SMCI

Super Micro Computer

-- 42.000 TSLA

Tesla

-- 357.090 NVDA

NVIDIA

-- 138.630 MSTR

MicroStrategy

-- 380.300 INTC

Intel

-- 23.930

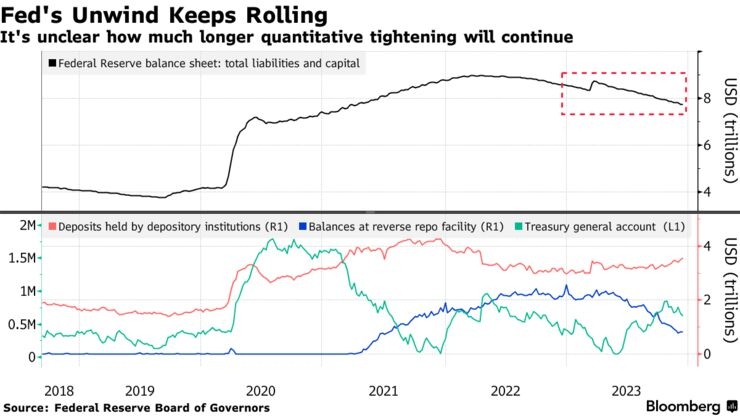

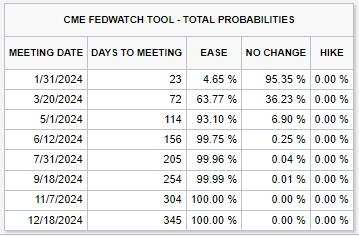

“The market may be expecting the Fed to cut interest rates this year, but since many interest rate cuts have already been factored in, there is a high possibility that market expectations will moderate. Assuming that part of expectations for interest rate cuts has been factored in, the US dollar will rise first, and there is a possibility that 2024 will end softly,” says Jane Foley, in charge of FX strategy at Rabobank.

Priya Misra, portfolio manager at JPMorgan Chase Capital Management, said, “If it's in the yield range of 4% to 4.2%, it's worth buying anywhere.” He pointed out that the US 10-year bond yield before the Fed interest rate decision meeting last month was the upper limit of this range, and stated that “in order to break through 4.2%, it will be necessary to completely stop raising interest rates or cutting interest rates completely.” Considering the Fed's change in direction at the end of 2023 and the indication that “interest rate hikes will end” in the December minutes, it is said that both are unlikely. In other words, according to him, it is unlikely that the price of US bonds will be any lower.

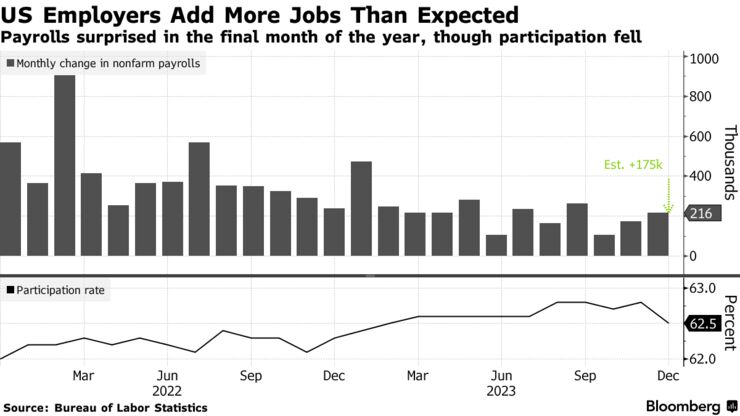

“The bond market maintains an optimistic view that the Fed will cut interest rates this year. “The perception that a temporary decline is an opportunity for reverse buying will not change once with stronger employment statistics than expected,” Kevin Flanagan, who is responsible for bond strategy at WisdomTree, pointed out.

Senior interest rate strategist Koshimizu Naokazu of Nomura Securities pointed out that “there are still positions that anticipate a decline in interest rates, and if such positions are resolved, there is a possibility that interest rate increases will be spurred.”

181338057犬心久美子 : Somehow the reliability of US bonds is so strong![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) But after all, 2 years, 5 years? About

But after all, 2 years, 5 years? About![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) treasury pound, etc.

treasury pound, etc.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I wonder if it's good

I don't exist in this world

千葉 : After all, I'm a wimp, I made a profit of Diamond too fast! I don't have enough patience, even though this happened twice last year

too fast! I don't have enough patience, even though this happened twice last year

千葉 : Any president is fine, so please come back young.

Any president is fine, so please come back young.