Amazon’s Entry Into the Elite $2 Trillion Club: Who Will Be Next?

In a significant milestone for the e-commerce giant, $Amazon(AMZN.US$ reached a market capitalization of $2 trillion for the first time on Wednesday, buoyed by a broader tech rally and positive sentiment from analysts.

Amazon's stock ascended by 3.5% to close at $193 on Wednesday. The company now joins Google's parent $Alphabet-C(GOOG.US$ , software behemoth $Microsoft(MSFT.US$, iPhone maker $Apple(AAPL.US$ and chip maker $NVIDIA(NVDA.US$ among companies as the latest member of the elite $2 trillionbu club.

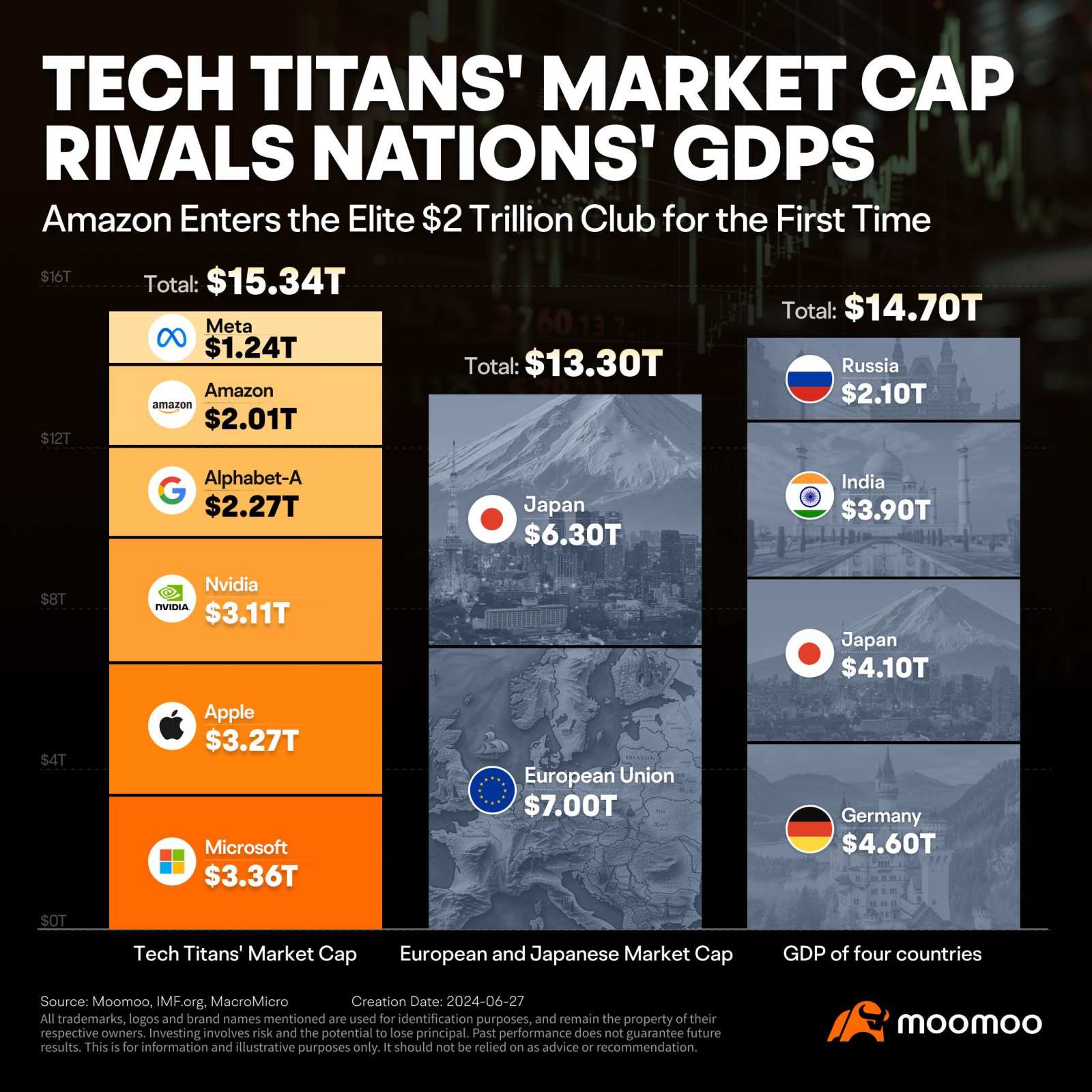

The elite group of U.S. companies now commands a combined market cap of $15.34 trillion. Remarkably, this collective valuation exceeds the total market capitalization of both the European Union (approximately $7 trillion) and Japan (around $6.3 trillion), which together amount to about $13.3 trillion. Furthermore, the combined market cap of these U.S. giants surpasses the GDP of several major economies, including Germany ($4.6 trillion), Japan ($4.1 trillion), India ($3.9 trillion), and Russia ($2.1 trillion), whose total GDP stands at $14.7 trillion.

The company's announcement of a new, aggressive strategy to secure its market position against up-and-coming Chinese e-commerce platforms Temu and Shein during a conference for Chinese sellers highlighted its proactive approach to global competition. Meanwhile, financial analysts from Bank of America reinforced this optimism, reiterating Amazon as their top pick among large-cap stocks and boosting their price target to $220, suggesting an 18% upside potential based on efficiency gains and margin expansion opportunities. Additionally, Amazon's significant stake in Rivian Automotive contributed to the positive sentiment, despite recent downturns in $Rivian Automotive(RIVN.US$'s stock performance, indicating Amazon's diverse investment interests and potential for long-term growth.

Fueled by breakthroughs and the exciting applications of artificial intelligence, the tech sector has captivated investors' imaginations, sending the $Nasdaq Composite Index(.IXIC.US$ soaring with an impressive year-to-date rally of 17.56%.

Amid discussions about whether the stock market can sustain its upward trend, attention frequently turns to how market capitalization is concentrated among U.S. equities.

