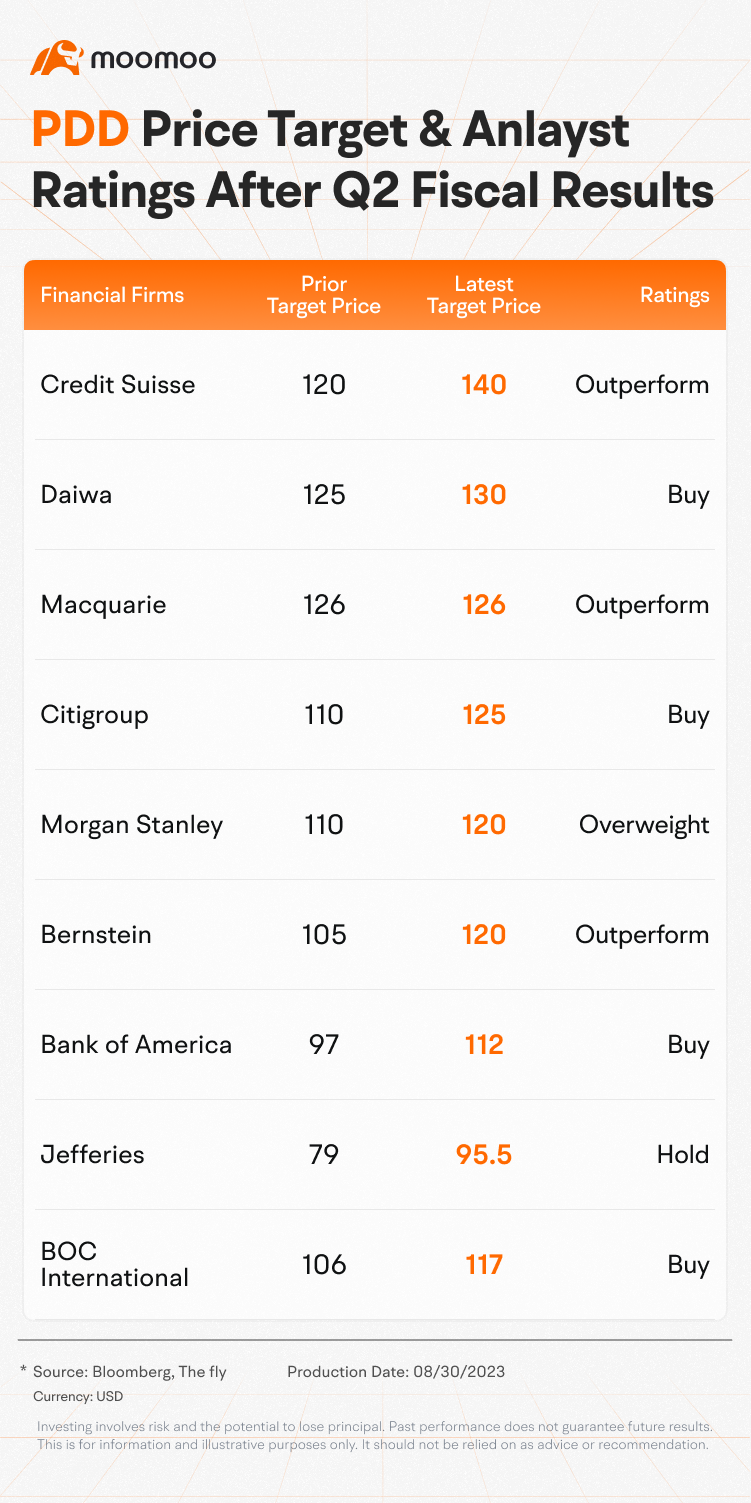

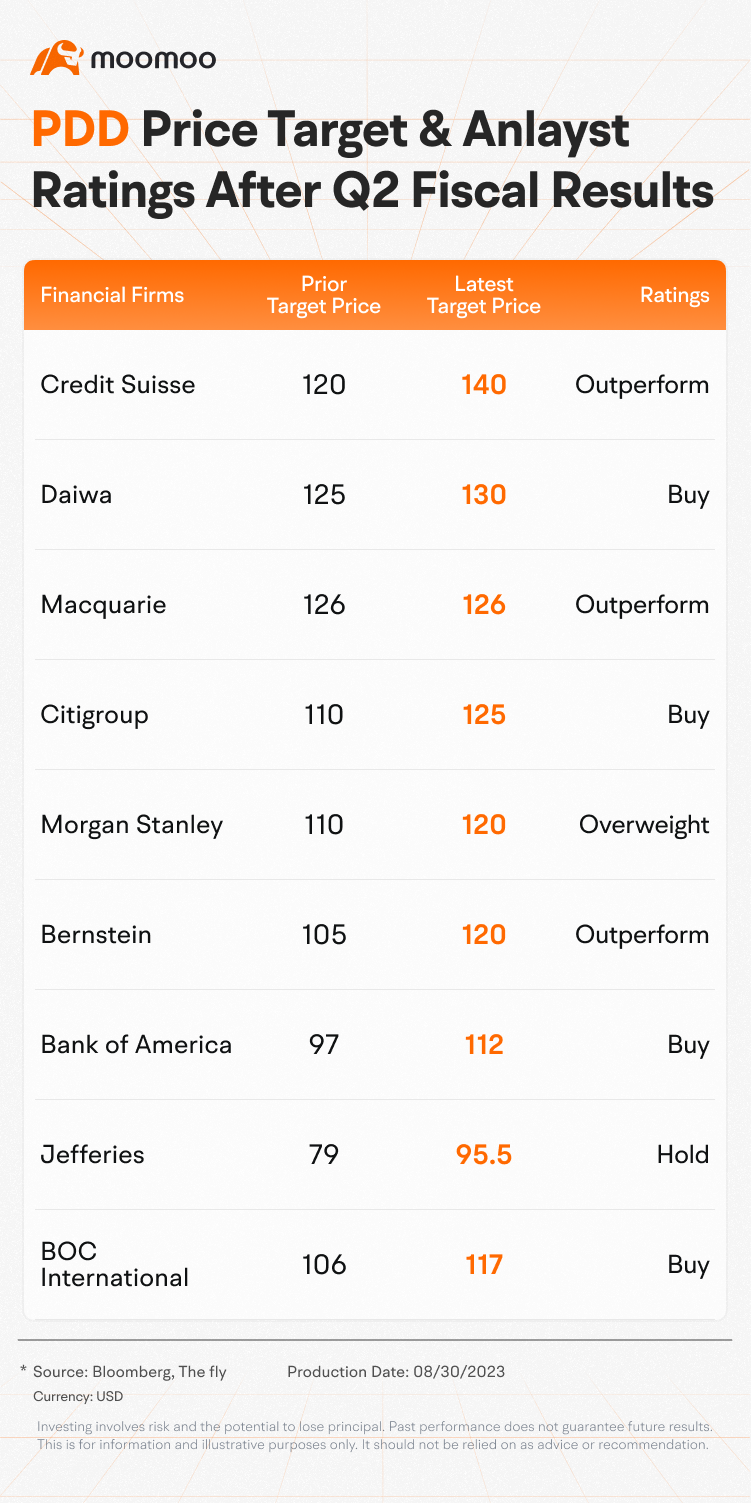

Analysts Raise PDD Target Price Following Strong Earnings Performance

Following the release of earnings reports by major e-commerce platforms, PDD, the leader in China's online retail market, delivered impressive Q2 results.

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded market expectations.

Boosted by its strong earnings performance, the stock price surged by 15.43% at market close, resulting in an increase of nearly $16.6 billion to its market capitalization overnight.

$CITIC BANK (00998.HK)$ analyst states that the fast expansion and rapid GMV ramp of Temu, as well as effective domestic consumption stimulus coupon/voucher during seasonal promotional period, contributed to higher than expected revenue growth. Heading into Q3, the continued ramp of Temu is likely to offset slowdown of Duoduo Grocery while online marketing service revenues are likely to sustain fast growth momentum thanks to improving realization rate from ad budget shifting to PDD's domestic platform.

$Bank of America (BAC.US)$ analyst Joyce Ju cites PDD's successful June promotions aimed to stimulate consumer demand, particularly in home appliances, smartphones, cosmetics and fresh produce, noting that the company is seeing much faster growth momentum relative to its major peers.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment