An Easy Guide: 5 Keywords to Understand Crypto Transactions

Moomoo now offers crypto trading!![]()

We know many of you are excited, but beginners might find terms like 'blockchain,' 'cold wallet,' 'private key,' and 'public key' confusing. ![]()

Let’s simplify them for you!

Why crypto emerged

Fiat currencies like the Singapore dollar or US dollar are backed by governments. However, excessive money printing can lead to inflation and decreased value. Cryptocurrencies aim to create a transparent, fair, and decentralized financial system, free from control by any single entity.

Understanding crypto transactions

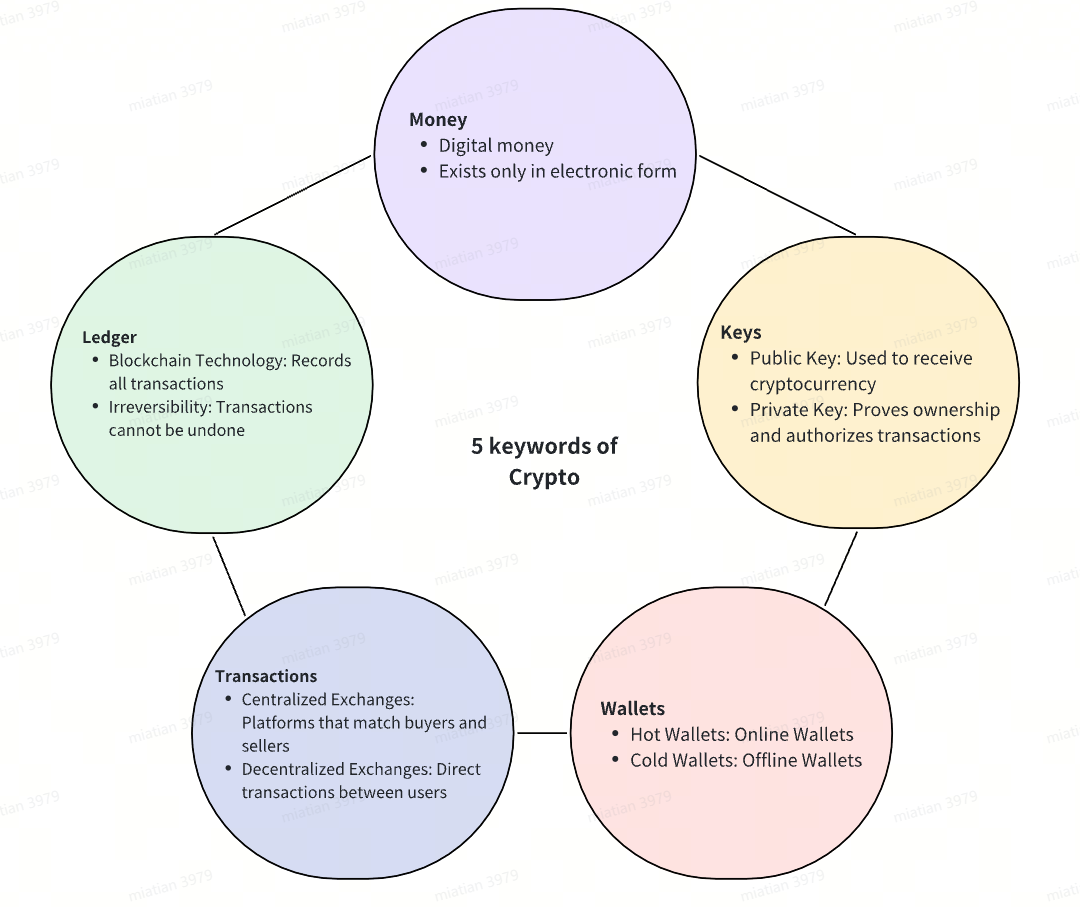

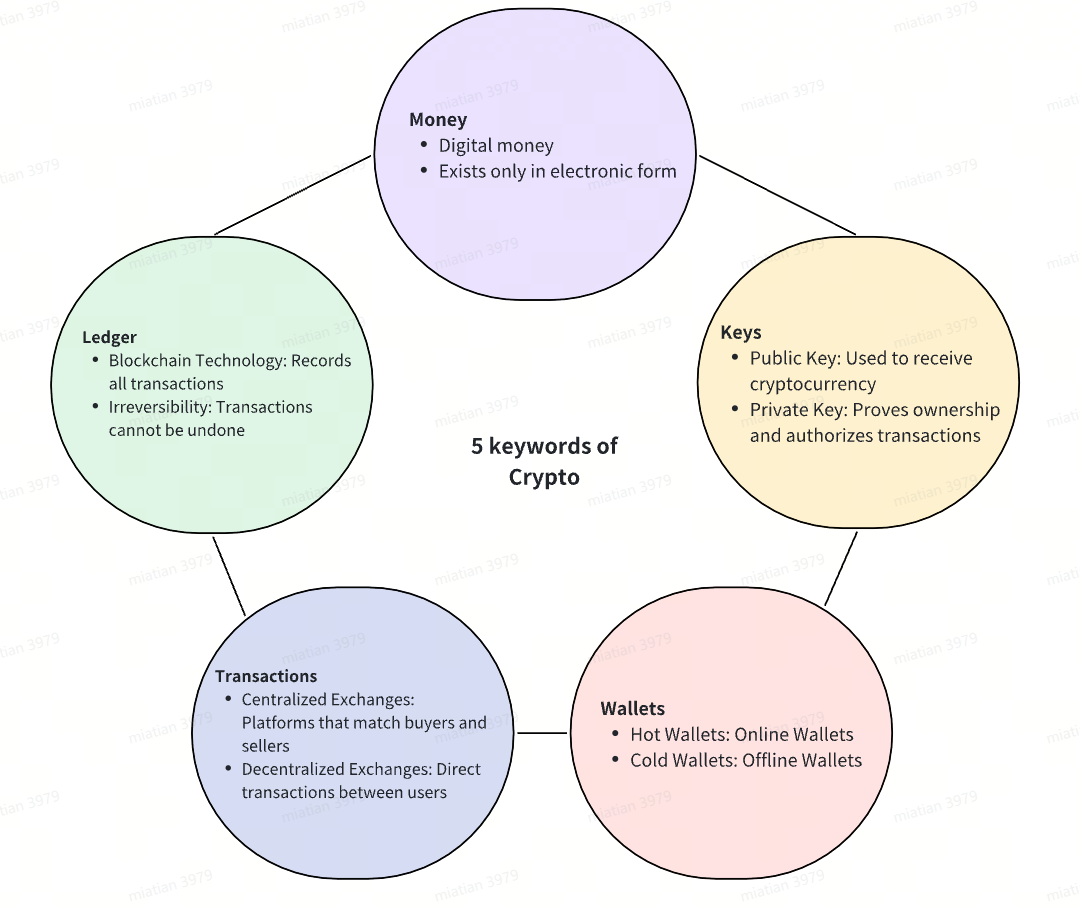

Let’s simplify crypto with basic terms: "money," "keys," "wallets," "transactions," and "ledger." This will help you quickly grasp how it all works.

I. What is crypto?

Money is something we all know well, and nowadays, we rarely use cash, relying instead on electronic payments. Crypto is also a form of money, but it exists purely in the digital world without any physical form. Most cryptocurrencies (for example Bitcoin, Ethereum) are not backed by real-world assets.

Unlike traditional currencies issued and controlled by central banks, crypto is decentralized and can be used anywhere in the world.

II. How is it secure? A key only you can access

When it comes to money, security is crucial. Just like your bank account needs a password, crypto requires a "private key" — a unique code that only you have. To receive crypto, others need your "wallet address."

Here's how it works: the private key generates a "public key" through encryption, which is used to encrypt transaction data. The public key then generates the wallet address, which you share to receive funds. Importantly, no one can reverse-engineer the private key from the public key or wallet address, ensuring security and anonymity.

Remember to safeguard your private key — losing it means losing your crypto forever.

III. What kind of wallet holds your key?

There are two types:

Hot Wallets: These are online and connected to the internet, making transactions quick and easy but more vulnerable to hacks.

Cold Wallets: These are offline, stored on hardware like USB devices or even printed as QR codes. They are more secure but less convenient for frequent transactions.

Choose based on your needs: for large, long-term holdings, a cold wallet might be best. For frequent trading, consider a hot wallet.

IV. Where can you trade crypto?

Centralized Exchanges: Like stock markets, they match buyers and sellers. They offer high liquidity, fast transactions, and user-friendly interfaces but can be susceptible to hacks and charge higher fees.

Decentralized Exchanges: These are peer-to-peer platforms without a central authority. They offer more privacy and security but might have lower liquidity and slower transactions.

V. How are transactions recorded?

Blockchain is the backbone of crypto, ensuring transparency and immutability. Think of it as a distributed ledger where every participant has a copy of all transaction records. When a new transaction occurs, it's added to everyone's ledger and can't be altered or reversed.

Transactions are grouped into blocks, and each block is cryptographically linked to the previous one, forming a chain. Altering any block would require redoing all subsequent blocks, which is computationally infeasible.

Ethereum's innovation

Ethereum goes beyond Bitcoin's blockchain by introducing smart contracts, which automatically execute terms when specific conditions are met. This innovation enables decentralized applications and exchanges.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Invest With Cici : Great read for newbies!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Everyone who has questions related to investing in crypto is welcome to join our official Learn Premium Group SG to connect with some other investors! Just search “Learn Premium Group” to apply~

Everyone who has questions related to investing in crypto is welcome to join our official Learn Premium Group SG to connect with some other investors! Just search “Learn Premium Group” to apply~

Wonder : Thanks for explaining the keywords.

When trading crypto in Moo Moo, how do these terms fit in? Like what is my private key, how to gain access n where is it stored, it is considered centralized exchange?

Supermengg :

Siewlun Ha : Go.

Yowe : lol

102312701 : good

Eat Drink Earl Grey Wonder : you only need to worry about private keys if you use a wallet to keep your cryptos off the exchange

EdisonYeo :

Wonder Eat Drink Earl Grey : thanks for replying. crypto is like greek for me![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Lazy Cat Invests : thanks

View more comments...