Amid discussions about whether the stock market can sustain its upward trend, attention frequently turns to how market capitalization is concentrated among U.S. equities.

Contrary to the common perception of a highly concentrated American market, a study by Morgan Stanley Investment Management's analyst Michael J. Mauboussin indicates that the U.S. is actually less concentrated compared to other major global players. In a ranking of concentration levels within the ten largest markets worldwide, the U.S. sits toward the lower end, with countries like India, Japan, and China exhibiting greater concentration. Even though the top ten U.S. firms now make up 35% of the total market cap—a record peak—it raises the question: Can the market continue to concentrate at this pace, or will we see a shift towards a more even distribution of market cap among U.S. companies?

Historically, from 1989 to 2011, the average weight of the top ten stocks in 47 global markets was 48%. During the decade from 2014 to 2023, the average weight of the top ten U.S. stocks was 19% of the total market value, accounting for 47% of the total returns. Last year, these shares rose to 27% and 69%, respectively. "Even after a decade of increasing concentration, the U.S. stock market remains one of the more diversified markets in the world," the report stated.

Historically, from 1989 to 2011, the average weight of the top ten stocks in 47 global markets was 48%. During the decade from 2014 to 2023, the average weight of the top ten U.S. stocks was 19% of the total market value, accounting for 47% of the total returns. Last year, these shares rose to 27% and 69%, respectively. "Even after a decade of increasing concentration, the U.S. stock market remains one of the more diversified markets in the world," the report stated.

From a returns perspective, periods of increased concentration often yield higher returns, while times of decreasing concentration typically result in below-average performance.

For instance, during the late 1990s internet boom, the S&P 500 index had a compound annual return rate of 23.5% from 1994 to 1999, in stark contrast to the modest 3.6% from 2000 to 2013 following the dot-com bubble burst.

As Amazon secures its position in the exclusive $2 trillion valuation club, the tech industry's rapid growth and the market's confidence in AI-driven advancements raise the question: which company will be the next? Share your thoughts.

Source: MarketWatch, CNBC, USAToday

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment