Alibaba FY2024Q3 Earnings Preview: Will Core Business Surpass Expectations and Alleviate Market Concerns?

The year 2023 was challenging for $Alibaba (BABA.US)$, China's e-commerce titan. Faced with factors such as China's macroeconomic environment and competitive pressures, Alibaba's stock price fell by 11% in 2023, while its competitor $PDD Holdings (PDD.US)$'s stock rose by 79%.

At its latest earnings call in last November, Alibaba articulated a clear strategic focus and priority selection for the entire group, decisively making choices that hone in on its core business.

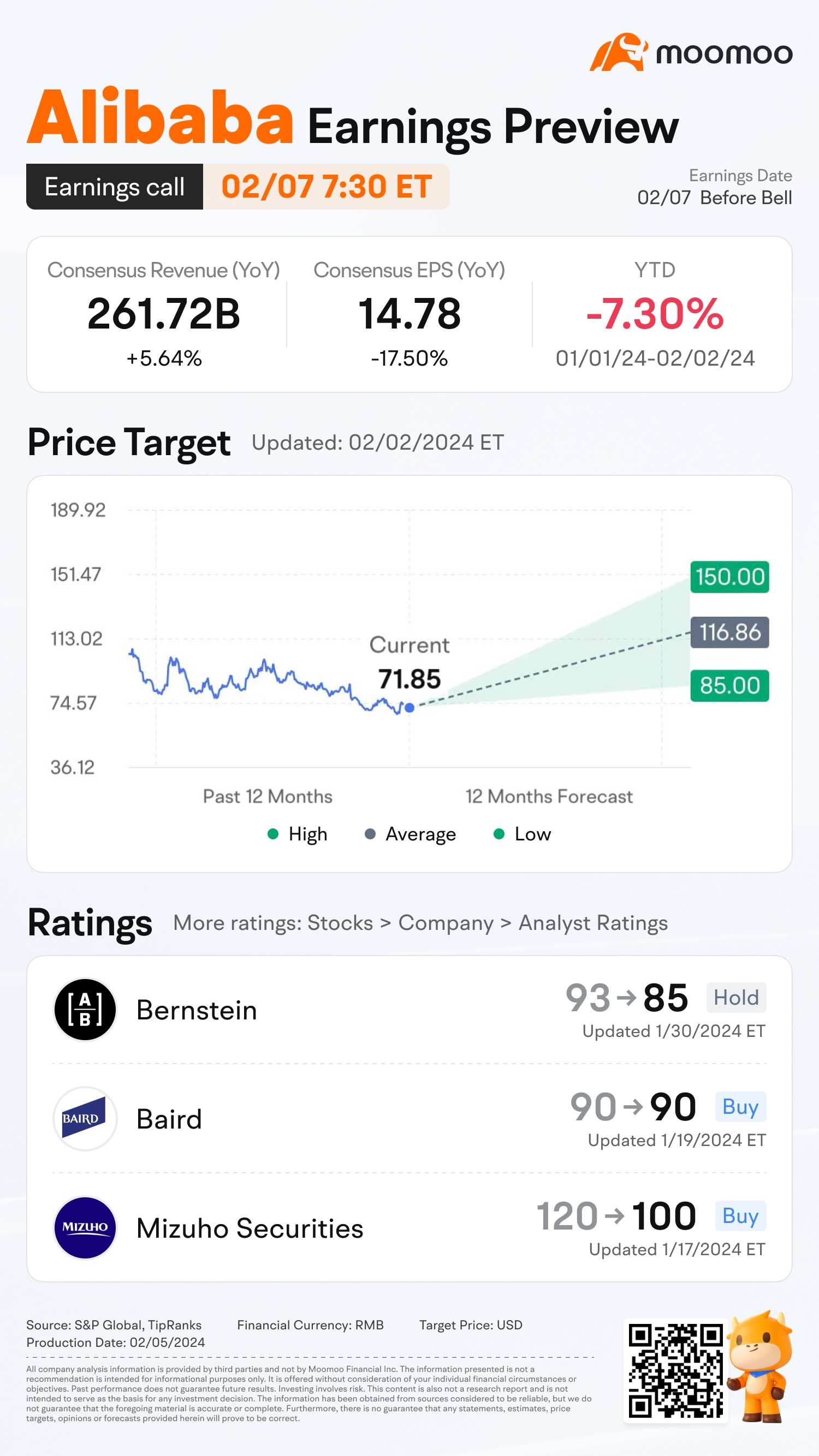

In the Q2 of fiscal year 2024, Alibaba's six major business groups exhibited varying degrees of year-over-year growth. According to Moomoo, market expectations for the FY2024Q3 financial performance of the company are as follows:

●The company is projected to achieve a revenue of 261.72 billion CNY, representing a year-over-year increase of 5.6%.

