$ASML disappointing results. What's going on?

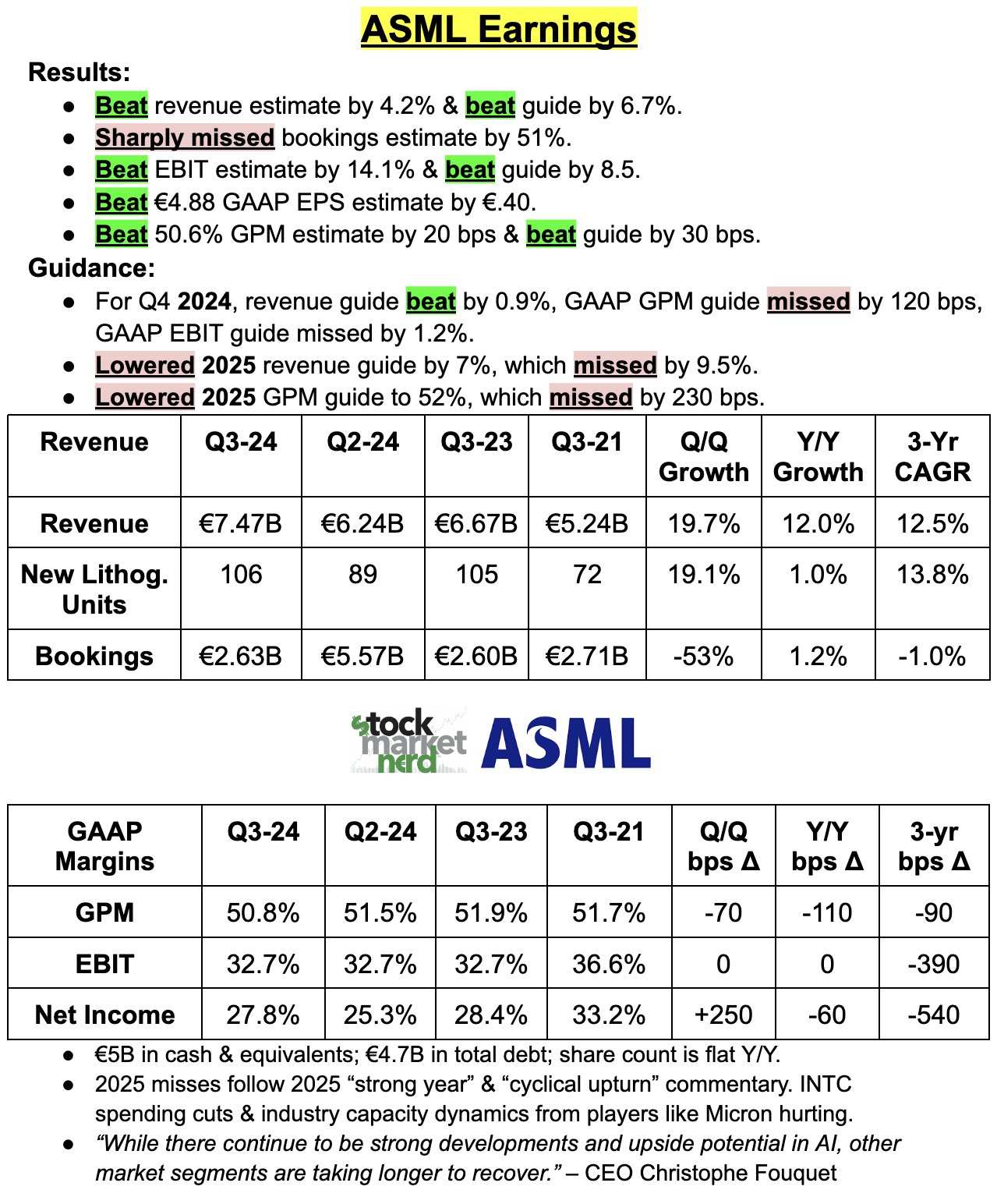

$ASML Holding (ASML.US)$ plunges more than 16% for the stock's 2nd biggest loss in 20 years after "accidentally" posting horrendous earnings early

Q3 bookings of €2.63B (vs. est. of €5.39B)

'25 sales at €30-35B (vs. est. of €35.94B)

What's going on?

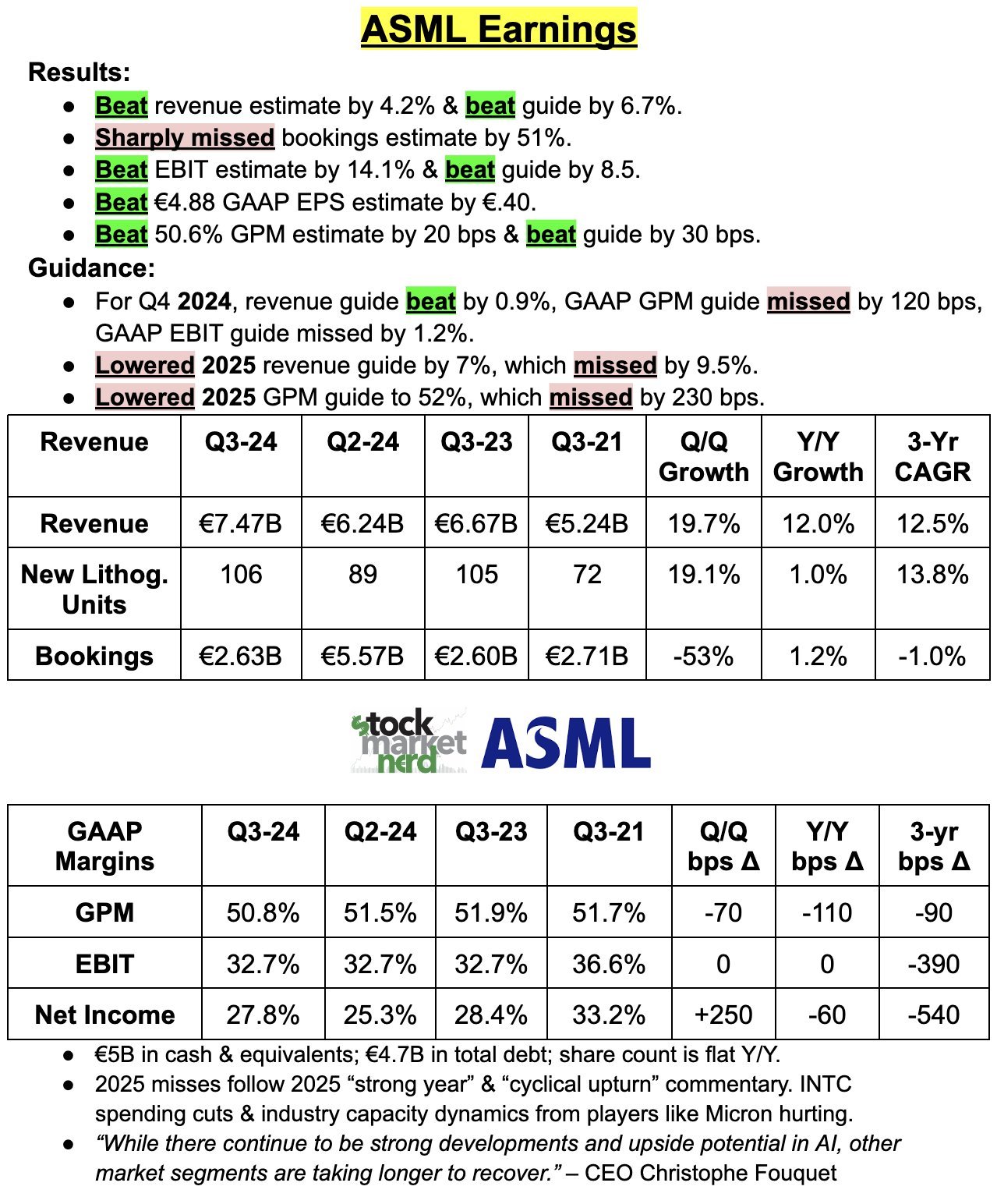

2. "Limited capacity additions in memory" aka $MU & SK Hynix are converting existing overcapacity for HBM

3. This is on top of China restrictions (the only booming market for equipment)

People miss that semi-equipment follows its own cycle and is facing some headwinds after a strong capex cycle '21-23.

AI is a tailwind, BUT the market is big in $ and not in capex. Even $Taiwan Semiconductor (TSM.US)$ sees a muted capex cycle.

Investors may be selling the wrong stocks today, creating attractive opportunities...

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment