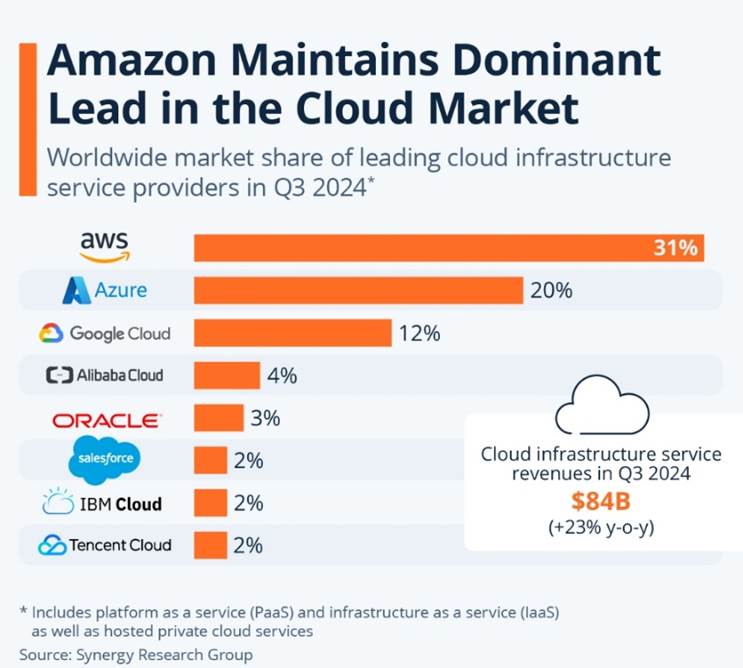

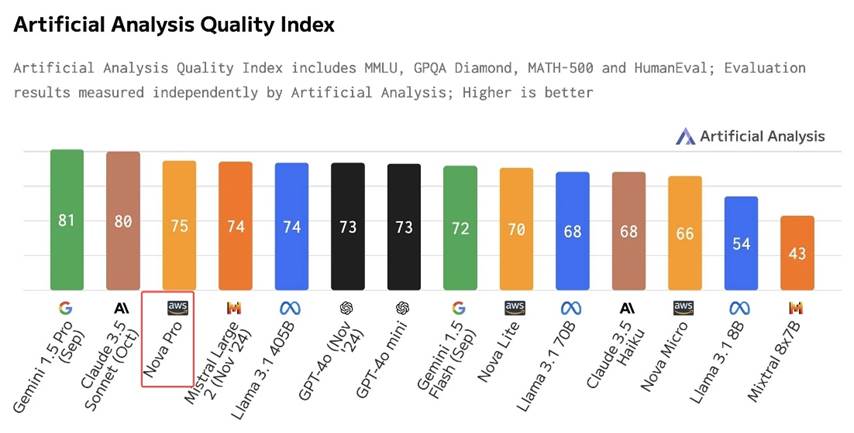

When it comes to AI giants, investors often first think of hardware companies like NVIDIA, AMD, and Broadcom, or software companies like OpenAI. However, Amazon is one of the few companies that fully exploits every aspect of AI. Its AI product layout includes AI chips, AI cloud computing, and highly competitive large models.

10baggerbamm : Amazon. never heard of that company before.

never heard of that company before.

RVLTN : shite company run with sheer arrogance. in life, this typically resuots in quite a fall

Sourena Sasaninejad RVLTN : wtf are you talking about…

70623829 : Already reflected.