The company's financial results signal "the best is yet to come," Bank of America Securities said Thursday in a report. BofA analysts see upside in iPhone sales and services revenue from the upcoming roll out of Apple Intelligence, with significant acceleration seen in the December quarter, MT Newswires quoted BofA as saying.

104692956a : yea, AAPL is great no doubt, however should mkt fall further, AAPL will find it harder to hold at such rich valuation

Alen Kok : k

webguybob 104692956a : agreed

Supermengg :

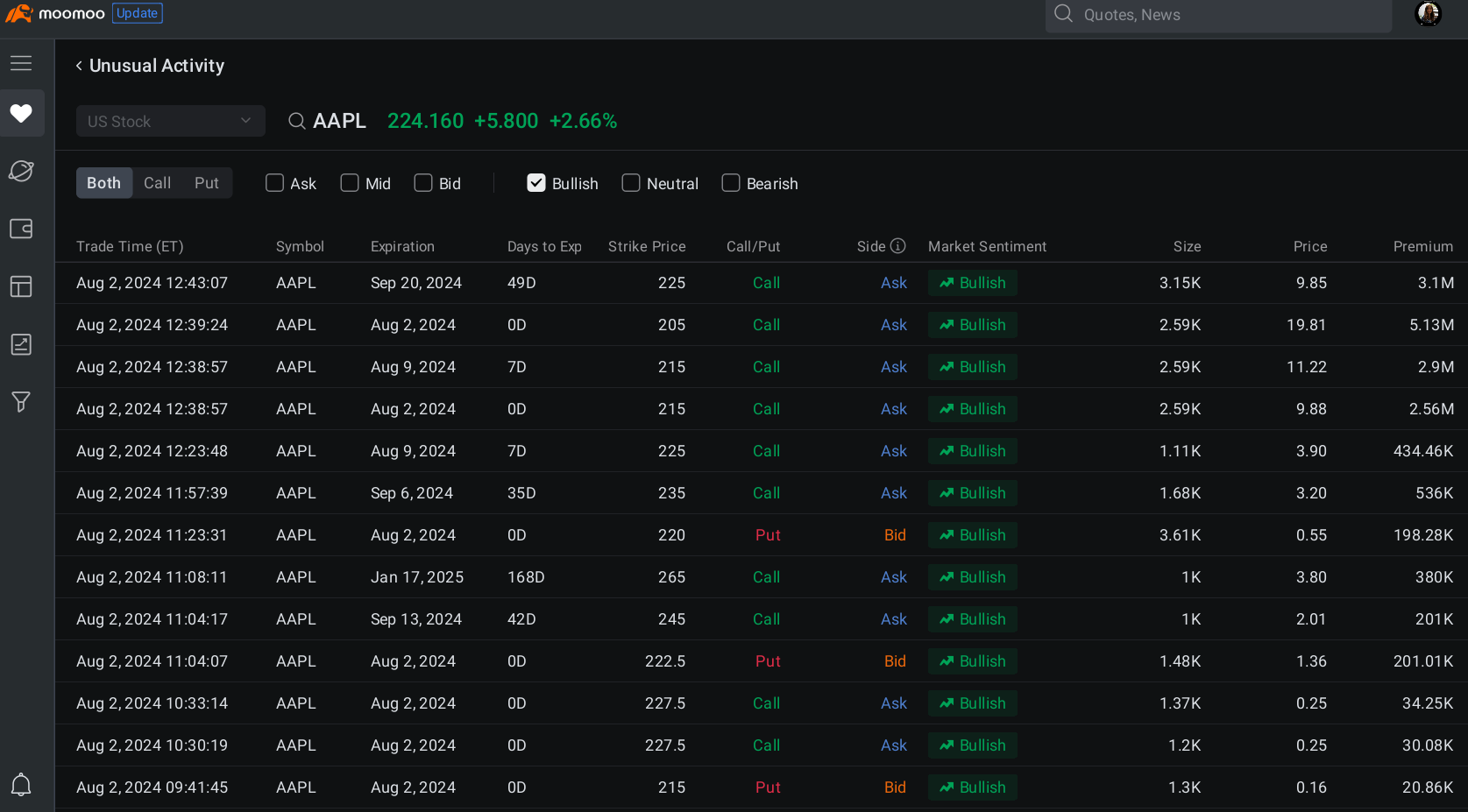

Derpy Trades : "About 174,520 call options that give the holder the right to buy Apple stock at $125 changed hands across 19 expiration dates..." 225 strike, not 125. Every time I see a mistake in these articles makes me trust them less.

104476495 : hi

104327919 : agreed

KYMO : Selling naked call?

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102188459 : Tq

View more comments...