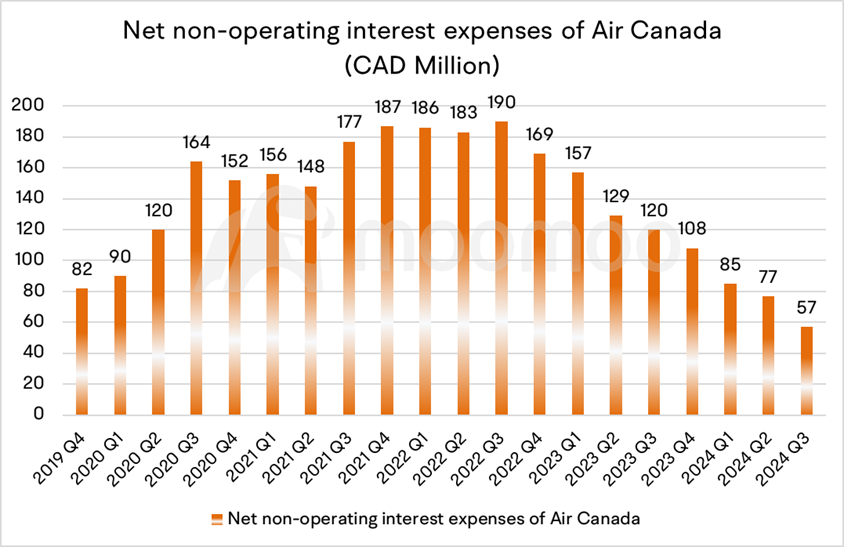

After the pandemic, Air Canada's debt burden has continued to rise. In 2019, its debt ratio was 84.2%; by 2023, it had increased to 97.4%. The company's interest expenses peaked in the third quarter of 2022, reaching C$190 million. Following the Bank of Canada's rate cut, its interest expenses significantly decreased in the second and third quarters. However, before the pandemic in Q4 2019, the interest cost was only C$41 million. Currently, the market expects the Bank of Canada to continue cutting rates from 3.25% to 2.75% in 2025, thus Air Canada's interest expense costs are bound to continue decreasing.