At the crossroad of rate cut: Are bond ETFs bound to be good?

Hey mooers! ![]()

Jerome Powell, the Federal Reserve Chair, is set to discuss the Fed's upcoming strategies against inflation at the Jackson Hole symposium, with possible hints at a rate cut to deter a major economic slump. With markets on edge and a presidential election approaching, Powell's speech is highly anticipated for clues about the Fed's monetary policy plans. Read more>>

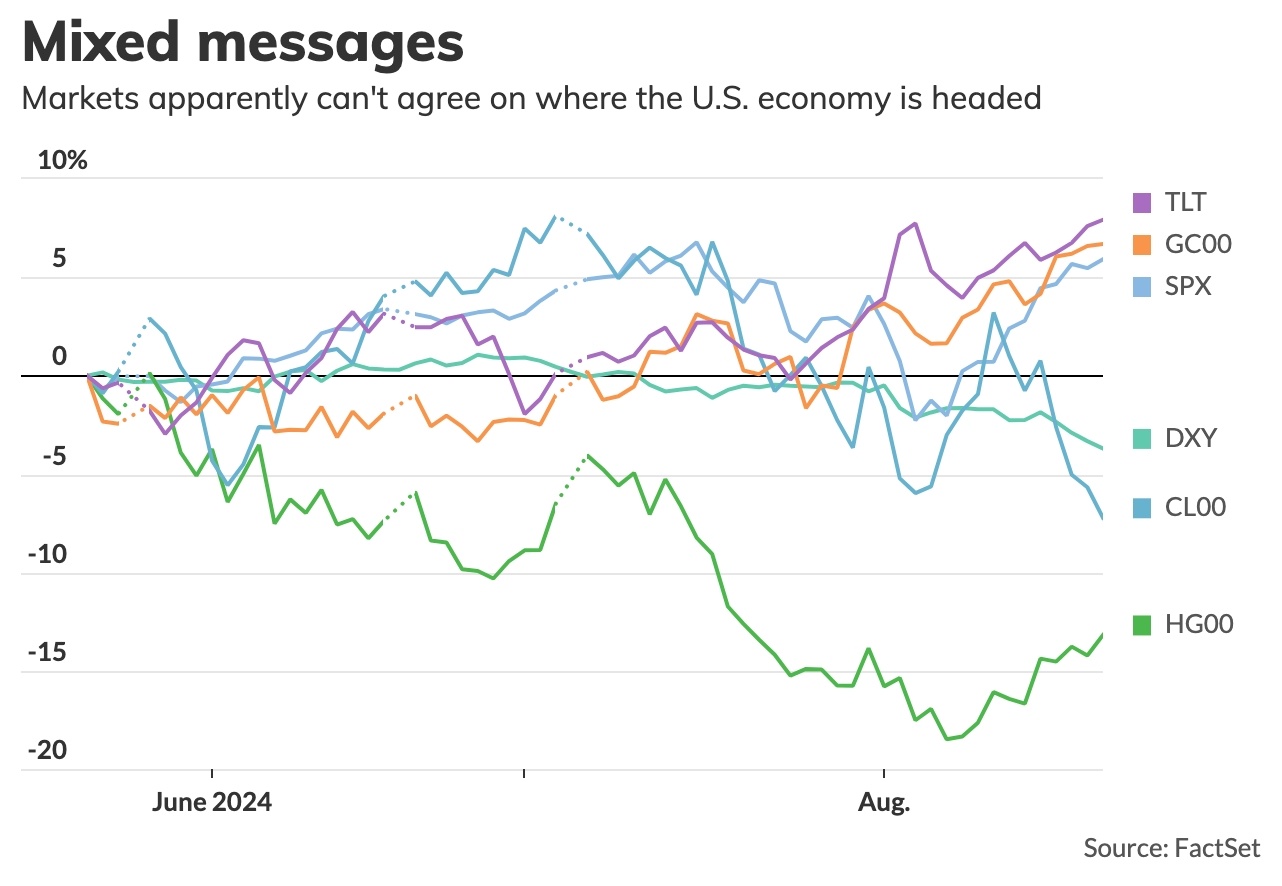

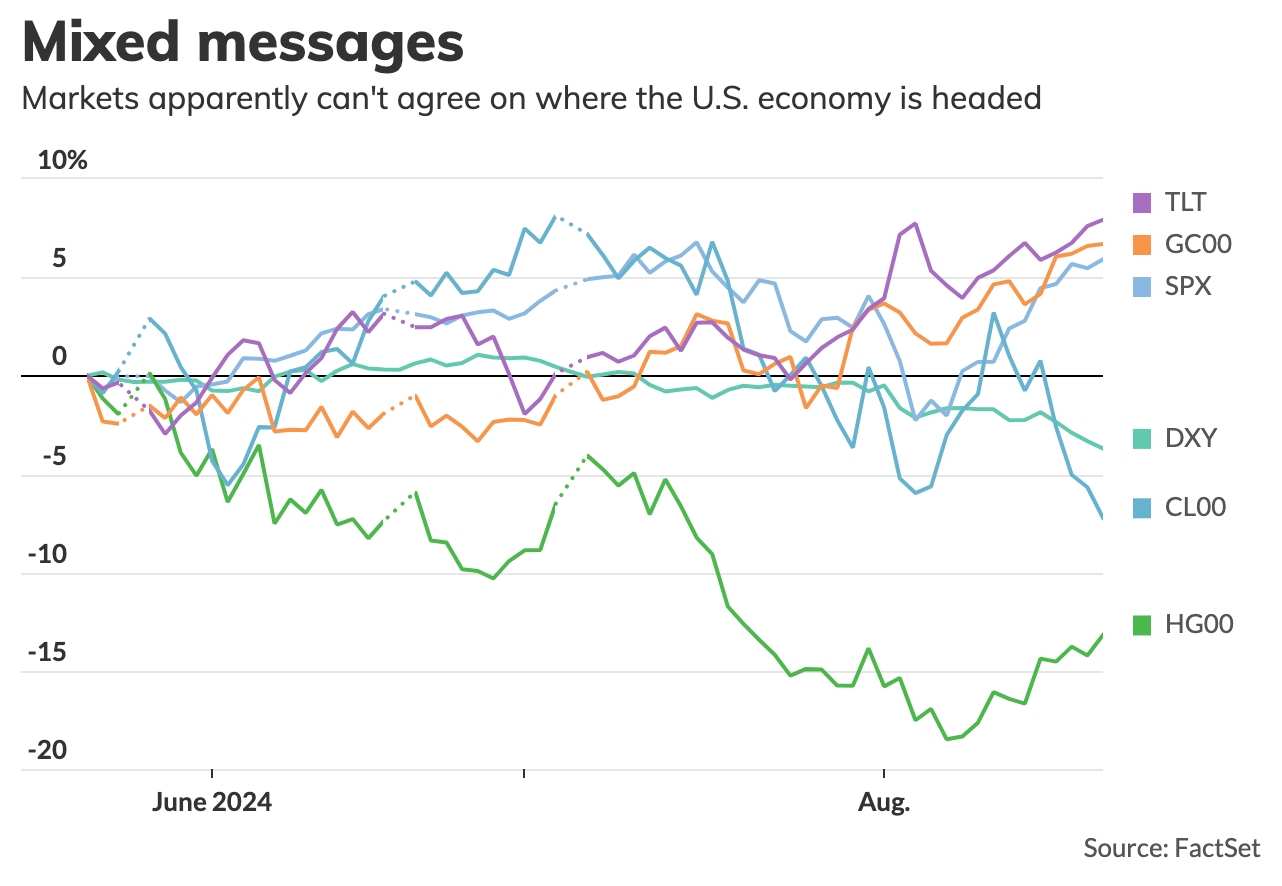

At this junction of many uncertainties, the market clearly cannot agree on the direction of the U.S. economy. A big surge in stocks indicates a soft landing for the economy, while rising bond and gold prices suggest a hard landing. The decline in oil and copper prices, which are sensitive to the economy, indicates weak global economic growth, and the falling U.S. dollar raises doubts about international investor confidence.![]()

Now the question is what are they and can I earn from them?

Beginning in March, the gold market has witnessed a robust rise. The price of gold reached an unprecedented peak on March 6th. During the months of April through July, the price of gold found stability, fluctuating between $2,300 and $2,400. Yet, as July concluded, the price of gold experienced another sharp increase, surpassing the crucial threshold of $2,500 in the early days of August, garnering significant interest from investors around the world.

