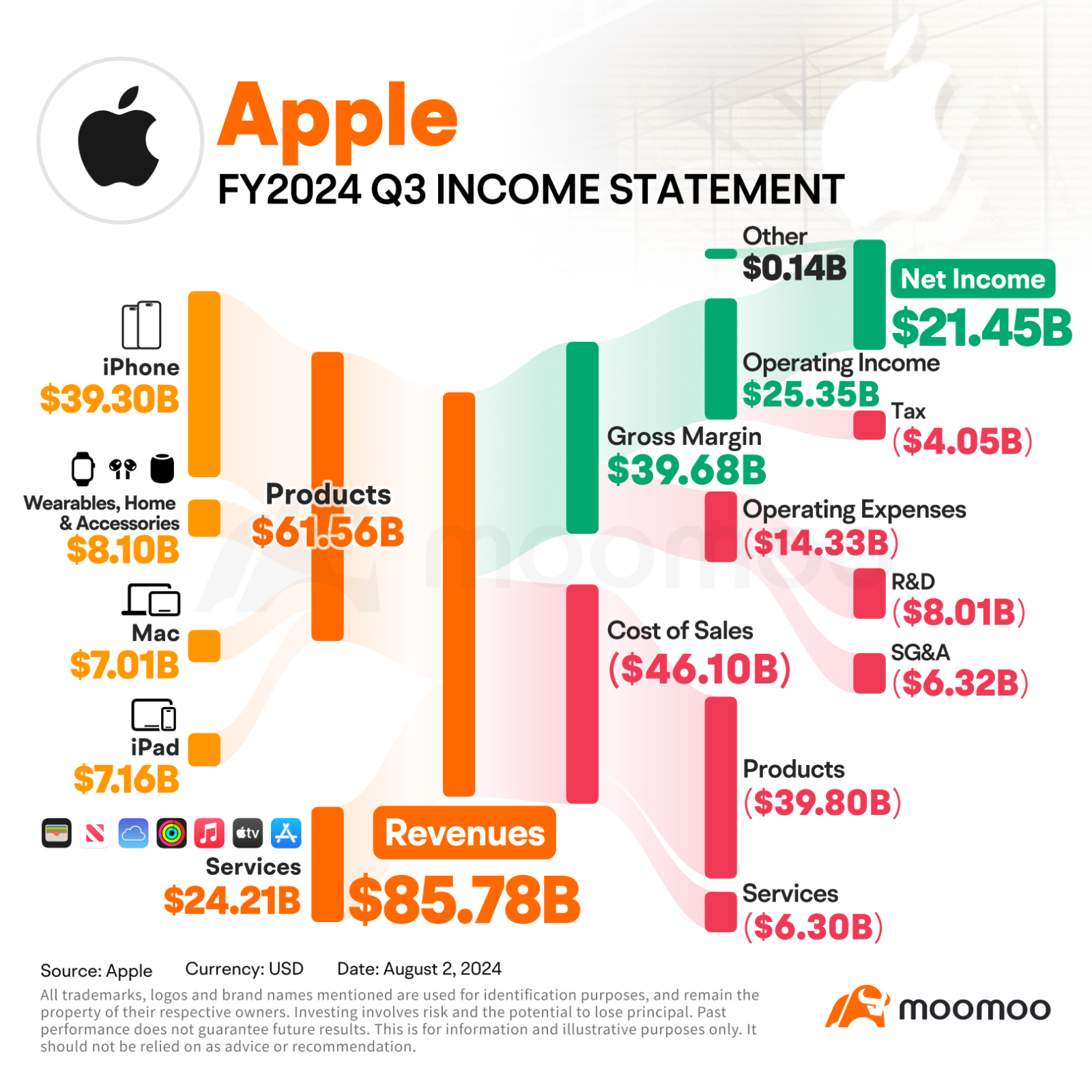

TD Cowen analyst Krish Sankar reaffirmed a Buy rating on Apple on July 30, citing several factors for his bullish stance. Apple’s solid financial performance, including top-line revenue aligned with expectations and earnings per share exceeding forecasts due to better gross margins and operational efficiency, supports the rating. Stability in iPhone demand and growth in other hardware products offset weaknesses in the China market. Additionally, strong performance in the services sector, contributing to a projected 14% increase in 2024, along with prospects for gross margin and free cash flow expansion, bolster Sankar's positive outlook. Significant shareholder returns, projected between $105 and $110 billion, further enhance Apple's attractiveness to investors.

身骑白马 : good

Sar_sha :

马到成功了 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104264890 : Great!

HSC_hipot : Don’t feel it’s robust at this stock price

103225807 : Hai