Amazon Earnings Preview: AWS and Advertising Are Expected to Be Sources of Growth

$Amazon (AMZN.US)$ is scheduled to report second-quarter earnings after the stock market closes on Aug. 1, investors are expecting Amazon Web Service (AWS) and ad business to keep driving sales.

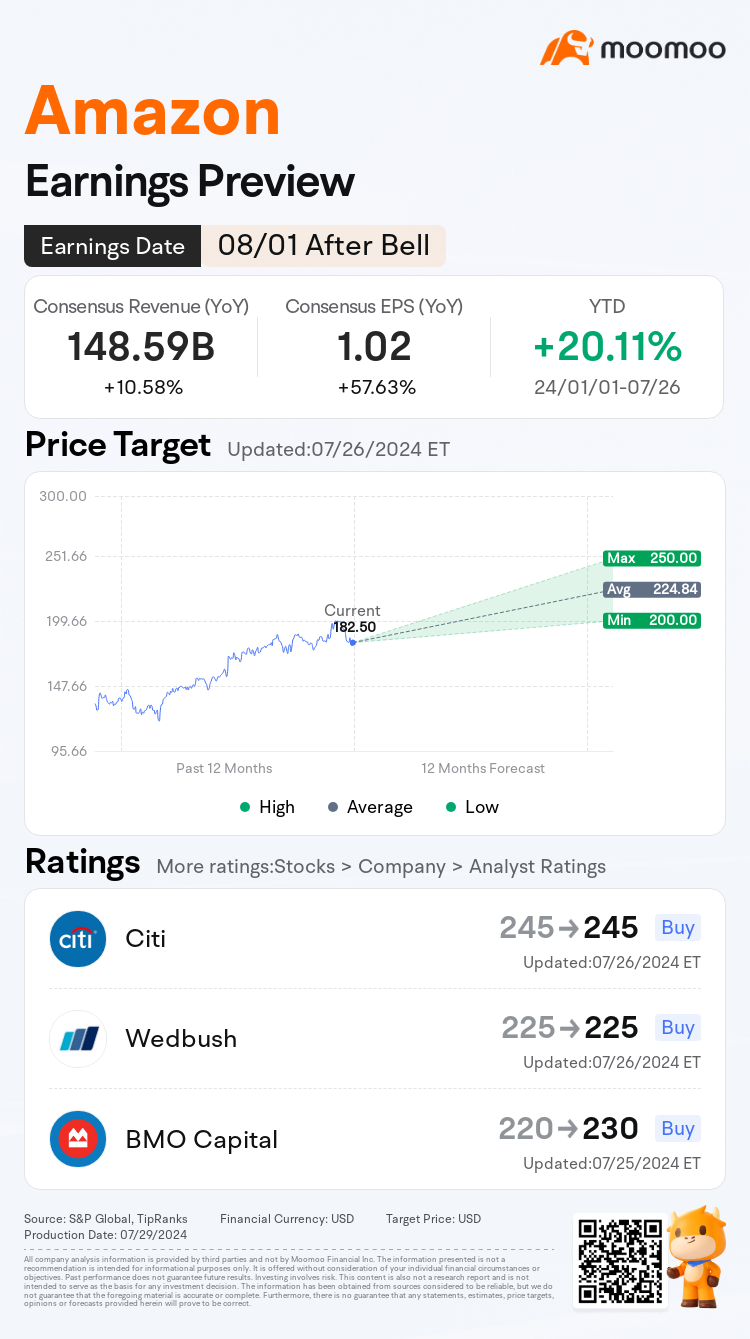

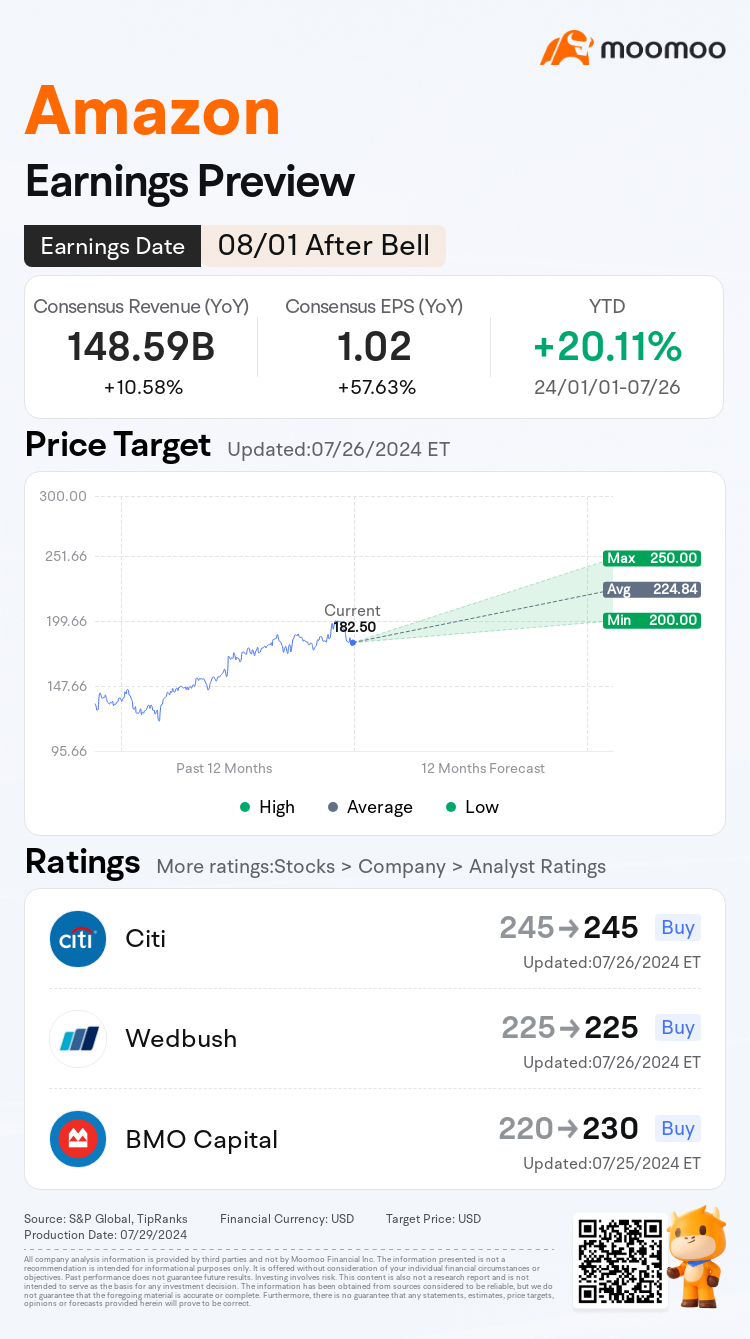

Consensus Estimates

● Amazon is expected to post quarterly earnings of $1.02 per share in the second quarter of 2024, which represents a year-over-year change of 57.63%.

● Revenues are expected to be $148.59 billion, up 10.58% from the year-ago quarter.

$Amazon (AMZN.US)$ stock has had a strong start to 2024, opening the year at $151.54 and currently sitting at $182.5 after reaching an annual high of $201.20 a few weeks ago. Fueled by expectations of continued growth driven by its core e-commerce business and emerging ventures like Amazon Ads and Amazon Web Services (AWS), the company's market capitalization surged past $2 trillion earlier this year.

Amazon Web Services (AWS)

AWS will continue to be under the microscope for investors with the Q2 report. The division, which rents cloud-based computing power and other services to businesses, is a key profit driver for Amazon. In 2023, AWS was responsible for two-thirds of Amazon's $37 billion in operating income, while contributing 16% of the company's total revenue.

Amazon is by far the largest provider of cloud services to businesses. But rivals such as $Microsoft (MSFT.US)$ Azure and $Alphabet-A (GOOGL.US)$’s Google Cloud Platform are racing to add AI offerings in a bid to win more share.

Along with competing for AI-related business, each of the so-called hyperscalers is working to reaccelerate sales growth after companies cut back — or optimized — on IT spending in 2022 and into last year.

So the growth rate for AWS will be closely watched by investors when Amazon's reports Q2 results. According to FactSet, analysts expect sales for the division to grow 17.5% to $26 billion. Sales grew at a 17.2% clip in the first quarter.

Amazon's AI Updates

On a call with analysts, Chief Executive Andy Jassy highlighted that AWS had reached a $100 billion annual revenue run rate. That includes a "multibillion-dollar" revenue run rate related to AI.

"The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS's AI capabilities is reaccelerating AWS's growth rate," Jassy told analysts.

Amazon also had a few updates related to AI initiatives, as noted in its last earnings release, when it noted “the extension of AWS and NVIDIA’s strategic collaboration to make AWS the best place to run NVIDIA GPUs, helping customers unlock new generative AI capabilities."

Besides, in March, Amazon announced that it invested an additional $2.75 billion in the AI startup Anthropic, completing a $4 billion deal with the artificial intelligence startup from late last year.

Retail Business Boosting Profits

The profitability of Amazon's retail business stood out to analysts following Amazon's first-quarter earnings report.

Amazon's international retail operations posted operating income for the first time since 2021. The division swung to a $900 million operating profit compared with a $1.2 billion loss in the first quarter of 2023. Sales in the segment increased 9.6% year over year to $31.9 billion.

The firm's North American operations, meanwhile, contributed $5 billion in operating income, up 450% from a year earlier. Sales advanced 12% year over year to $86.3 billion.

Amazon's high-margin advertising business is also helping profits. Ad sales jumped 24% year over year to $11.8 billion. That was just ahead of expectations of $11.7 billion, according to FactSet. In the company's Q1 news release, Jassy said ad sales "continue to benefit from the growth of our stores and Prime Video businesses."

In addition, investors will closely watch Amazon’s ability to execute its strategy of fast and efficient deliveries for Prime members, which aims to improve consumer experience and drive higher margins.

What do analysts say ahead of Q2 earnings?

Bank of America analysts wrote Friday that they believe growth in AWS demand could power its revenue above estimates, as Amazon has expanded the range of products available through its Bedrock platform.

Amazon's advertising revenue is likely to grow in the quarter and the second half of the year as the rollout of ads on Prime Video continues, analysts said. Wedbush analysts said 87% of advertisers who advertise on Amazon said in a recent survey that they increased spending in the second quarter compared to last year, and 91% said they plan to increase their ad spend in the third quarter.

What’s more, investors will also spotlight the sales performance of Prime Day. Adobe Analytics estimates that U.S. shoppers spent an estimated $14.2 billion online during the two-day event, up 11% from last year.

Bank of America analysts said their estimates put Prime Day's gross merchandise value around $13.4 billion, up 10% from last year and better than their projections of a 7% bump, also noting that a record number of Prime signups could help Amazon continue to gain market share in online retail.

Source: Investor’s Business Daily, Yahoo Finance, Investing

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

105535782 : ok

105535782 : ok

102188459 : Tq

104166257 : hi

102486946 : Good Job !