the cutting-edge market, but it seems that the benefits of “domestic return” can be received in non-cutting-edge fields.

◆The US government announced in March this year that it will provide a maximum subsidy of 8.5 billion dollars to the company. According to the U.S. Department of Commerce, this funding supports the company's plans to produce advanced semiconductors at large-scale plants in Arizona and Ohio.

◆Stock prices continued to be sluggish due to sluggish performance and delays in the AI field, so there is a possibility that some bad material has been factored into stock prices. In the future, it may be easier to respond due to good materials.

◆The largest US foundry. It is ranked 3rd in the world after TSMC, which is number 1, and Samsung Electronics, which is number 2 in the global foundry market. In addition to semiconductors for electronic devices, mobile phones, automobiles, etc., they also manufacture products for space and defense. Major customers include General Motors and Lockheed Martin.

◆The US government announced plans to provide 1.5 billion dollars to the company in February this year as part of measures to strengthen domestic semiconductor manufacturing. The company plans to use the funds to expand new manufacturing facilities and existing facilities. The plan is to expand production capacity within the United States with government support. However, the management team did not add more production capacity than necessary, and indicated their intention to expand production capacity in line with the real demand of the industry.

◆In the May financial results announcement, both results and guidance surpassed market expectations. The company expects growth to continue quarterly in the two fields where profits are most concentrated: automobiles and smartphone devices.

◆A major semiconductor memory company. It has the 3rd largest market share in the AI semiconductor memory market.

◆The company's production is mostly carried out in Japan, Singapore, and Taiwan, but it has revealed plans to invest 40 billion dollars to build a semiconductor manufacturing base in the United States by 2030. The US government announced in April this year that it will provide a maximum subsidy of 6.1 billion dollars to the company. It is planned to be used for the construction of semiconductor factories in Japan.

◆A unique US semiconductor manufacturer that not only benefits from the “return to Japan” of semiconductor production, but is also riding the “AI boom.” It lags behind SK Hynix and Samsung Electronics, which have the 1st and 2nd place market share in the AI semiconductor memory market, but they are rapidly trying to catch up. Mass production of NVIDIA's latest “HBM (broadband memory) 3E” for AI semiconductors began in February this year. Performance recovery is expected to continue due to increased demand for AI semiconductors.

★ “3 Hot Buys” ★

In the current semiconductor stock sale, even stocks that were not highly affected by “export restrictions to China” were sold. Despite the fact that the benefits of the “AI boom” are far greater, there are also stocks that have depreciated. So,China's sales composition ratio declinedI'm doing it,Also, stocks that are expected to increase AI-related salesI picked them up as the “3 recommended purchases.”

$NVIDIA (NVDA.US)$

In the current semiconductor stock sale, even stocks that were not highly affected by “export restrictions to China” were sold. Despite the fact that the benefits of the “AI boom” are far greater, there are also stocks that have depreciated. So,China's sales composition ratio declinedI'm doing it,Also, stocks that are expected to increase AI-related salesI picked them up as the “3 recommended purchases.”

$NVIDIA (NVDA.US)$

◆The AI semiconductor market share is over 80%. Exports of advanced semiconductors to China have been prohibited due to “export regulations to China,” and China's sales structure ratio declined from 36.8% for the fiscal year ending 2017/1 and 32% for the fiscal year ending 2022/1 to 22% for the fiscal year ending 2024/1. Meanwhile, business performance has continued to expand in the meantime. This is because the benefits of the rapid expansion in demand for AI semiconductors by major US tech companies were far greater than the adverse effects of “export restrictions to China.”

◆Based on TSMC's strong earnings outlook, there is a high possibility that the company's strong demand for AI semiconductors will continue. This is because TSMC has an almost monopoly position in contract manufacturing of AI semiconductors, and NVIDIA is TSMC's main customer after Apple. In other words, it can be said that most of TSMC's outlook on AI semiconductors reflects demand trends for NVIDIA products.

◆Our business is based on the two pillars of semiconductor solutions and infrastructure software (including cloud services). VMware, which was acquired in 2022, is responsible for cloud services. The fact that it has two businesses that benefit from the AI boom can be said to be unique among other companies in the same industry.

◆ “China's sales composition ratio declined from 53.6% for the 2017/11 fiscal year and 35.5% for the 2021/11 fiscal year to 32.2% for the 2023/11 fiscal year.

◆In the semiconductor business, there is no direct confrontation with NVIDIA like AMD, but they make custom semiconductors for hyperscalers, which are NVIDIA's main customers. In the financial results announcement in June, sales forecasts for AI-related semiconductors were revised upward from the previous 10 billion dollars to 11 billion dollars, reflecting strong demand. On 7/18, it was reported that the company is discussing manufacturing AI semiconductors for Open AI, which developed “ChatGPT.” If true, there is a possibility that it will be a competitive product of NVIDIA, and it will be a positive material for the company.

◆ Electric power solutions company. Provides semiconductor-based power and power solutions. Customers include manufacturers of industrial equipment, communication infrastructure, cloud computing, automobiles, and consumer equipment. In the AI business, NVIDIA is one of the customers.

◆China's sales composition ratio is relatively high, but it has declined from 61.2% for the 2020/12 fiscal year to 51.3% for the 2023/12 fiscal year. China mainly provides power solutions for EVs (electric vehicles).

◆Stable performance has been achieved even during the semiconductor recession, and growth has accelerated in the past few years due to expanding demand due to the benefits of the AI boom. The company's market share is as high as 80% in the power field of NVIDIA's latest AI semiconductor Hopper and Blackwell platforms. Based on the fact that shipments of NVIDIA's latest AI semiconductors will begin in earnest in the latter half of the year, it is expected that benefits can also be expected for the company's performance.

7/19/24 Market Analyst Amelia

Source: Company materials and created by MooMoo Securities from Bloomberg

Source: Company materials and created by MooMoo Securities from Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

181301798 : I wonder if regulations and regulations against China are taken up every time, and if AI goes bankrupt, American high-tech companies that have continued to invest huge sums in it will go bankrupt, so there's no way that there is such a reason; for the most part, people who say AI boom can only see immediate movements

From now on, AI will evolve more than humans think, and it will change to a world where AI coexists

トクリン : Is AI a boom?

It's essential from now on, isn't it?

Now that the number of people is decreasing worldwide, all industries will sink if AI is not used to replace people.

It is true that it continued to be called AI somewhat repeatedly, but if this industry sinks, I think most other industries will also sink.

Trump is a businessman, so he said that in his performance before the election, but if Taiwan fails, America comes first this time, and it will create domestic demand.

So I want to hold on without being pessimistic.

戸尾カッター : By saying something, there is no way we can overlook technology that is extremely effective in the military industry.

kazusawa 181301798 : You're right!

kazusawa トクリン : That's right!