$Arqit Quantum (ARQQ.US)$ Swing Trade Opportunity Summary - ...

Swing Trade Opportunity Summary - Score: 6.65

Arqit Quantum Inc. presents a moderately favorable opportunity for swing trading with a worksheet score of 6.65, suggesting potential yet cautious consideration for a position. The stock shows recent breakout activity slightly below the 52-week high, indicating momentum but with a less robust catalyst. Despite a strong balance sheet, negative retained earnings highlight historical profitability challenges. ARQQ's low float and a high risk-reward ratio bode well for traders willing to accept the inherent volatility. With its sector lacking current heat, other trade-offs include a promising technical setup yet limited profitability.

Arqit Quantum Inc. presents a moderately favorable opportunity for swing trading with a worksheet score of 6.65, suggesting potential yet cautious consideration for a position. The stock shows recent breakout activity slightly below the 52-week high, indicating momentum but with a less robust catalyst. Despite a strong balance sheet, negative retained earnings highlight historical profitability challenges. ARQQ's low float and a high risk-reward ratio bode well for traders willing to accept the inherent volatility. With its sector lacking current heat, other trade-offs include a promising technical setup yet limited profitability.

Risk Level: 8 (High Risk)

ARQQ carries a substantial amount of risk, primarily due to its volatile nature and lack of consistent profitability. The stock's historical losses signify potential downturn risks, even as liquidity remains satisfactory. The lack of immediate catalysts and the stock's susceptibility to dramatic price swings heighten risk, making it potentially perilous in a less diverse portfolio. The substantial fluctuation in daily trading prices contributes to its elevated risk profile. Traders must approach with caution, prepared with appropriate hedging strategies and risk tolerance.

ARQQ carries a substantial amount of risk, primarily due to its volatile nature and lack of consistent profitability. The stock's historical losses signify potential downturn risks, even as liquidity remains satisfactory. The lack of immediate catalysts and the stock's susceptibility to dramatic price swings heighten risk, making it potentially perilous in a less diverse portfolio. The substantial fluctuation in daily trading prices contributes to its elevated risk profile. Traders must approach with caution, prepared with appropriate hedging strategies and risk tolerance.

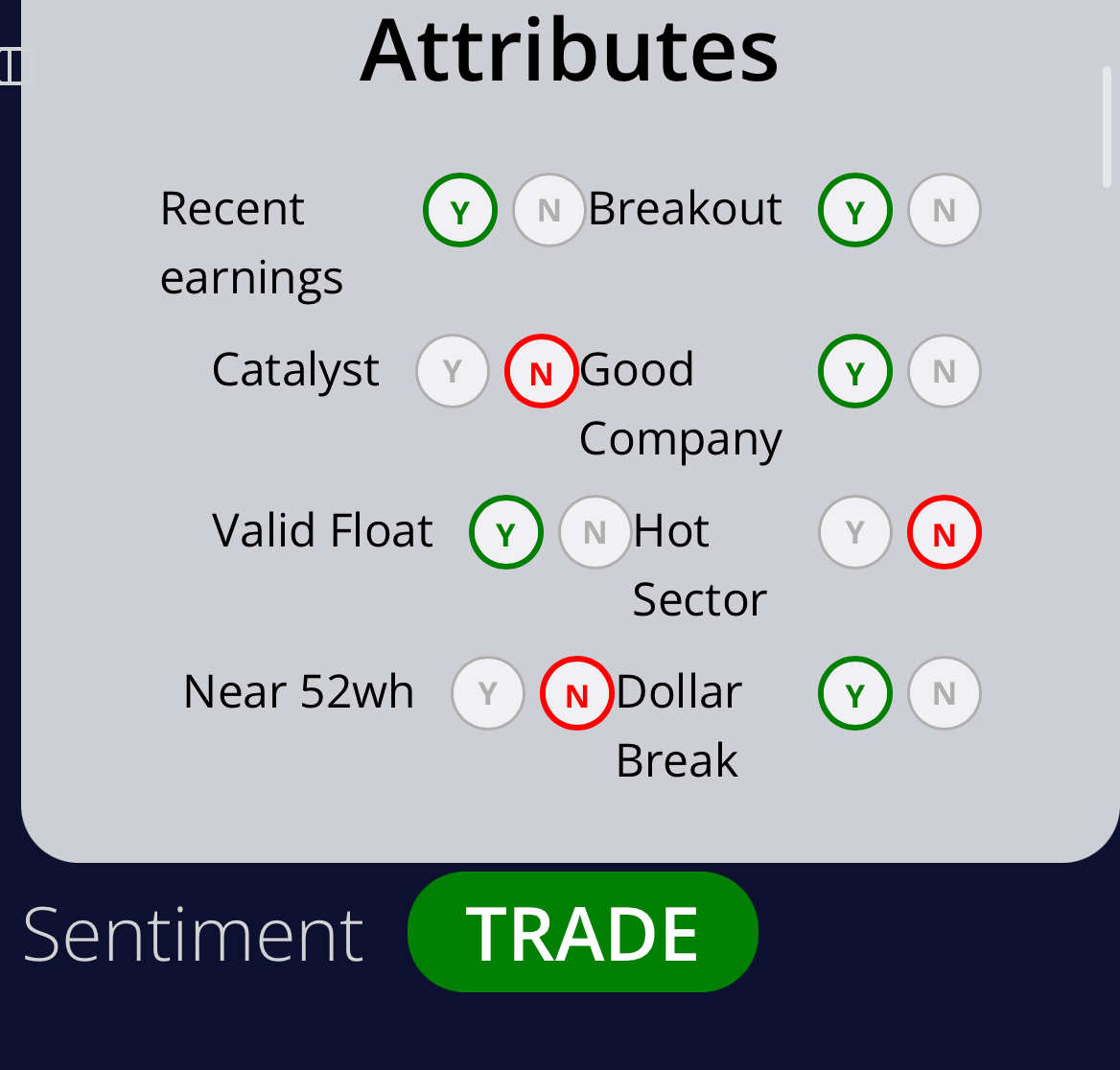

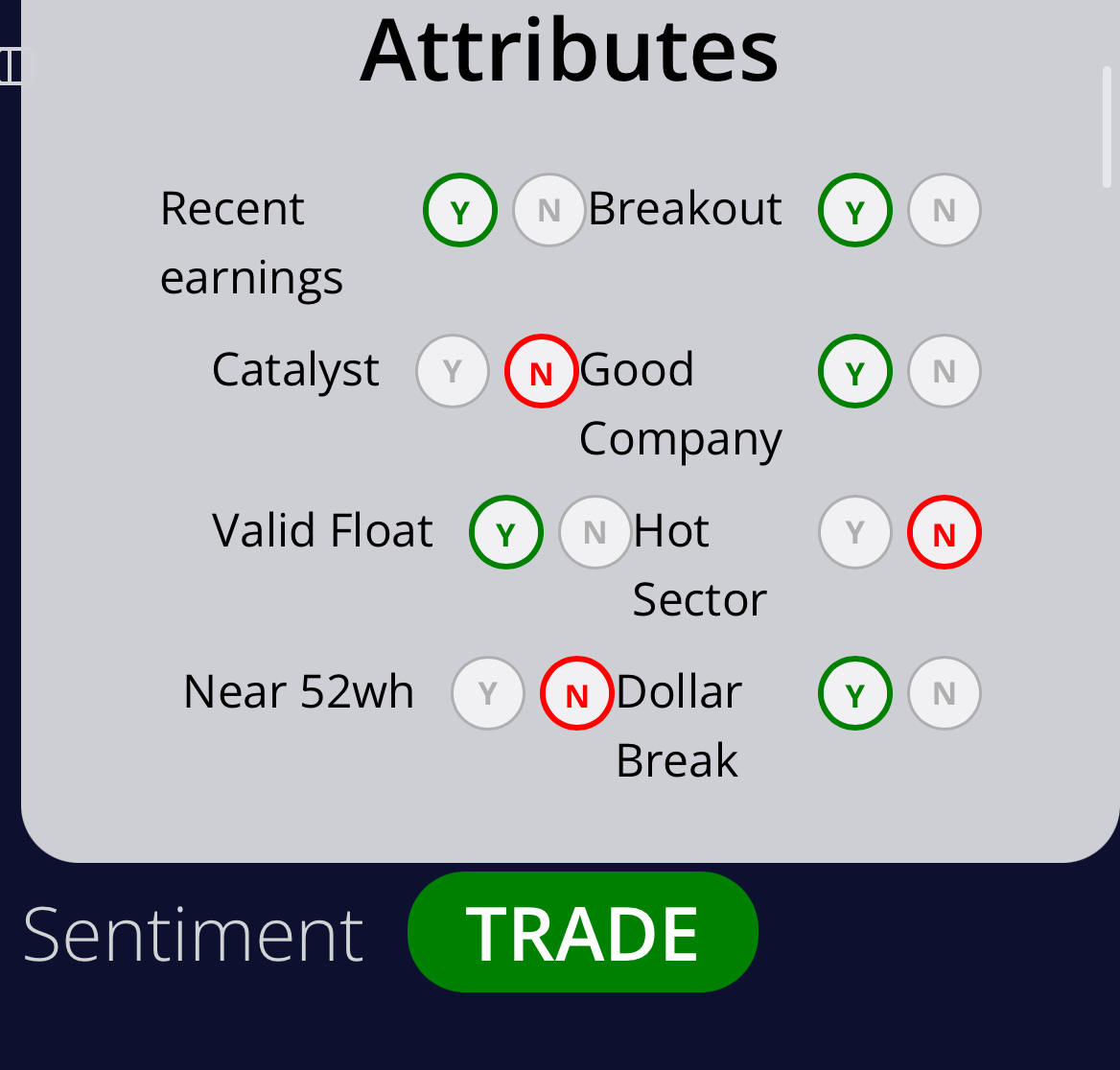

IRIS Worksheet

Ticker ARQQWork Sheet Score 6.65

Attributes

Recent earningsYNBreakoutYNCatalystYNGood CompanyYNValid FloatYNHot SectorYNNear 52whYNDollar BreakYN

Sentiment TRADE

Arqit Quantum Inc. (ARQQ)

Swing Trade Opportunity Summary - Score: 6.65

Arqit Quantum Inc. presents a moderately favorable opportunity for swing trading with a worksheet score of 6.65, suggesting potential yet cautious consideration for a position. The stock shows recent breakout activity slightly below the 52-week high, indicating momentum but with a less robust catalyst. Despite a strong balance sheet, negative retained earnings highlight historical profitability challenges. ARQQ's low float and a high risk-reward ratio bode well for traders willing to accept the inherent volatility. With its sector lacking current heat, other trade-offs include a promising technical setup yet limited profitability.

Risk Level: 8 (High Risk)

ARQQ carries a substantial amount of risk, primarily due to its volatile nature and lack of consistent profitability. The stock's historical losses signify potential downturn risks, even as liquidity remains satisfactory. The lack of immediate catalysts and the stock's susceptibility to dramatic price swings heighten risk, making it potentially perilous in a less diverse portfolio. The substantial fluctuation in daily trading prices contributes to its elevated risk profile. Traders must approach with caution, prepared with appropriate hedging strategies and risk tolerance.

Levels

Support Level: $21.00, consolidation over 178 days suggests sustained support.

Resistance Level: $44.48, which is the recent 52-week high indicating strong upside potential.

Breakout Magnet Level: $43.00, price ranges around this level can signal firmly established trends.

Trading Strategy

For a trading capital of $10,000, I propose a long position in ARQQ. The trade involves purchasing 23 shares, with an entry price set at $43.0, influenced by the stock's proximity to its resistance level and recent price behavior. The profitable exit target, derived from other key levels and expected market movement, is $108.95. To shield against unexpected downturns, a stop loss is advised at $28.343. This structure ensures a risk-reward matrix of 1:4.5, aligning with potential profit maximization while mitigating downside exposure.

