Amazon Options Flow as Prime Day Launches | Options Corner

$Amazon(AMZN.US$ options climbed in volume as investors awaited the results of the mid-year sale Prime Day. Prime Day is over two days this year, July 16 and 17, and investors are watching for options that expire at the end of the week.

In 2023, Amazon's prime day sales grew sales 6.7% to $12.9 billion worldwide. In the U.S., e-commerce sales grew 6.1% during the same period, according to Digital Commerce 360's 2023 Global Online Marketplaces Report.

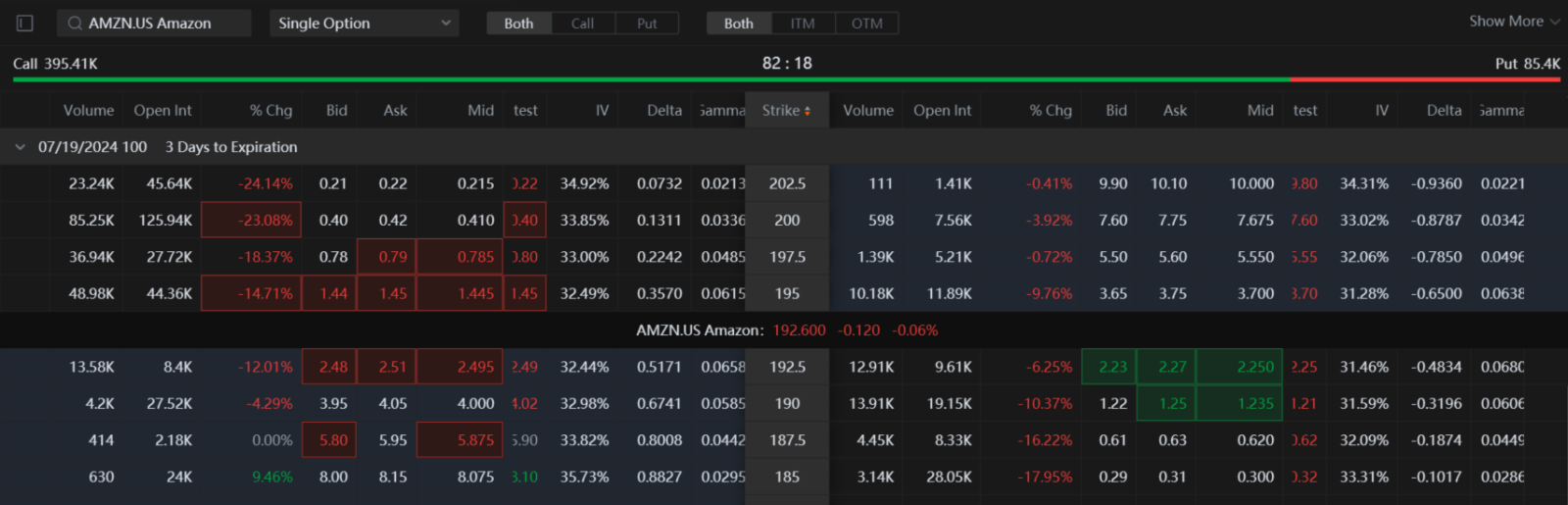

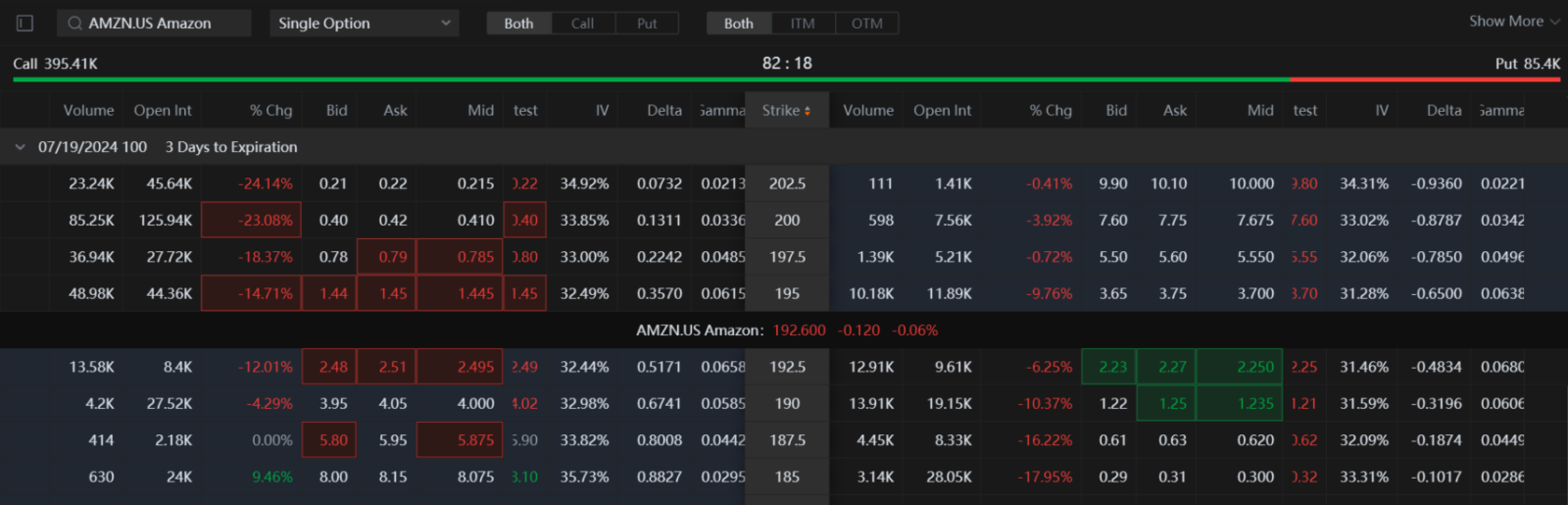

Two options contracts expiring Friday stood out for their outsized open interest: $200 call. Traders swapped the contract 85,000 times, and the contract saw an open interest of 125,000. It gives holders the right to buy Amazon for $200 at a current asking price of 40c a share for 100 shares. The contract has seen heavy volatility for the eight months the contract has traded.

It most recently jumped nearly 300% in the last two weeks of June before falling 84%.

Another contract expiring Friday that stood out was the $185 put, facing 28k in open interest with just 3,000 contracts changing hands. The contract gives holders the right to sell the underlying for $185/share for 100 shares at a current price of 26C.

Amazon currently trades at $192/share, up just 0.10%, and has an options call put ratio of 82:18. According to moomoo, traders have swapped $5B in Amazon stock, with 1.5B flowing in, and $1.6B flowing out Wednesday.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment