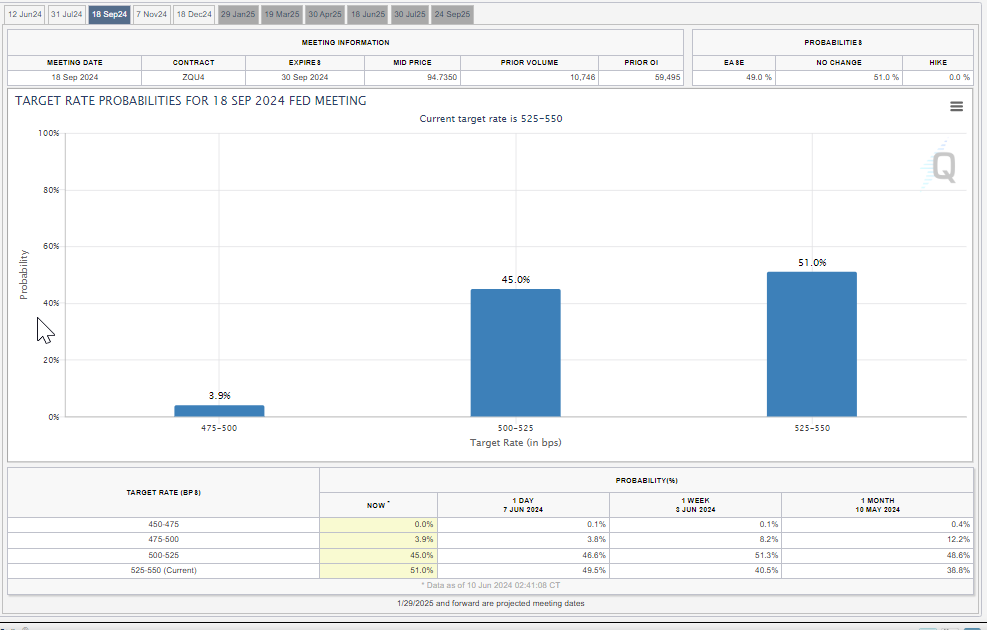

This week, investors can expect CPI and PPI data, but most importantly, an FOMC rate decision on Wednesday at 2 PM EST. The Fed will also display its economic predictions, a dot plot of where members of the Open Market Committee see rates in the coming months, and signal how many rate cuts it expects to make for the remainder of the year.

Leo Sanders : should we put now or wait?

Saul De La Cruz : predictions on apple?

Saul De La Cruz Leo Sanders : on what

Leo Sanders : oñ Nvidia stock it's at 119, 120 it might drop lower I wait till after Wednesday?

PatriciaBrooks : I would like to invest in a stock

105493515 Leo Sanders : $BURSA (1818.MY)$