An Inflation Shocker Sends Stock Soaring

Follow me to stay informed and connected!

Yesterday's CPI data can be said to be surprisingly good. As soon as the report came out, the three major stock indexes all rose sharply. So let's analyze what information this CPI conveys.

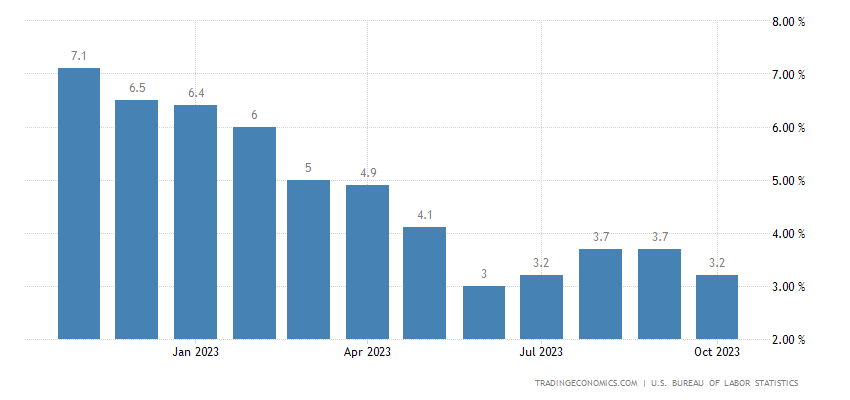

The Consumer Price Index in October, as unchanged in October, which was better than the expectation for an increase of 0.1%, resulting in a year-over-year rate that declined from 3.7% to 3.2%.

The core CPI rate, excluding food and energy, rose 0.2% and below expectations for an increase of 0.3%, resulting in a year-over-year rate of 4.0%. The disinflationary trend remains intact, with the core CPI falling to a two-year low.

Reasons for the Slowing of US Inflation in October:

First, gasoline prices fell. Although the Israel-Palestine conflict in early October raised market concerns, it has not led to a sustained rise in oil prices. On the contrary, Brent crude oil prices have fallen from a high of $96 per barrel at the end of September to $83 per barrel in early November. Retail gasoline prices in the US have also continued to fall since late September, currently dropping below $3.50 per gallon. The pressure on oil prices is decreasing, which is good news for the economy because the risk of "stagflation" caused by insufficient energy supply will be reduced.

Second, rental inflation has slowed down. The monthly increase rate of owners' equivalent rent (OER) in October fell from 0.6% in September, which exceeded expectations, to 0.4%, but the growth rate of primary residence rent remained at 0.5%. Overall, higher-weighted "long-term lease" rentals have shown stronger stickiness than expected this year. I expect rental inflation to continue to decline, but at a slower pace than previously expected by the market.

Third, the decline in prices of some core goods and services brought drag. As supply and demand further balanced, the month-on-month core commodity prices in October fell by 0.1%. Among them, the price of used cars fell further by 0.8%, but the decline was narrower than the previous month's 2.5%. The price of new cars turned negative on a month-on-month basis, and the price increases of furniture, toys, computers, smartphones, and other items were relatively moderate. The non-shelter core services that the Federal Reserve is most concerned about also cooled last month. Hotel and airfare prices, which fluctuated greatly, fell month-on-month. However, after seasonal adjustment, the month-on-month growth rate of medical insurance prices turned from -3.5% to an increase of 1.1%. This means that the drag of medical service prices on inflation has ended.

Looking ahead, due to base effects, inflation in November and December may still experience a "tail lift" . Assuming that the month-on-month inflation growth rate in November and December is the same as in October due to the low base effect of the last two months in 2020, the overall CPI year-on-year growth rate may rebound to 3.3% and 3.7%, respectively, and the core CPI year-on-year growth rate may rebound to 4.1% and 4.2%, respectively. In addition, the seasonal factors in November and December tend to push up the inflation rate, which may also mean that the month-on-month inflation growth rate after seasonal adjustment may rebound.

However, overall, the slowdown in inflation in October is still a positive signal, which means that the necessity of further interest rate hikes by the Fed has decreased. For the market, the slowing of inflation supports the improvement of risk preference, and assets that have undergone adjustments in the early stage may still be in a period of rebound.

The rebound over the past two weeks has awakened the retail investor, as measured by the monumental surge in optimism in last week’s survey by the American Association of Individual Investors. The percentage of bulls rose from 24.3% to 42.8% in just one week, which was the largest weekly increase since the market emerged from the Great Financial Crisis in 2009.

However, investors should not overly rely on expectations of Fed easing. Benefiting from base effects, US inflation is expected to continue to decline in 2024, but in recent years, factors that are unfavorable to supply, such as aging populations, government intervention in the economy, frequent geopolitical conflicts, and anti-globalization trends, have increased. This means that inflation will persist for a longer period and the US inflation center may rise systematically. The implication for monetary policy is that the Fed will find it increasingly difficult to choose between growth and inflation. To guide the economy to a soft landing next year, the Fed may need to increase its tolerance for inflation. In the baseline scenario, the Fed will maintain its current interest rate level in the first half of next year and turn to interest rate cuts in the second half, with the first cut possibly in September. In the medium term, the Fed may raise its inflation target.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment