Alphabet (GOOGL) Ads Revenue Beat Will Push Stock Price Higher

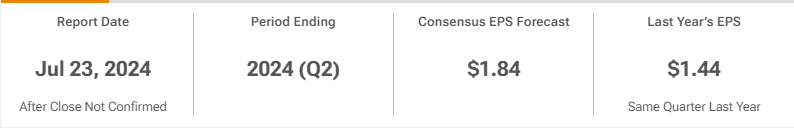

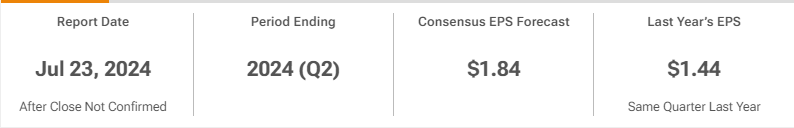

$Alphabet-A(GOOGL.US$ will be reporting their fiscal second quarter earnings after market close on Tuesday (23 July). This upcoming report will be giving the market an update on the state of the digital advertising market and whether generative AI hype is translating to revenue growth.

Alphabet has an impressive first quarter and they announced the dividend of $0.20 per share for the first time with authorized stock repurchases of $70 billion.

Market is anticipating earnings per share of $1.85 on revenue of $84.35 billion, That would be a major jump from the same period last year when the company reported earnings per share of $1.44 on revenue of $74.6 billion.

Alphabet (GOOGL) Shares Up 30% Year-To-Date

Alphabet shares are up 30% year to date. Shares of rivals Microsoft (MSFT) and Amazon (AMZN) are up 18% and 22% year to date, respectively. All three companies are pouring money into building out their generative AI capabilities, spending lavishly on data centers capable of powering the AI models they offer via their cloud service platforms.

Alphabet advertising revenue expected to top $64.5 billion, up from $58.1 billion last year. That includes year-over-year increases in Google Search & other, YouTube ads, and Google Network revenue, pointing to a positive advertising environment.

If Alphabet could beat the expectation on its revenue for the reporting quarter, we could see $Meta Platforms(META.US$ stock price benefitting from it as Meta is Alphabet ad business rival.

Analyst Price Target Forecast

Based on 39 Wall Street analysts offering 12 month price targets for Alphabet Class A in the last 3 months. The average price target is $202.80 with a high forecast of $240.00 and a low forecast of $170.00. The average price target represents a 11.63% change from the last price of $181.67.

If Alphabet maintain or better the first quarter ads revenue and beat the estimate, we could expect another dividend declared and this could help to push the stock price higher with a small surge.

But I think we might want to understand how Alphabet make money and why ad revenue is one of their biggest revenue contributor.

How Alphabet Make Money (Not Only From Ads)

As we have seen Alphabet reporting ad revenues in the billions and rising year after year, it has shown that ads is no doubt one of their biggest revenue sources. But there are other revenue streams which need our attention as well.

2023 Overview On Alphabet Revenue

Alphabet generated $307.39 billion in revenues in 2023.

More than three-quarters of its revenues in 2023 came from ads (search, YouTube, and Google Network).

Revenues from YouTube ads rose by 7.8% year on year, while revenues from Google Network ads fell by 4.5%.

Top Alphabet Revenue sources in Q1 2024

Ads (Google Search & other properties): $46.16 billion (57.3%)YouTube ads: $8.09 billion (10%)Google Network ads: $7.41 billion (9.2%). Google subscriptions, platforms, and devices: $8.74 billion (10.9%).

Google Cloud: $9.57 billion (11.9%). Other bets: $495 million (0.6%). Hedging gains: $72 million (0.1%)

In Q1 2024, Alphabet’s revenue totaled $80.54 billion, of which $61.66 billion (or 76.6%) was from ads. Revenue from search ads hit $46,16 billion, a 14.4% annual increase. Meanwhile, YouTube ads registered at $8.09 billion (10%), after rising 20.9% year on year, and Google Network ads fell by 1.1%, to $7.41 billion (9.2%).

As a result of the better-than-expected performance, Alphabet managed to reach market cap of more than $2 trillion for the first time at the end of the trading day post earnings.

So how should we trade Alphabet as we look forward to Alphabet earnings report with ads revenue anticipated to beat estimates?

Technical - MACD and KDJ - Potential Entry for Alphabet

We have seen Alphabet share experiencing a gap up after its previous first quarter earnings, so if the estimate for revenue especially the ads revenue is beaten, we could see similar gap up.

At time of this writing Alphabet share is up 0.20% at 24-hour trading, and I think investors are still confident on the second quarter.

From the technical, there is no clear signal for buying as MACD and KDJ is trying to form an upside signal, but that could probably give us an idea that the current price could be a potential entry.

Summary

As Alphabet has increased their spending on Ai to improve their advertising earnings, so this second quarter might be time to show if the return on AI investment for its advertising is positive and should encourage further investment.

The key focus for this earnings should be on their AI path development and their line of business, primarily the cloud computing as that is another area which could be another potential key revenue sources.

Appreciate if you could share your thoughts in the comment section whether you think Alphabet would provide yet another impressive earnings that beat estimates and another gap up followed?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment