Amazon Earnings Preview: Online Sales Recovery and Strong Cloud Growth Poised to Boost Profits

E-commerce and cloud giant Amazon is scheduled to disclose its first-quarter financial results post-market on April 30. The spotlight is on the anticipated expansion of its advertising income and the performance of Amazon Web Services (AWS).

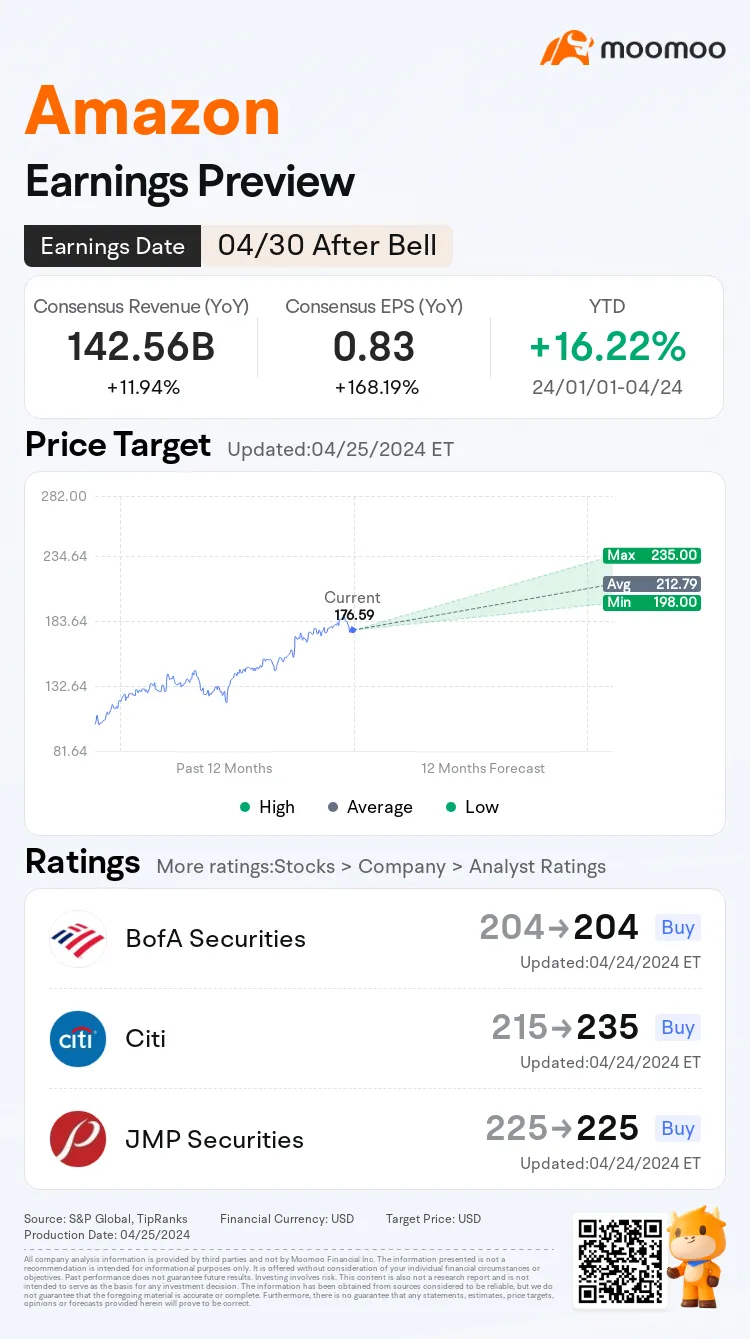

Consensus Estimates

• Analysts estimate Amazon to post revenue of USD142.56 billion for 2024Q1, up 11.94% YoY;

• EPS is estimated to be USD 0.83, up 168.19% YOY.

■ Amazon's retail sales are expected to hit double-digit growth

Amazon's Retail Third-Party Sales proportion has steadily increased quarter by quarter; its physical store sales have also benefited from the increasing customer traffic and continued to contribute to the revenue growth. The company's overall retail sales are expected to increase by 10.1%, returning to double-digit growth.

Sydney Goodman, an analyst from Bloomberg, expects that Amazon's gross merchandise value could climb at a 14% compound annual growth rate in 2022-27 to top $1.2 trillion globally, after reaching $1 trillion in 2026, giving it control over about 30% of all US e-commerce sales.

■ Amazon's cloud business could be the epitome of the industry's steady growth

Results from Amazon's rivals show the cloud market is still booming. Microsoft's earnings beat estimates last Thursday, driven by the strong performance of its Azure cloud-computing business amid growth in demand for AI workloads. The stock climbed 1.82% on Friday. Cloud-computing strength gave support to other cloud-dependent names, including Amazon, which rose 3.43% on Friday.

Although AWS, a powerhouse behind the success of giants like Netflix and Airbnb, now faces the possibility that emerging startups might opt to build their platforms on the frameworks provided by Microsoft or Google with more AI features, Amazon's server infrastructure remains the go-to choice for businesses aiming to upgrade legacy systems or engage in online activities.

Amazon's generative-AI growth opportunity differs from Microsoft's due to the latter's relationship with OpenAI. For Microsoft, increased usage of OpenAI drives incremental revenue, with the vast majority of its sales attributed to inferencing workloads. For AWS, however, sales could be a healthy mix of both training and inferencing. Clients will use AWS infrastructure along with either homegrown or third-party large language models, and then train those models with their own data before shifting to inferencing. This is the main reason it could take AWS a bit longer than Microsoft to realize AI-specific benefits.

■ Advertising gains may stay robust

The knock-on effects of big tech earnings didn't stop there. Google's results provided signs of strong demand for online advertising. Amazon's e-commerce advertising and streaming media advertising will also benefit from this trend. The sector's business (including Third-Party Sales ads) is Amazon's fastest growing revenue stream, surging at a compound annual growth rate of 51% in 2015-23, to $46.9 billion, and could surpass $100 billion by 2027. Ads are also its most profitable segment, with a 40-50% operating margin.

Bloomberg analyst Geetha Ranganathan predicted that its ad sales may rise by more than 20% in 1Q as Amazon takes market share. This, along with the introduction of ads to Prime video content earlier this year, are catalysts for sales gains.

■ Prime subscription penetration grows steadily

Amazon also benefits directly from subscription fees. Prime membership, which offers benefits like free two-day shipping, streaming of movies and music, and exclusive deals, incentivizes customers to stay within the Amazon ecosystem. Global prime subscribers reach 200 million and will likely to break records this year. The retail subscriptions division is expected to advance 12.3%, in turn boosting advertising revenue by 23.6%.

Appealing to Gen Z is also key. In a market survey, more than 80% of Gen Z respondents said they use Amazon, the highest among subscription services.

■ Major banks maintain bullish ratings on Amazon

UBS analyst Stephen Ju raised the firm's price target to $215 from $198 and kept a Buy rating ahead of the Q1 results on April 30. Stephen Ju expected the revenue to be at the high end of the guidance range of $143.5B, operating income between $13B-$13.5B, and AWS growth at 15%-16%.

Citi analyst Ronald Josey raised the its price target to $235 from $215 with a Buy rating. Citi projects operating income to reach 10% margins in 2025 on continued advertising strength and improving retail efficiencies. Given faster shipping speeds, the firm believes conversion rates are improving as Amazon's retail business benefits from its regionalization approach with shorter transport distances as the overall cost to serve comes down. Amazon remains one of its top picks across the internet sector.

Wedbush analyst Scott Devitt raised the firm's price target to $225 from $220 and kept an Outperform ratin. The company has reported operating income ahead of Street estimates for five consecutive quarters, and Wedbush estimates Q1 operating income of $11.6B, approximately 5% above consensus. Heading into results, the firm is looking for sustained advertising momentum given positive feedback from advertisers in its Q1 Digital Advertising Survey and from digital advertising agencies, and ongoing improvements in both North American and International retail margins.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74619152 : In French please

74619152 : I don't understand English

Ya Animal 74619152 : Learn English. It's useful

151345481 : I love Korean

Money Thrill 74619152 : Traduire avec Google translate. copy paste ... so I learned better english![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)