Equity: $10,000

Bias: Long

Allocation: 11.11%

Size: 23 shares

Entry: $43.00

Exit: $108.95

Stop: $28.343

Risk-Reward: 1:4.5

Conclusion

Given the worksheet's composite score of 6.65, ARQQ fits within the parameters of a trade-worthy asset, provided one is attentive to its volatility and high risk. Its technical setup, albeit speculative, signals a momentary opportunity if navigated with limitive exposure. While ARQQ is an intriguing addition under specific swing trade conditions, its reliability fades against fundamentally solid peers. Thus, one should gauge this trade against broader market conditions and other available opportunities.

Final Verdict: Trade

Based on the analysis, ARQQ holds promise due to its technical momentum yet remains a high-risk pick. Engage with prudence, aligned by tactical entry and exit strategies, whilst monitoring market fluctuations to capitalize effectively.

For a trading capital of $10,000, I propose a long position in ARQQ. The trade involves purchasing 23 shares, with an entry price set at $43.0, influenced by the stock's proximity to its resistance level and recent price behavior. The profitable exit target, derived from other key levels and expected market movement, is $108.95. To shield against unexpected downturns, a stop loss is advised at $28.343. This structure ensures a risk-reward matrix of 1:4.5, aligning with potential profit maximization while mitigating downside exposure.

Equity: $10,000

Bias: Long

Allocation: 11.11%

Size: 23 shares

Entry: $43.00

Exit: $108.95

Stop: $28.343

Risk-Reward: 1:4.5

Conclusion

Given the worksheet's composite score of 6.65, ARQQ fits within the parameters of a trade-worthy asset, provided one is attentive to its volatility and high risk. Its technical setup, albeit speculative, signals a momentary opportunity if navigated with limitive exposure. While ARQQ is an intriguing addition under specific swing trade conditions, its reliability fades against fundamentally solid peers. Thus, one should gauge this trade against broader market conditions and other available opportunities.

Final Verdict: Trade

Based on the analysis, ARQQ holds promise due to its technical momentum yet remains a high-risk pick. Engage with prudence, aligned by tactical entry and exit strategies, whilst monitoring market fluctuations to capitalize effectively.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment