RGTI

Rigetti Computing

-- 15.4400 LAES

SEALSQ Corp

-- 8.760 TSLA

Tesla

-- 454.130 NVDA

NVIDIA

-- 139.930 KULR

KULR Technology

-- 4.8000

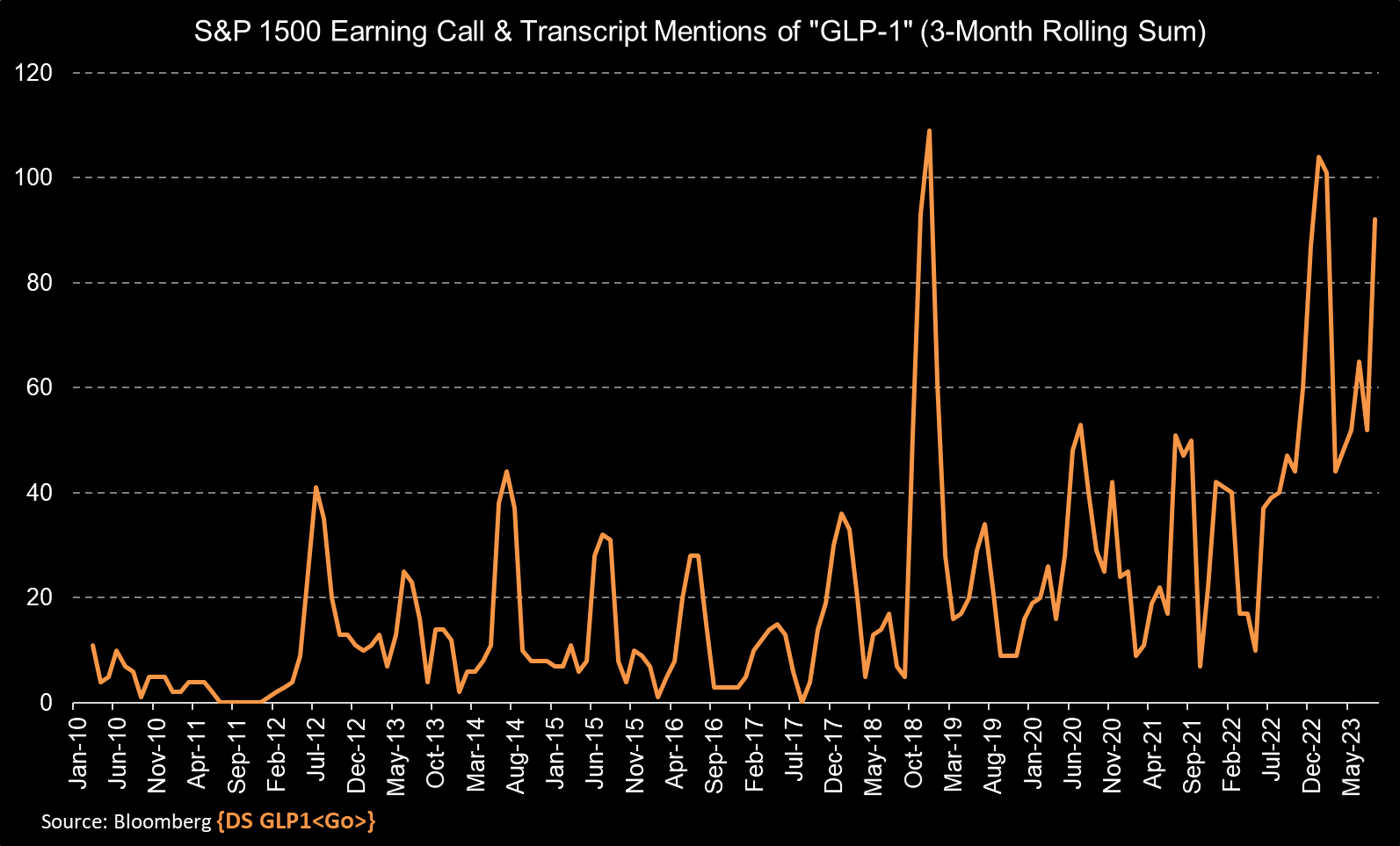

James van Geelen from Citrinitas Capital said, "If GLP-1 drugs have a 30% penetration rate in the obese population, the obesity rate in the United States would be lower than it was in 1997. And that could happen over the course of two or three years."

"We expect new therapies launching beginning in 2026 from firms including Amgen and Pfizer could grow to roughly one-quarter of the market by 2032," Morningstar said.

DelgadilloJoe : Hi