Bank Earnings Season Preview: Major Concerns Switch from Deposits Outflow to Credit Quality

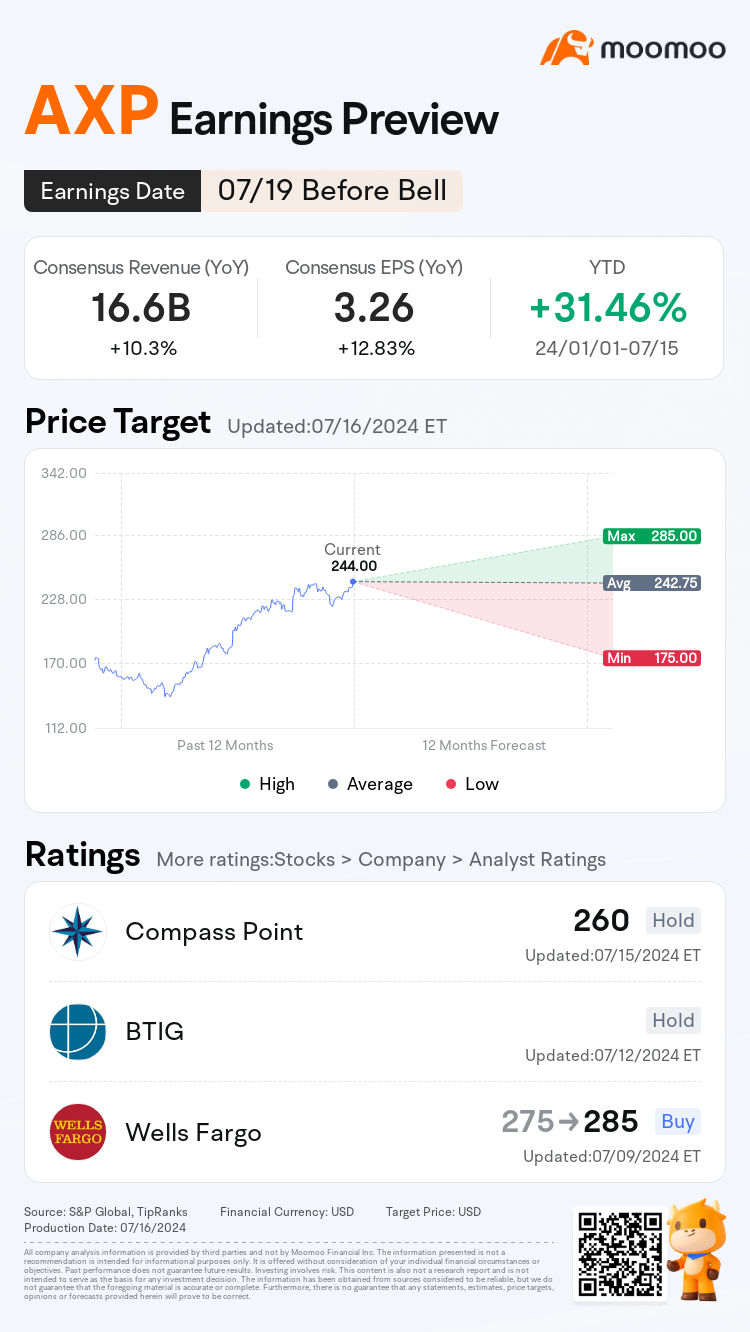

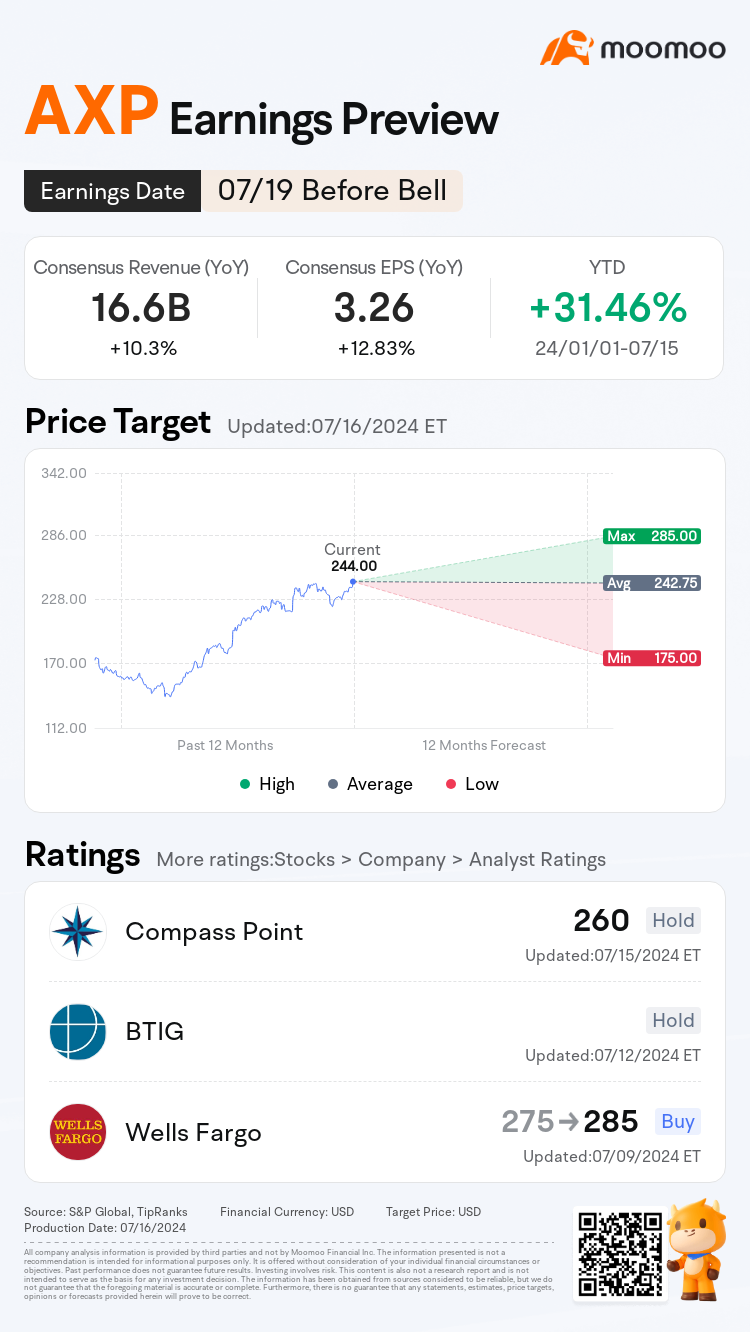

$American Express (AXP.US)$ , one of Berkshire Hathaway's largest holdings, will release its Q2 financial report before the bell on Friday. The upcoming earnings are expected to be bolstered by robust gains in loans and card fees, stringent cost management, and solid credit outcomes. The company still likely benefits from a premium customer demographic that typically incurs fewer credit losses compared to competitors and is willing to pay substantial fees for high-end products.

■ AmEx card issuing volumes normalize

AXP has been generating very robust card mailings over the past several months. However, in May, there was a leveling off with flat year-over-year figures, following a six-month period of notable increases.

Partly due to this factor, Barclays said that AXP's revenue in the second quarter may not be as impressive as the 10.5% growth rate in the first quarter, but the full-year growth rate may still remain in the 9-11% range. Wells Fargo's analyst Donald Fandetti notes that Q2 rev growth should moderate q/q, due to 1pt less billed business on day count and FX headwind. He projected rev growth of 9.5% (10%+ FX-adj).

■ AmEx's net interest margin benefits from continued decline in interest costs

As American Express's membership base expanded, the proportion of funds sourced from customer deposits has risen from only 14% in 2008 to 72% today. The interest on checking accounts for bank cards in the United States is usually very low.

Back in the first-quarter earnings season, Bank of America and JP Morgan's net interest margins fell, but AmEx's still grew. Although the market expects the Federal Reserve to cut interest rates in September, AmEx's optimization of its liability structure means that NIM is still likely to remain stable.

■ Default rate is expected to rise modestly

The net charge-off ratio, which accounts for loans determined to be unrecoverable and written off from the loss reserves, is expected to rise slightly to 2.5%, up from 2.3% in the first quarter. The company’s management team recently reiterated that this year's default rate would see a modest increase compared to last year.

The good news is, according to Vantage Score, the y/y increase in card delinquencies in May appears to have stabilized for higher income borrowers. Given AmEx's good customer structure, this trend could translate into improving credit quality in the following quarters.

As for provisions, Wells Fargo projected provision expense of $1.46B vs. consensus $1.5B.

■ How do analysts view AmEx's upcoming earnings?

The financial sector team at Bloomberg noted that American Express' stock has experienced a significant upswing, trading around 30% higher since the beginning of the year and carrying a 58% PE premium over its industry counterparts. The bar is high ahead of American Express' 2Q earnings. During the investor day in April, management reiterated their long-term growth ambitions and has been actively working towards achieving them. Despite the company's strides, rising credit costs pose a possible risk to earnings per share growth. The consensus on net charge-offs suggests they could remain higher than pre-pandemic levels through 2025, although there have been enhancements to the credit portfolio. Besides, the strong exchange rate of the US dollar in the second quarter has impacted overseas revenue.

Despite many unfavorable factors, Wells Fargo still claims that AXP has the best-in-class credit quality compared to its peers, and maintains its estimated EPS of $13.2/$15/ $17.1 for 2023-2025. The analyst raised the target price from $275 to $285 in the latest report released on July 9th, stating, “We believe the shares will see multiple expansion as they deliver on the long-term growth algorithm. AXP remains our Top Pick.”

Source: Wells Fargo, Bloomberg, Barclays

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

身骑白马 : good

74776524 : 9((;

103809741RahimiRamly : thanks you so much