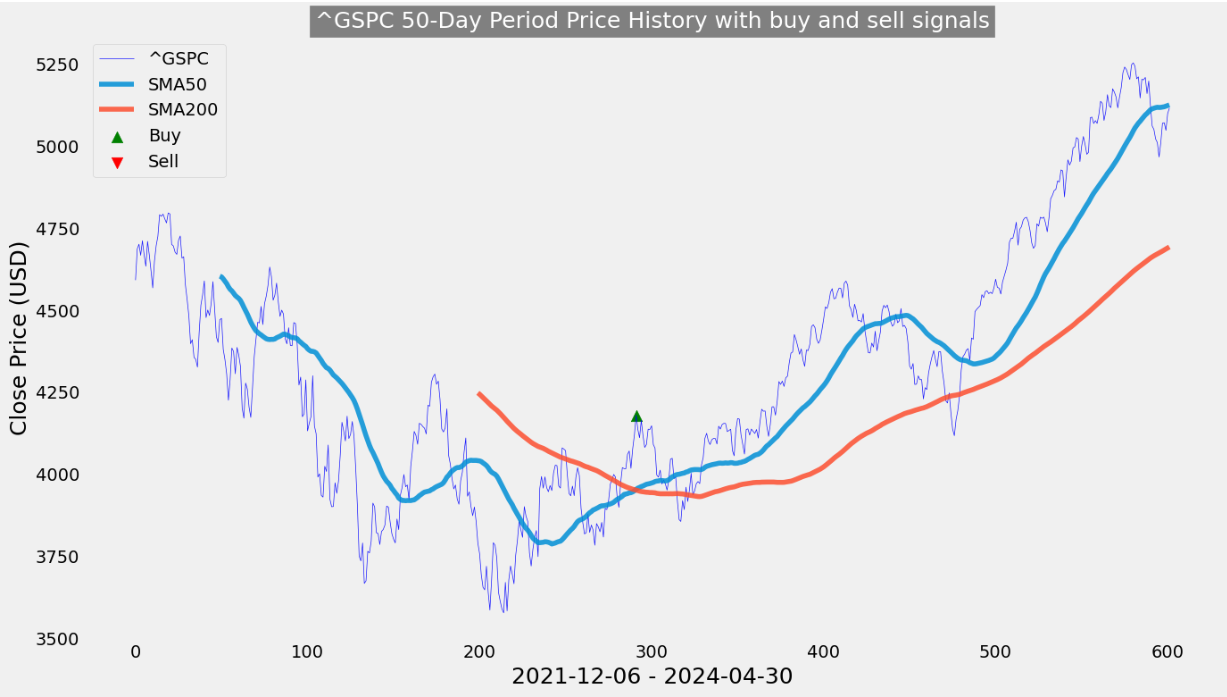

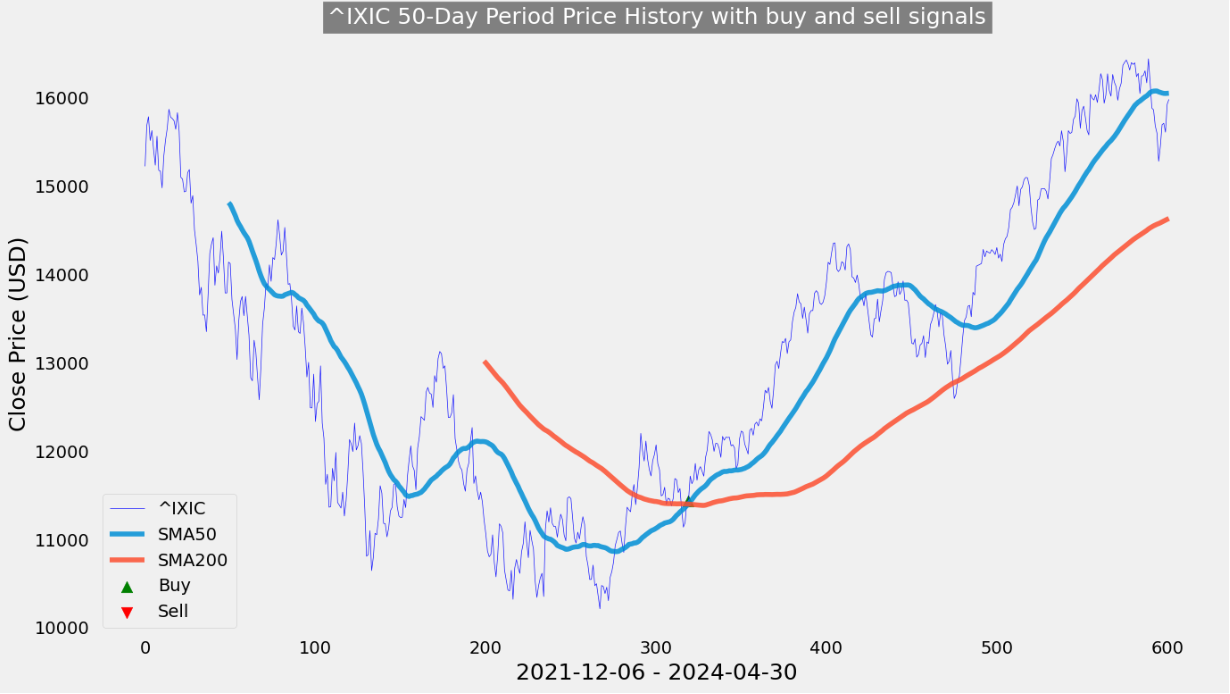

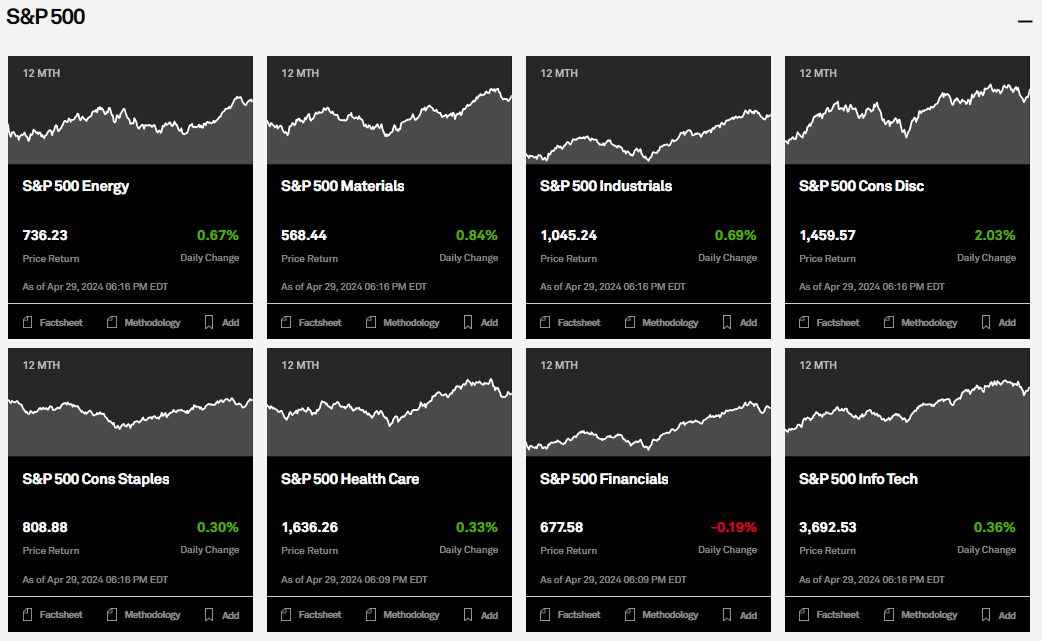

The Treasury's announcement that Q2 borrowing is projected at $243 billion, $41 billion more than previously estimated, caused a brief dip in stocks at 3:00 PM US eastern time. However, the market rebounded, with many stocks closing the session on a positive note, leading the equal-weighted S&P 500 to a 0.3% gain, ahead of this week's Federal Reserve meeting, jobs data, and big-name earnings reports.