●Earnings per ADS are anticipated to be 14.78 CNY, a decrease of 17.5% compared to the same quarter in the previous year.

●The average price target for Alibaba is $116.86, suggesting a potential increase of 62.6% from the stock price at the close of the previous week. However, it is important to note that within the past month, analysts from Bernstein and Mizuho Securities have both lowered their target prices for Alibaba.

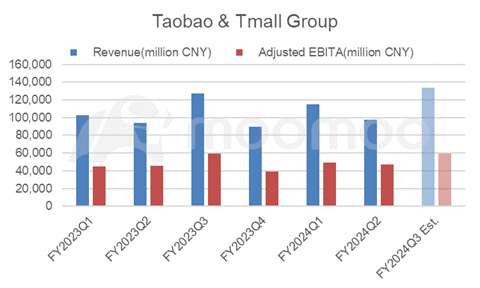

Taobao and Tmall Group (TTG)

TTG, the core business of Alibaba Group, are moving forward with a steadfast low-price strategy, ramping up subsidies to bolster small and medium-sized enterprises, while amplifying investment in price competitiveness, consumer experience, and AI integration.

However, due to macroeconomic headwinds and the disruptive force of live-streaming e-commerce platforms nibbling away at Alibaba's market share, analysts project a steady revenue trajectory of 5.3% year-over-year in FY2024Q3.

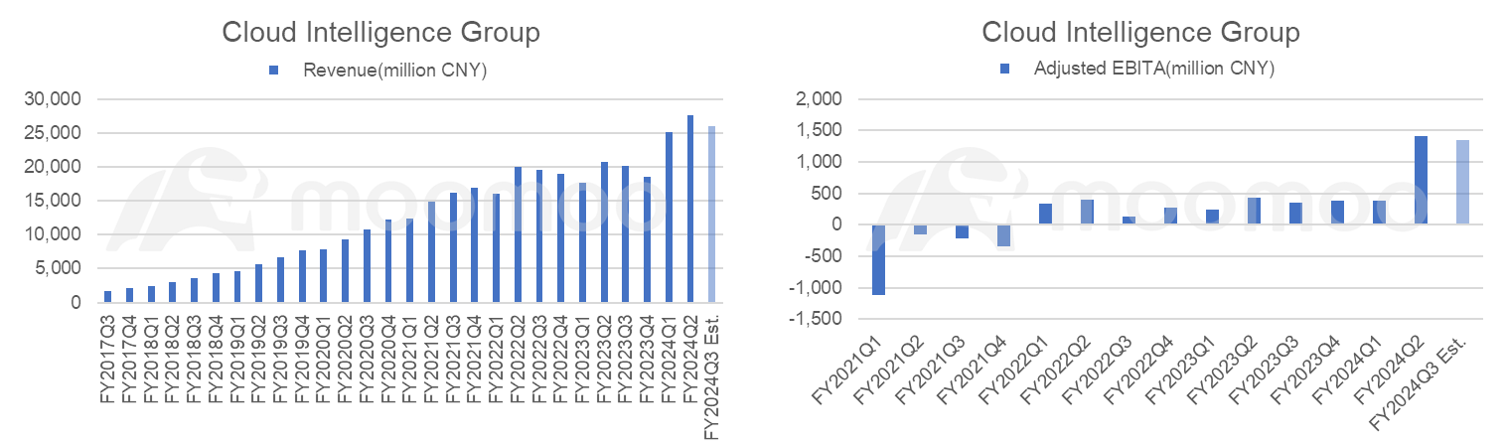

Cloud Business Recovery Still Requires Time

Alibaba Cloud has realigned its organizational structure to reflect a strategic focus on leveraging AI for growth, with a particular emphasis on prioritizing its public cloud offerings. CEO Wu Yongming stated,

By prioritizing public cloud, we will continue to reap scale effects and technological dividends.

Analysts anticipate that the revenue contribution from new technologies such as AI to Alibaba Cloud's earnings will take time to materialize. In the interim, due to short-term demand-side pressures and the company's proactive adjustments to low-margin projects, the recovery of the cloud business is expected to require additional time. The Bloomberg consensus forecast data shows that the cloud business is expected to decline by 5.98% in revenue and 4% in adjusted EBITA on a quarter-over-quarter basis in FY2024Q3.

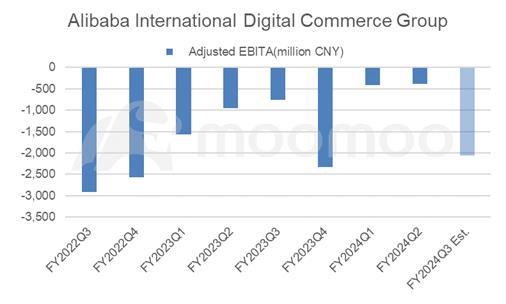

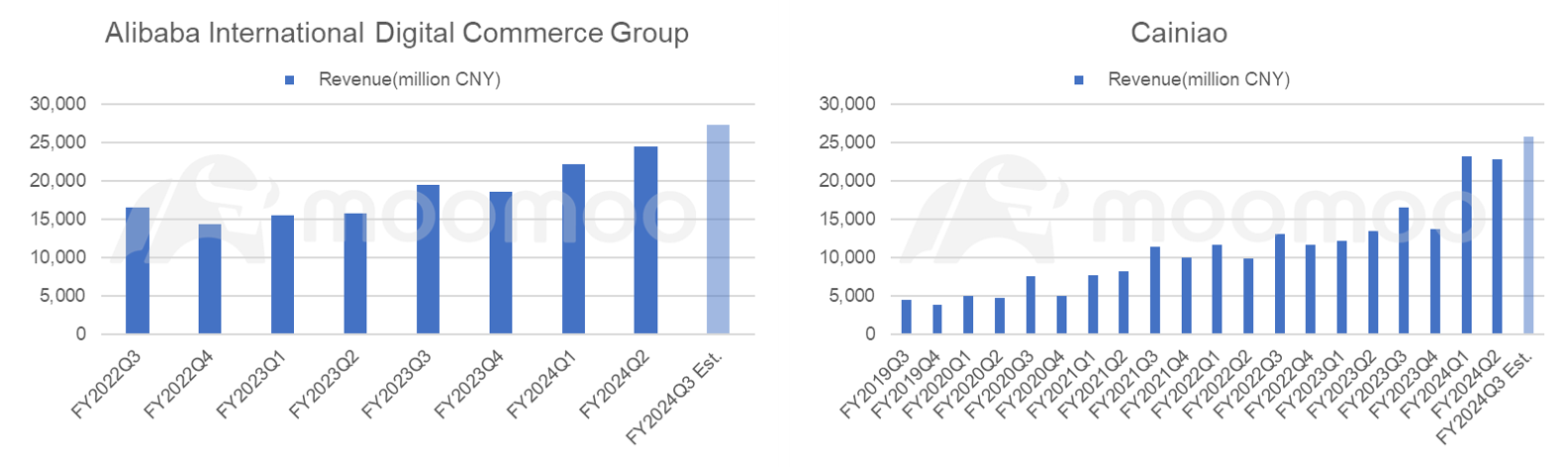

International Business Collaborates with Cainiao for Development

The international business division is experiencing rapid growth, driven primarily by robust performance from major retail platforms, notably fueled by the expansion of AliExpress Choice. This growth engine is significantly boosting user retention and purchase frequency. However, increased investment in cross-border activities may lead to a widening loss for the international segment. According to Bloomberg, it is expected that the adjusted EBITA in FY2024Q3 will expand from -384 million CNY in the previous quarter to -2057 million CNY.

In tandem, Choice is forging a collaborative effort with Cainiao. Through advanced data analytics and algorithmic innovations, Cainiao is streamlining delivery times, enhancing efficiency, and elevating consumer satisfaction. This synergy is not only catalyzing order growth for Choice but also augmenting revenue for Cainiao.

Management Expresses Confidence in the Company's Future

Alibaba Group's co-founder Jack Ma and Chairman Joe Tsai acquired shares worth millions of dollars in the company in Q4 of last year, signaling management's confidence in Alibaba and the broader internet industry. As of January 23rd, Jack Ma's shareholding has exceeded that of SoftBank, making him the largest shareholder in Alibaba Group.

Throughout the entire year of 2023, Alibaba bought back shares valued at $9.5 billion. As of December 31st, Alibaba's ongoing share buyback initiative, set to continue until March 2025, has $11.7 billion remaining for future repurchases.

Barron's selected Alibaba as one of its top stock picks for the year 2024. They contended that the company represented a cost-effective investment opportunity in China, citing its modest market valuation and substantial cash reserves.

Barclays analyst Jiong Shao also took into account the valuation of Alibaba. Noting that the company has produced $27 billion in free cash flow in the last 12 months, Shao evaluated Alibaba's valuation to be " among the most compelling". In addition, Shao views Alibaba stock as "screens as the cheapest major tech stock globally" and has given it an Overweight rating.

Source: Bloomberg, Yahoo Finance, Barron's

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment