$Arm Holdings (ARM.US)$ The semiconductor industry is bustli...

The semiconductor industry is bustling with news and stock markets every day. NVIDIA (NVIDIA) and TSMC, whose names often come up, are also wonderful companies, but today I would like to introduce the strongest company in the world called Arm (Arm). Please refer to industry trends and stock investments.

In a nutshell, Arm is “a semiconductor design company that handles designs used in 99% of smartphones.” Below, I'll explain the details in as easy to understand as possible.

■Broad ecosystem and market share ARM technology has been widely adopted around the world. ARM-based processors are installed in over 99% of the world's smartphones, and a total of over 287 billion chips have been shipped so far. Also, 70% of the world's population uses ARM-based products. Modern life is no longer possible without Arm.

■High energy efficiency and performance ARM processors are highly energy efficient and are used in a wide range of devices, from smartphones to data centers. The latest ARMv9 CPUs deliver superior performance and efficiency even for AI-based applications.

■Technological Innovation and Scalability ARM promotes continuous technological innovation and provides processors with advanced computing power, such as the Cortex series and Neoverse series. This makes it compatible with a wide range of applications, from small devices to large data centers.

■Strong partnerships and customizability ARM works with over 1000 partner companies, and companies have the flexibility to customize processors according to their own needs. This strong partnership enables rapid product development and market launch.

■Financial Status ARM's annual revenue for fiscal year 2024 exceeded 3 billion dollars and reached a record high. Due to advances in AI technology, demand for ARM-based technology is expected to increase in the market as a whole in the future. By combining these strengths, ARM has a strong technical foundation for diverse devices and applications, and it is expected that it will continue to grow in the future.

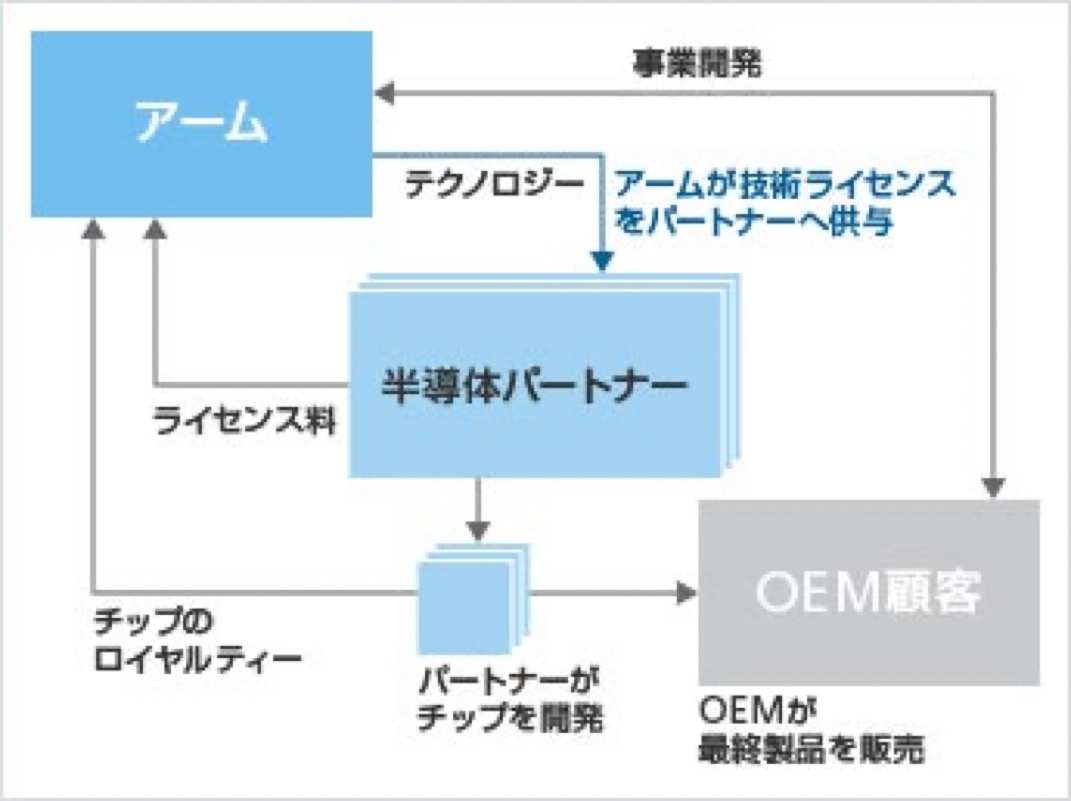

Arm has two main business models.

① License business: Selling semiconductor-designed IP.

② Loyalty business: Earn loyalty income from the sales value of chips developed with Arm technology. Simply put, semiconductor manufacturers that want to use Arm technology first pay license fees, and then they also pay royalty income to Arm from the sales value of chips made using that technology. Great business model.

Arm's sales ratio is roughly balanced with license revenue of 40% and royalty revenue of 60%, which is one of the reasons why the financial base is stable. That's amazing, Arm. And SoftBank's President Son, who acquired ARM in 2016, is also too farsighted.

※↓ From SoftBank's website. This image is easy to understand.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

たかば : If it were a smartphone semiconductor brand, would it be Qualcomm in the US? I wonder if MediaTech is from Taiwan.

凡人凡人 : Thank you very much