Are Small-Cap Stocks Shining Again? Here's What You Need to Know

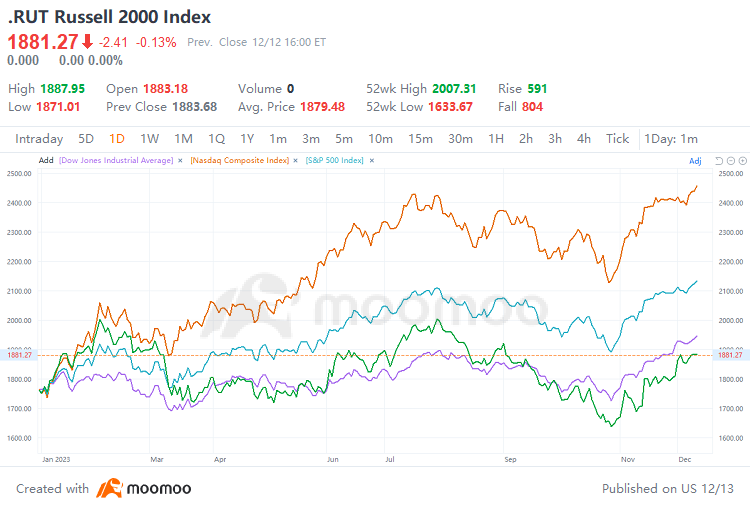

Since the end of October, there has been a significant recovery in market risk appetite, fueling a strong rebound in small-cap stocks that had underperformed for most of the year, as investor confidence in the Federal Reserve's policy shift and the soft landing of the U.S. economy has continued to rise. Specifically, the $Russell 2000 Index(.RUT.US$ surged almost 15% from its low in October, outpacing the S&P 500's 12.8% rally over the same period.

The Comeback of Small-Cap Stocks: Key Drivers Explained

1. Fading Fears of Rate Hikes and Economic Downturn Boost Small-Cap Stocks:

As small-cap stocks are notably sensitive to changes in interest rates and economic conditions, high interest rates and persistent concerns about an impending economic downturn had initially exerted pressure on their stock prices. These were the two most significant factors affecting small-cap stocks.

However, now that market expectations suggest that the Federal Reserve will not increase interest rates this year and may cut rates in the first half of next year, and fewer voices are discussing the possibility of an economic recession, small-cap stocks have once again regained investor interest amidst a recovering market sentiment.

2. Small-Cap Stocks Exhibit Greater Profit Elasticity as the Economy Recovers:

Despite higher operating uncertainty, small-cap stocks are often associated with high growth and growth potential. As the economy improves, these small and medium-sized companies may demonstrate greater performance flexibility than larger companies. Earnings for Russell 2000 companies are expected to rise 30% next year after falling 11.5% in 2023, LSEG data shows.

3. Valuation Advantage Over Big-Caps:

According to LSEG Datastream data, the relative value of U.S. small-cap stocks compared to large-cap stocks is currently at historically low levels. The lower valuations can offer a crucial margin of safety for investors who allocate their funds towards small-cap stocks.

4. Diversification Demand Drives Increased Investor Interest in Small-Cap Stocks:

At present, U.S. stocks are heavily concentrated, with investors who buy the $S&P 500 Index(.SPX.US$ having 30% of their funds invested in the Magnificent Seven. This highlights the importance of small-cap stocks as a diversifier that can mitigate the risk of pullbacks resulting from over-exposure to large-cap tech stocks.

5. Drawing Lessons from History: Strong Rebound Often Follows Extreme Downturns:

In retrospect, small-cap stocks have demonstrated a tendency to rebound strongly following a period of below-average returns. When looking at all five-year periods for the Russell 2000 Index in which the annualized return fell below 5%, subsequent three-year annualized returns turned positive, with the average rebound being as high as 17.5%. Historical data also shows that U.S. small-cap stocks tend to lead gains when the market recovers. Following the historic performance after the final Fed rate hikes, the Russell 2000 Index saw an average annual rise of 18.4%.

Despite the strong rebound that has sparked optimism among investors, small-cap stocks still pose some risks that cannot be overlooked, according to analysts. The first of these is high volatility, with small-cap stocks experiencing nearly 25% volatility in the past five years. Additionally, difficulty in generating profits is another criticism that small-cap stocks face. A mid-November report by Apollo Global Management indicated that around 40% of companies listed on the Russell 2000 index are currently operating at a loss.

Source: moomoo, LSEG Datastream, Bloomberg, Apollo Global Management

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment