AMC Earnings Preview: Grab rewards by guessing the opening price!

Hi mooers! ![]()

$AMC Entertainment (AMC.US)$ is releasing its Q3 earnings on November 6 after the bell. Unlock insights with AMC Earnings Hub>>

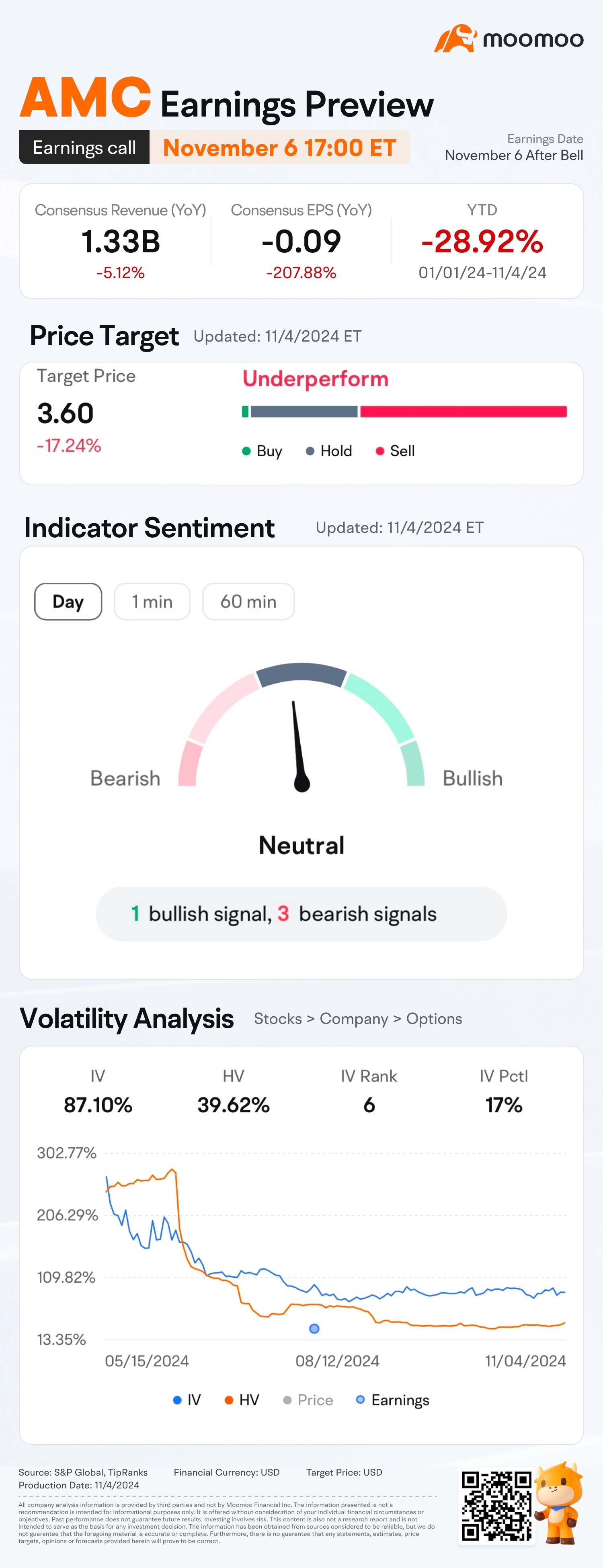

This quarter, analysts are expecting AMC Entertainment’s revenue to decline 5.1% year on year to $1.33 billion. In 2024, AMC's share price has dropped over 28%, as of November 4. Do you think the company's management will bring some surprise to investors? Subscribe to @Moo Live and book the conference call!

Since its last quarter earnings release, shares of $AMC Entertainment (AMC.US)$ have seen an decrease of 12.8%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $AMC Entertainment (AMC.US)$ 's opening price at 9:30 ET November 7 (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close on 9:30 ET November 7)

● Exclusive 300 points: For the writer of the top post on analyzing AMC's earnings prospects.

Read more >> Earnings season insights: understanding earnings reports to capture market opportunities

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104712493 : AMC’s earnings prospects are positively influenced by several strategic initiatives:

Alternative Content Offerings: AMC has been successfully diversifying beyond traditional movie screenings by showing high-profile concert films. Their distribution of Taylor Swift: The Eras Tour and Renaissance: A Film by Beyoncé attracted substantial audiences, proving that live music events can be lucrative revenue streams. These offerings could become a recurring source of income, helping stabilize revenue even if traditional movie attendance fluctuates.

Premium Experience and Customer Loyalty: AMC has focused on enhancing the theater experience with luxury seating, gourmet food options, and premium large-format screens, aiming to attract more customers who value immersive viewing. Additionally, the AMC Stubs loyalty program encourages repeat visits, helping to build a stable customer base.

Theater Partnerships and Merchandise: AMC has introduced retail and online sales of branded merchandise, which includes tie-ins with popular film franchises. These initiatives could drive additional income outside of ticket sales. Partnerships and merchandising deals can complement AMC’s revenue, allowing it to capitalize on the popularity of specific films or brands

Reduced Debt and Improved Cost Management: AMC has been working on debt restructuring and reducing operating costs to improve profitability. Any further success in managing expenses and optimizing its debt load could enhance net earnings, especially if revenues from these alternative channels continue to grow.

8Ch8mpi8n : 4.25

EasyGravy 104712493 : This is a trapped bagholder in a bankrupt popcorn stock

刘伯温 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) look be great

look be great

103765367 : Hi

Wilson kw : AMC shall prevail on its recent average price movement.

103968058 :

loving Buffalo_1407 : I thought this time would be better than before.

102636671 : good good

leap89 : It is expected that with the enhancement of rate cut expectations, there will be a wave of wsb trends later, and meme stocks will be hyped.

View more comments...