ASML Earnings Preview: The New 2nm Equipment Orders Are the Focal Point of Attention

Semiconductor equipment company ASML will release its Q2 report on Wednesday. The forthcoming financial figures are anticipated to showcase ASML's robust portfolio, escalating investments, and a rise in design innovations.

Nonetheless, market uncertainties, geopolitical strife, and escalating costs associated with tech advancements may have muted the firm's outlook.

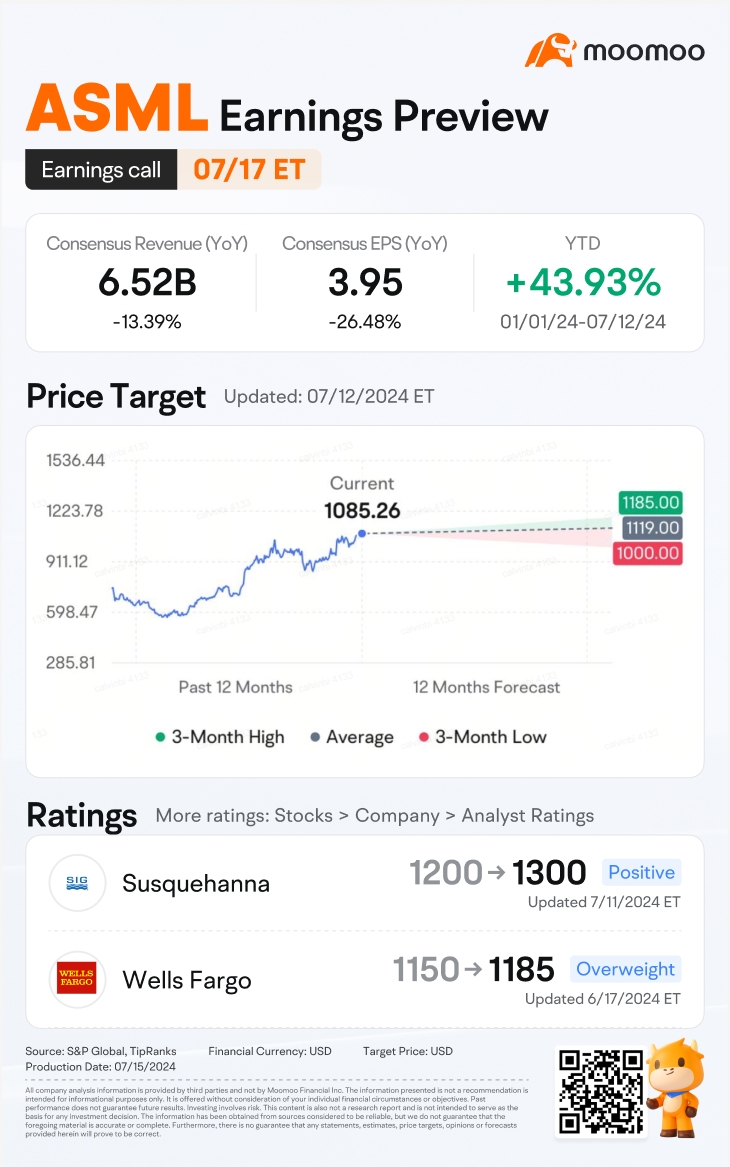

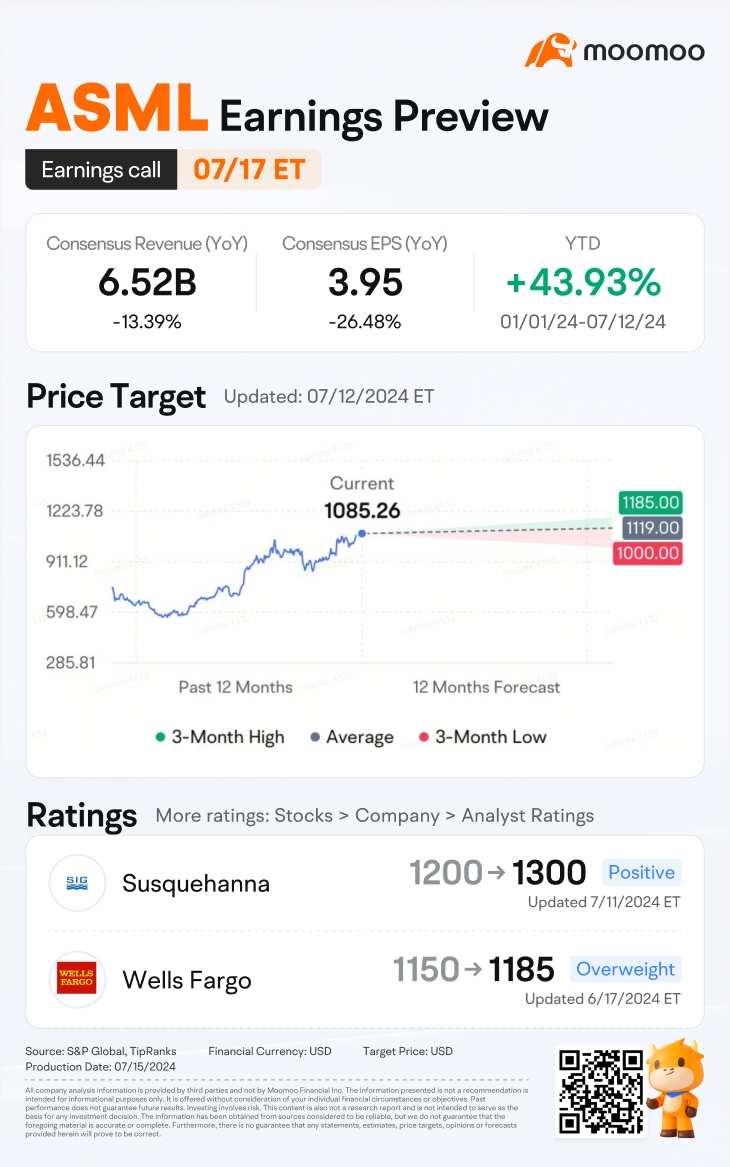

ASML's first-quarter orders were disappointing as the contribution from the world's largest contract chip maker, TSMC, wasn't there. As for Q2, analysts expect ASML's revenue to decrease by 13.39% and profit to decrease by 26.48%. Despite strong demand for AI, the time difference between orders and profit confirmation has not yet been reflected in this year's financial report.

ASML's gross margin is expected to fall to nearly 50.6% from 51.3%, but the forecast is in line with company guidance of 50% to 51%.

■ Investors focus on cutting-edge semiconductor equipment order volume

Equipment manufacturers revealed that the supply of EUV machines is tight, with delivery time of up to 16 to 20 months. ASML responded to customer demand by planning new production capacity last year, and the delivery volume growth next year is clear. The estimated total delivery quantity this year is 53 units, and it is expected to reach more than 72 units next year.

The company is projected to announce nearly 5.04 billion euros ($5.50 billion) in orders, as per consensus forecasts by Visible Alpha, surpassing the 4.50 billion euros in orders reported in the second quarter of the previous year, though there is a possibility that orders come in below forecast if a new deal with TSMC hasn't been signed.

■ 2nm + high numerical aperture EUV will become a catalyst

ASML's strategic focus will be on high-volume manufacturing for TSMC's 2nm nodes. C. C. Wei, Vice Chairman & CEO of TSMC, said during the Q1 2024 earnings call, "2nm technology development is progressing well with device performance and yield on track or ahead of plan. 2nm is on track for volume production in 2025."

In addition to supplying TSMC, Intel and ASML's jointly developed High NA EUV is expected to be put into use before 2027. The announced price this year is $400 million, significantly higher than the current price of ordinary EUV.

ASML's production capacity plan for 2025 has not changed its targets of 90 EUV units, 600 DUV units, and 20 High-NA EUV units. In addition, the 2024 Investor Day will be held on November 14th this year, presenting the latest blueprint for the next five years.

■ How do analysts view ASML?

Janardan Menon, analyst at Jefferies, anticipated that TSMC will implement high-NA technology at the A14 node by 2028. Following a discussion with ASML's CFO Roger Dassen, Menon indicated that ASML maintains an outlook that its revenue in 2025 will probably align with the higher end of its forecasted range.

The Jefferies analyst also projected that ASML's average orders could reach approximately €5.7 billion in each of the remaining three quarters of the current year, which could propel the company's sales to €40 billion by 2025.

Morningstar's semiconductor analyst Javier Correonero noted,“As lithography machines get more complex, switching costs and service revenue potential strengthen, with no competitor coming even close to ASML's technological leadership. ASML has potential to improve gross margins in the next decade.” The analyst anticipates that ASML will outpace the semiconductor market's expansion, driven by its robust market standing, projecting an annual revenue increase in the low double digits over the coming decade.

■ Risk Disclosure:

Should export restrictions to China intensify, ASML's growth prospects may be compromised, with the company heavily tied to US policy decisions beyond its influence.

Additionally, the inherent cyclicality of the semiconductor sector and ASML's reliance on a select group of suppliers for key parts heighten its risk exposure, where any supply chain interruptions could lead to operational setbacks. The anticipated downturn in activity from logic customers, who are still assimilating the substantial expansions in capacity undertaken during the previous year, is expected to have exerted a negative impact.

Source: Jefferies, Morningstar

Also Read: TSMC Q2 Earnings Preview: Can Price Hikes and Capex Plans Propel Shares Beyond $200?

Also Read: TSMC Q2 Earnings Preview: Can Price Hikes and Capex Plans Propel Shares Beyond $200?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74858182 : I am interested in investing with moomoo, but the process of registration and login is fastrething, and South Africa has ID, most of them .

has ID, most of them .

the company only takes passport

74858182 : I will be glad to get feedback soon

PAUL BIN ANTHONY : very helpful thanks

PAUL BIN ANTHONY : very helpful thanks well done good morning tq Sir

well done good morning tq Sir