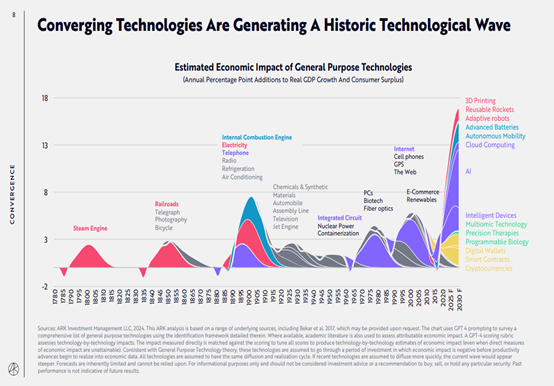

According to ARK's research, convergence among disruptive technologies will define this decade.Five major technology platforms - Artificial Intelligence, Public Blockchains, Multiomic Sequencing, Energy Storage, and Robotics - are coalescing and should transform global economic activity.