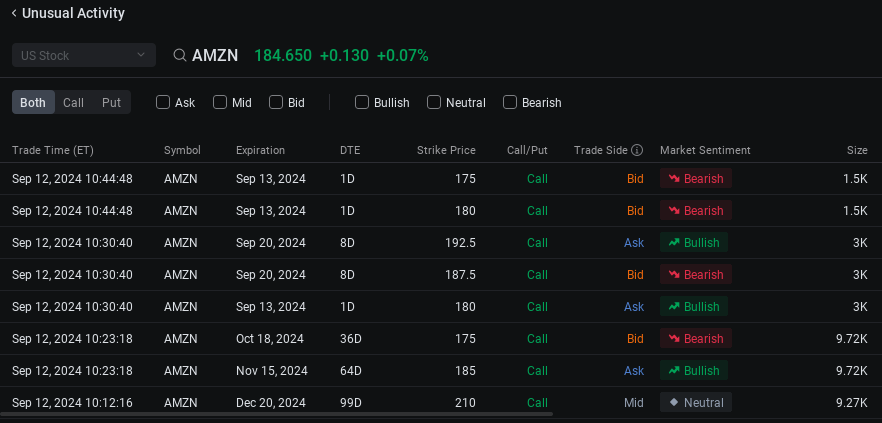

The heaviest volume in the Amazon options market is in call options that give the holders the right to buy the stock at $187.50 by the close of trading tomorrow. Almost 26,000 calls changed hands so far, more than triple the open interest. That contract traded between a high of 99 cents and a low of 26 cents before reaching 36 cents at 12:10 p.m. Thursday.

102928701 : Thank you![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

well presented and explanatory

MaoLo : There needs to be a pullback to 160 before reaching 190.

Wynnzhanglasvegas : Is it only 50% chives?

Laine Ford : good stock

54088 FROM RWS : 200

YWCYAPWEICHOY 叶伟财 : I recommend you to use moomoo for buying Crypto, it's safe, licensed, and has zero commissions. https://j.moomoo.com/01kd0q