Alibaba, JD, PDD eCommerce Upside Potential After Encouraging CPI

On 12 March 2024, we saw that Chinese stocks were rallying after Beijing concluded its annual parliamentary meeting with a 5% GDP growth target. Consumer price growth accelerated, potentially signaling a rebound in consumer spending.

We saw that $Alibaba(BABA)$ $JD.com (JD.US)$ $PDD Holdings (PDD.US)$ reacted positively to the news. But now we need to ask ourselves whether these ecommerce stocks would continue its upside rally since they have fallen quite a fair bit.

So is it a good time for us to load up on them? Or will it be an uphill climb for these stocks? Other Chinese ADRs might face some challenge on this, I believe.

What Are The Factors Encouraging This Sentiment?

The improvement in the consumer price index which was up 0.7% in February have been welcomed positively by investors. The rise show increased demand during the key Lunar New Year holiday season.

Whereas the producer price index, however, continued to fall. Investors have been concerned about deflation as consumer spending has been weak in the world's #2 economy, so rising consumer prices is a good sign.

With Beijing's plans to support the economic recovery and its target of 5% economic growth for the year.

Investors also seemed to like Beijing's plans to support the economic recovery and its target of 5% economic growth for the year. I would think it is time for us to look at how these 3 chinese ecommerce stocks would face in the coming weeks.

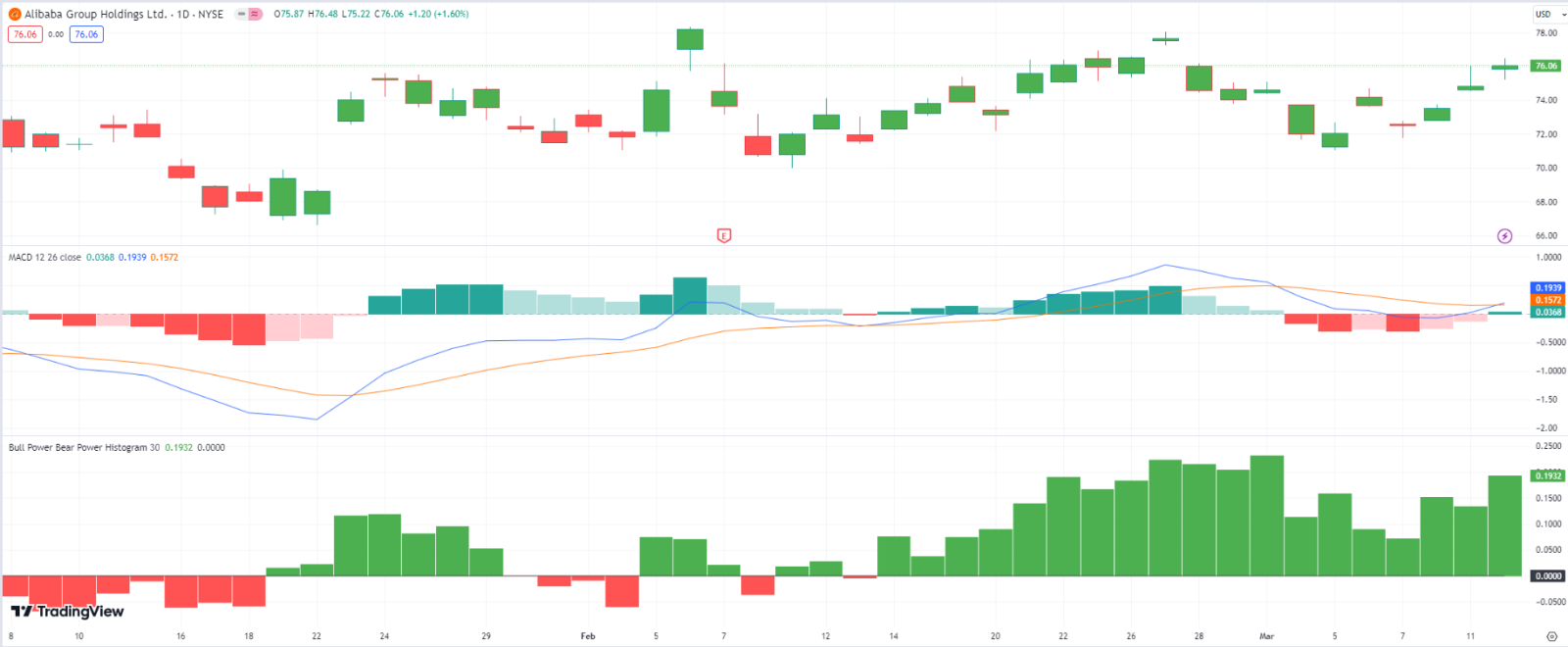

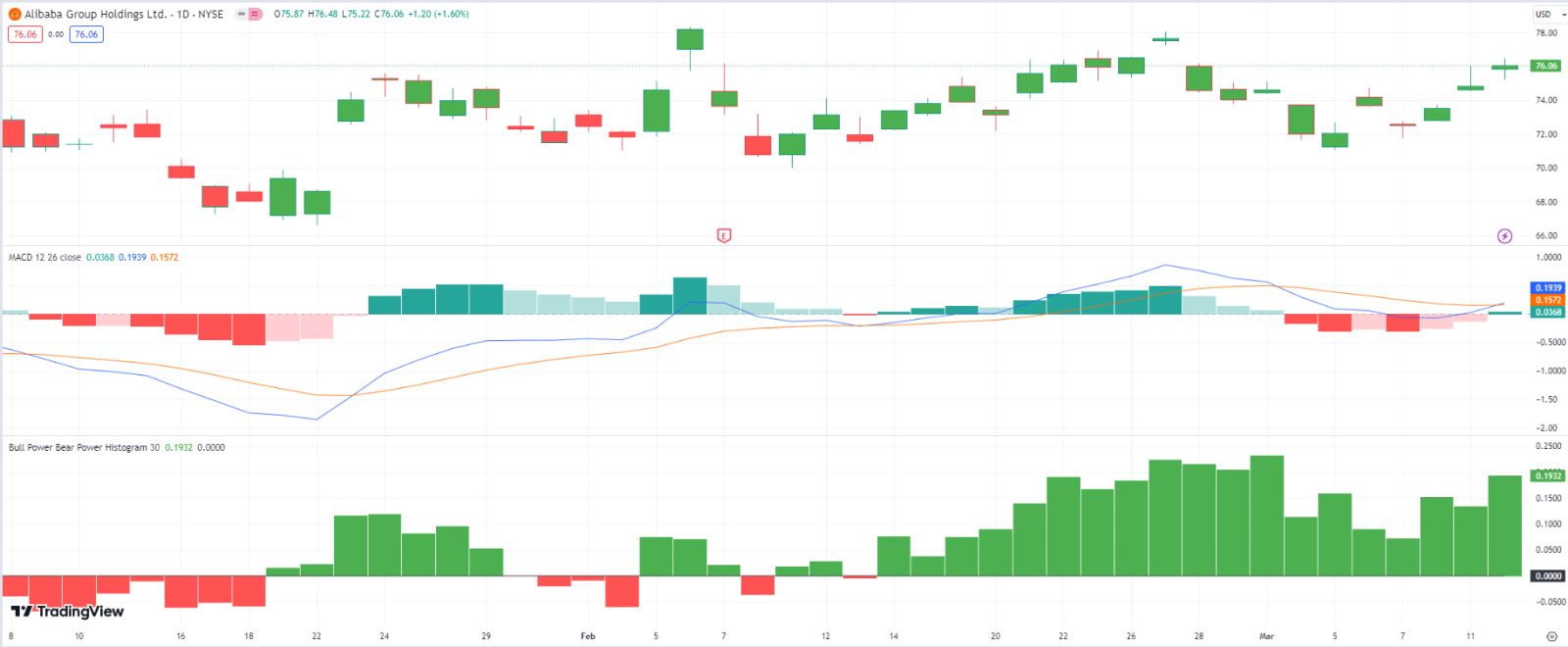

Alibaba (BABA)

Alibaba backs Digital Media, this is a good news to investors and we could see that there have been bullish power build up consistently for BABA.

There might be some monitoring to do on the MACD to determine how the market would react to the recent Chinese CPI rise, overall I believe BABA could be a potential stock to enter near its current price.

JD.com (JD)

JPMorgan Chase & Co. sells 76317 Shares of JD.com, but that does not dampen investors interest as seen in the daily chart, as we still see a pretty nice 3 consecutive Bull power build up, and MACD looks like it is building in an upward trend.

We might want to continue to monitor and see if JD could continue both the Bull power and MACD uptrend, then JD would be a potential BUY.

Pinduoduo (PDD)

Among these 3 Chinese ecommerce stocks, I would find PDD not as promising based on what I have gathered from the chart.

We are still not seeing any Bull power build up for quite a long period already, and there might be some signs of uptrend from MACD, but we need to monitor closely.

Summary

I would monitor Alibaba and JD.com over the next week, as I see potential in them as China release more support for their economy with CPI rising. But it is worth monitoring PDD in case there is any surprise news to propel PDD.

Appreciate if you could share your thoughts in the comment section whether you think Chinese ecommerce stocks would benefit well from new Chinese CPI rise?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

10baggerbamm : everybody agrees the Chinese stock market is very undervalued and that's why I am keying in on one particular company. KNDI. they've been traded for over a decade the company has 28% year revenue growth last year they had 130 million in revenue but the greatest value of this company is it trades at less than two to one price to market cap. the entire market cap of the company is 211 million. technology companies typically trade 15 to 30 times revenue and this company trades at less than two times. it represents a tremendous risk reward additionally the management sees how undervalued it is and is authorized a 30 million buyback in the open market this calendar year.. they're executing their business plan in Q4 of last year they completed the entire United States distribution network. this should provide 20 to 25% further revenue growth this year and next year going forward. the stock's been $20 plus in prior years and it's sitting at two and a half dollars now trading it less than two times revenue it's the best value on the entire NASDAQ right now and represents one of the best value of all Chinese stocks.