Apple Reported Robust Earnings, Future Growth Tied to AI and China Sales Improvement

$Apple (AAPL.US)$ reported its fiscal third-quarter earnings on Thursday, surpassing Wall Street's expectations with an overall revenue increase.

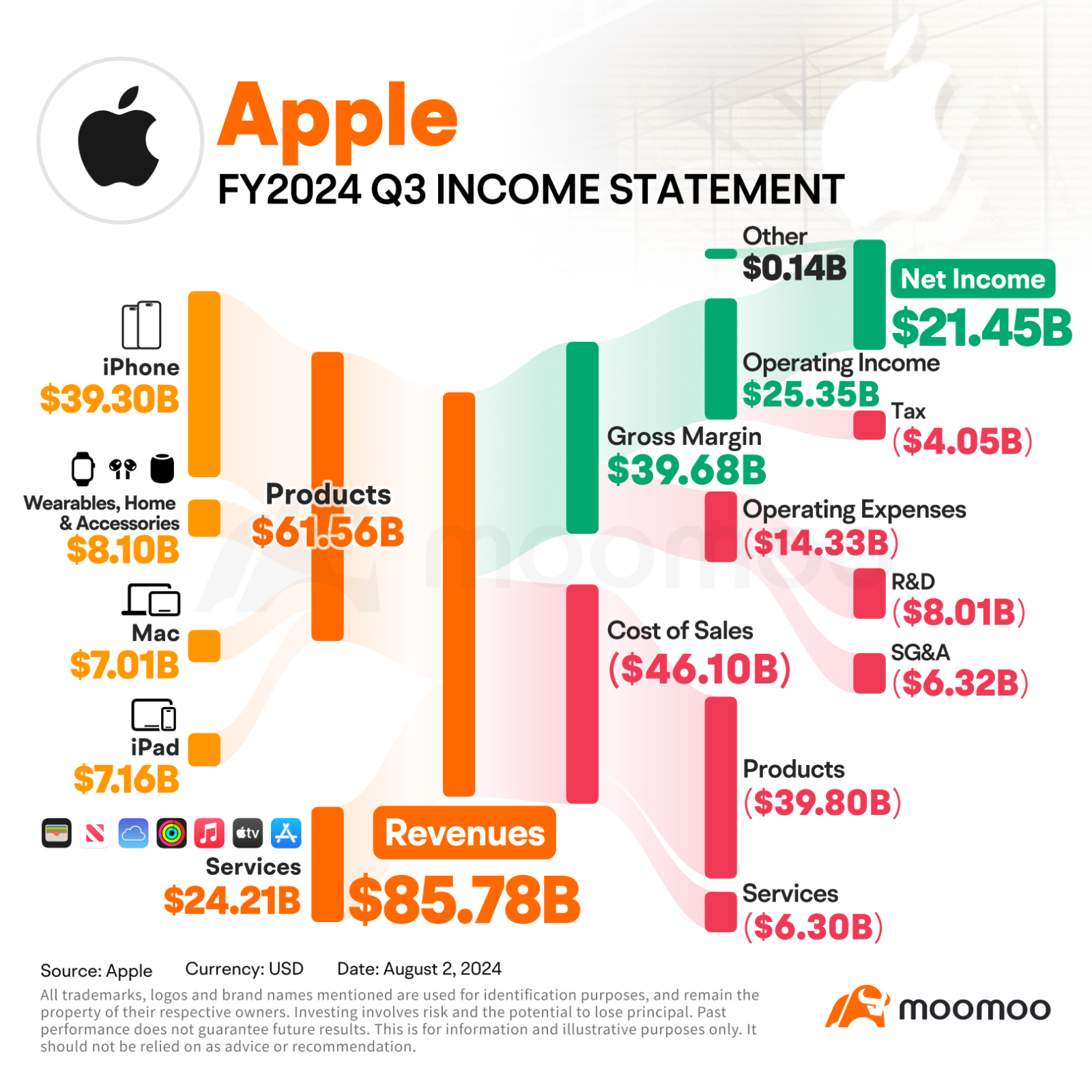

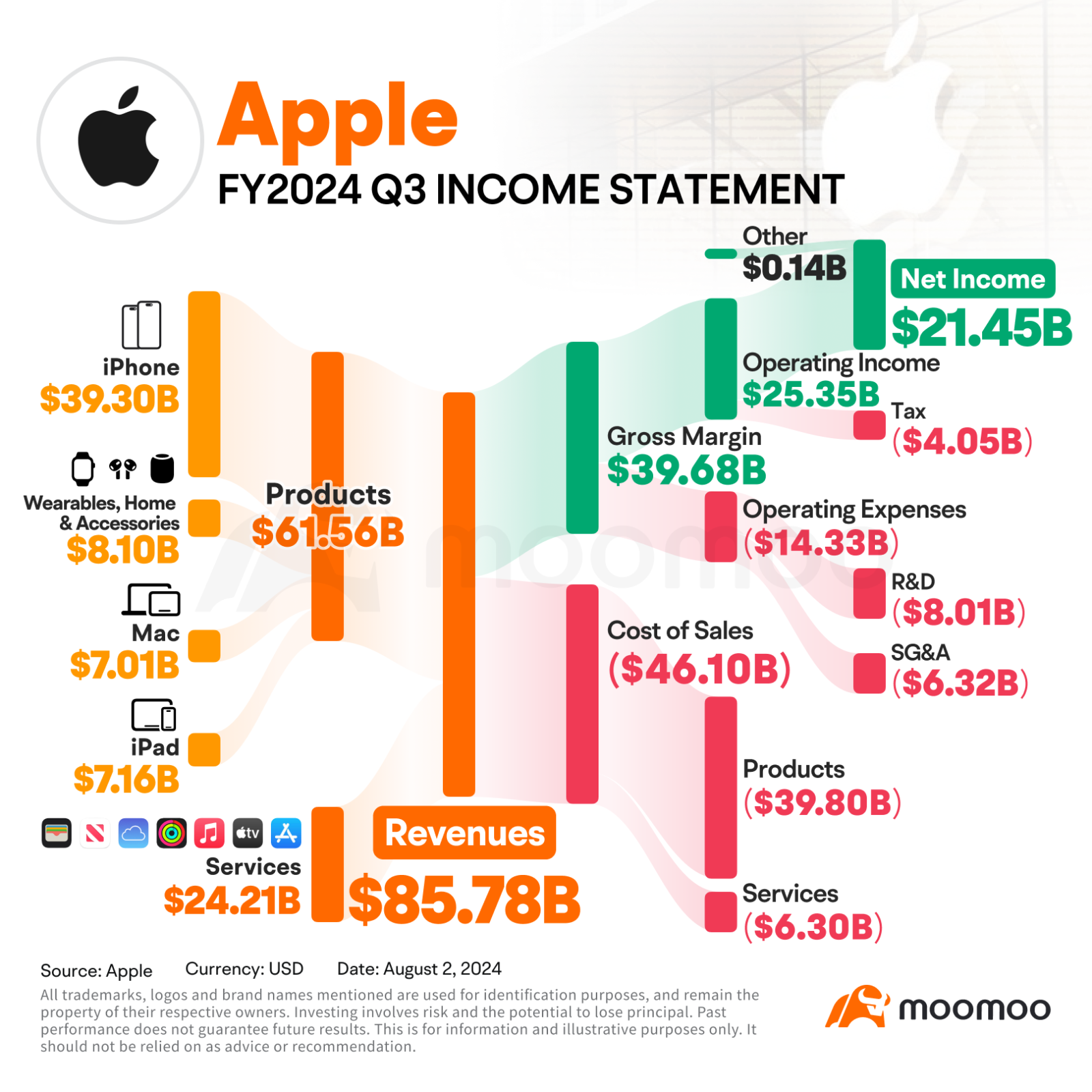

Apple's revenue for the quarter was $85.78 billion, compared to $84.53 billion estimated. Earnings per share amounted to US$1.40 a share in the period, exceeding the US$1.35 analysts had estimated. The company expects similar overall revenue growth in the current quarter, according to CFO Luca Maestri. Apple also anticipates Services to grow at about the same rate as the previous three quarters, approximately 14%. Operating expenditures are projected between $14.2 billion and $14.4 billion, with a gross margin of 45.5% to 46.5%.

Sector Breakdown

iPhone

The iPhone remains Apple's cornerstone, contributing about 46% of the company's total sales. Despite beating LSEG estimates, iPhone revenue declined by approximately 1% year over year to $39.29 billion.

"On a constant currency basis, we grew year on year, " Apple CEO Tim Cook told CNBC's Steve Kovach, emphasizing the company's operational outlook.

Analysts predict that Apple will release the largest software update for the iPhone this fall. Although, It comes at a time when competitors like Samsung have been quicker to launch comparable services and has capabilities derived from artificial intelligence.

iPad

Apple's iPad division showed the most significant growth, surging nearly 24% year over year to $7.16 billion in sales, driven by new product releases.

The new products included a iPad Pro with an M4 chip, as well as a faster version of the iPad Air with a bigger-screen option. Cook highlighted that about half of iPad buyers are first-time buyers, indicating that the tablet market is far from saturated.

Mac

The Mac division posted $7 billion in sales, a 2% increase from the previous year. Meanwhile, the "Wearables, Home, and Accessories" category, which includes Apple Watch, Beats headphones, and HomePod speakers, reported sales of $8.10 billion, a 2% decline.

"A whopping two-thirds of the Apple Watch buyers were new to the product. So, we're still growing that base significantly," Cook noted.

Services sector

The Services sector, including hardware warranties, $Alphabet-C (GOOG.US)$ revenue, cloud storage subscriptions, and Apple TV+ content subscriptions, reported $24.21 billion in sales, up 14% and meeting expectations.

Apple's active device count reached unprecedented levels, although the company did not specify the number. In February, Apple reported 2.2 billion active devices. There are now 1 billion paid subscriptions, including App Store app subscriptions.

Geographical Breakdown

Regionally, Apple's performance varied. Revenue in the Americas, the company's largest market, increased by 6.5% to $37.68 billion. Europe, the second-largest market, saw an 8.3% rise to $21.88 billion. In Japan, revenue grew by 5.7% to $5.10 billion, while the Rest of Asia Pacific segment experienced a significant 13.5% increase to $6.39 billion.

However, Greater China region was a weak spot. Revenue in this region declined by 6.5% to $14.72 billion, missing analysts' expectations. Apple faces increasing pressure from week spending and local competitors like Huawei, which introduced new competing products.

Path to the future: Apple Intelligence

The forthcoming introduction of Apple Intelligence, an AI-driven service, is expected to significantly impact future earnings by bringing a strong upgrade cycle.

"What we've done is we've redeployed a lot of people onto AI that were working on other things," Cook said. "From a data center point of view, as you know, we have a hybrid approach. So, we both have our own and we partner with people. And so that capex would be in the partners' financials, and we would be paying expense."

Cook added, "Certainly embedded in our results this quarter is an increase year over year in the amount we're spending for AI and Apple intelligence."

The technology is set for an October release for iPhone, iPad, and Mac. This suite will be integrated into forthcoming updates iOS 18, iPadOS 18, tvOS 18, macOS Sequoia, and watchOS 11, currently in public beta. These updates will mark Apple's significant entry into generative AI features, incorporating some integrations with OpenAI's ChatGPT. Full rollout of Apple Intelligence capabilities is planned with iOS 18.1.

Analyst Opinion

Analysts are mostly positive about Apple's future.

"The company's future success depends on two factors: keeping AI development costs low and ensuring that new AI-driven features compel price-sensitive consumers to upgrade their devices," said Emarketer analyst Jacob Bourne.

Evercore ISI analyst Amit Daryanani highlighted key points from Apple's latest report. The company returned to top-line growth, with sales increasing across all geographies except Greater China. The Asia-Pacific region, excluding China, saw a revenue growth of approximately 13%. In Greater China, the revenue decline of 6% was better than anticipated, with the rate of decline improving.

TD Cowen analyst Krish Sankar reaffirmed a Buy rating on Apple on July 30, citing several factors for his bullish stance. Apple’s solid financial performance, including top-line revenue aligned with expectations and earnings per share exceeding forecasts due to better gross margins and operational efficiency, supports the rating. Stability in iPhone demand and growth in other hardware products offset weaknesses in the China market. Additionally, strong performance in the services sector, contributing to a projected 14% increase in 2024, along with prospects for gross margin and free cash flow expansion, bolster Sankar's positive outlook. Significant shareholder returns, projected between $105 and $110 billion, further enhance Apple's attractiveness to investors.

Wedbush analyst Daniel Ives maintained a Buy rating on Apple and raised the price target to $285.00 from $275.00, citing several factors for his positive outlook. Apple's FY3Q24 earnings surpassed expectations, driven by strong iPhone sales and Services growth, and the improvement in the China market contributed to better-than-anticipated results. Ives forecasts continued growth into the September quarter and is optimistic about Apple's future integration of AI technology, including ChatGPT, which could open new monetization opportunities. Strong guidance for the September quarter and the anticipated supercycle driven by the upcoming iPhone 16 and Apple Intelligence further support Ives's view that Apple is poised for significant growth, making it one of Wedbush's top tech picks for the year.

Source: SEC filings, CNBC, Bloomberg, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

身骑白马 : good

Sar_sha :

马到成功了 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104264890 : Great!

HSC_hipot : Don’t feel it’s robust at this stock price

103225807 : Hai