Amazon Options Attract Investors Seeking Protection Against Continued Stock Sell-Off

$Amazon (AMZN.US)$ is seeing increasing demand for protection against continued price slump as the stock tumbled after disappointing quarterly results.

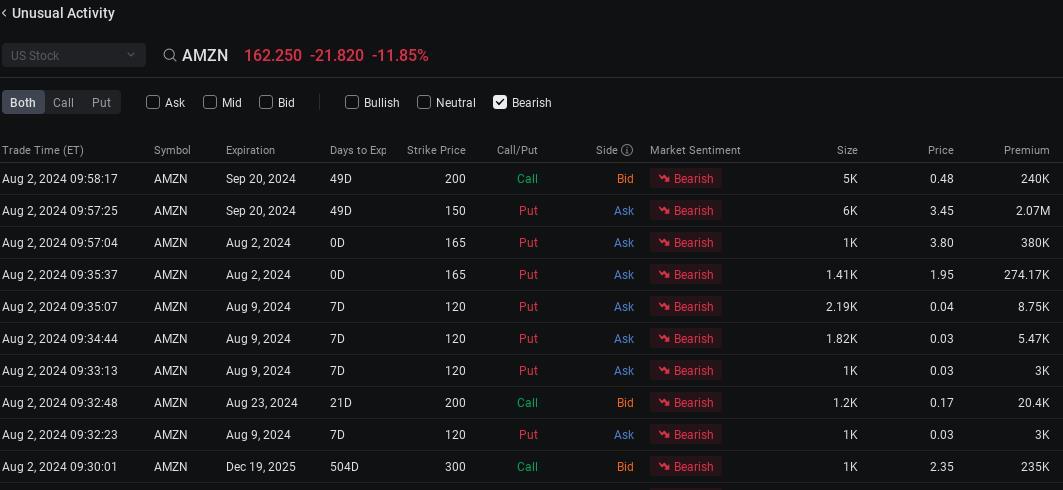

Less than 30 minutes into the trading day, a block trade for put options giving the holder the right to sell 600,000 Amazon shares at $150 each by Sept. 20. That's the biggest of the bearish unusual options trade posted just after 10 a.m. Friday. The strike is much lower than the current price of $162.16, after declining almost 12%.

Sour

Shares of the tech titan tumbled after reporting second quarter sales and third quarter outlook that missed analysts' estimates amid weakness in online stores. That could signal that the retail giant isn't immune from slowing consumer spending.

While net sales for the three months ended June 30 rose 10% to $148 billion, that trailed the $148.78 billion expected, according to the estimates compiled by Bloomberg. In the same earnings results released late Thursday, the company forecast third-quarter sales of $154 billion to $158.5 billion. The midpoint of that outlook is below the $158.4 billion expected by analysts.

Online stores, third-party seller services and subscription services trailed analysts' estimates even as the the company held its biggest shopping event, the 10th Prime Day in the second quarter. The bright spots were in the company's cloud business, the Amazon Web Services, and its advertising services that these weren't enough to assuage investors.

Amazon's stock slump Friday was aggravated by rising U.S. unemployment that accelerated the sell-off in the broader market. The $S&P 500 Index (.SPX.US)$ declined 2.4% while the tech-havy $Nasdaq Composite Index (.IXIC.US)$ tumbled 3.2%.

Across the 18 options expiration dates for Amazon stretching through December 2026, call options that give the holders the right to buy the stock at $170 attracted the heaviest volume, with 82,670 contracts changing hands as of 11:36 a.m. Holders are rushing to unload the contracts that have fallen out of the money as the stock price fall further below that.

Unemployment rose in July to 4.3%, the highest level since October 2021, data released by the Bureau of Labor Statistics Friday showed. That fueled fears of a U.S. economic recession. Nonfarm payroll employment rose by 114,000, weaker than the average monthly gain of 215,000 in the past year.

Share your thoughts on Amazon.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102188459 : Tq

54088 FROM RWS : 150

103539497 : hi

104166257 : hi

我只想赚个买菜钱 : ok

我只想赚个买菜钱 : k

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM RWS : wow

54088 FROM RWS : 150

View more comments...