This is becasue in such an unpredictable market climate, it's important to contemplate the use of leveraged ETFs as a strategic instrument to seize opportunities and enhance possible gains, despite having restricted capital.

Leveraged ETFs are designed to amplify the daily performance of the reference benchmark index by multiples. Take the $ProShares UltraPro QQQ ETF (TQQQ.US)$, for example, which strives to produce triple the daily performance of the $NASDAQ 100 Index (.NDX.US)$. This means that if the Nasdaq 100 increases by 1% on a given day, $ProShares UltraPro QQQ ETF (TQQQ.US)$ is expected to rise approximately 3% that same day. On the flip side, a 1% decline in the index would lead to an estimated 3% drop in $ProShares UltraPro QQQ ETF (TQQQ.US)$.

Beyond index leveraged ETFs that mirror the movements of a collection of stocks, there's an emerging type of investment called individual stock leveraged ETFs, which focus on the performance of a single corporation's shares. The $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ stands out as one of the prominent individual stock leveraged ETFs that specifically follows the stock of Nvidia.

Some mooers have profited from ETFs we mentioned above. Let's share the joy!

With the anticipation of rate cuts and the undeniable ebb and flow of the markets, it's more important than ever to share our insights and perspectives.

Whether you're a seasoned investor or just getting your feet wet, your thoughts and feelings on these financial shifts matter.

This is a fantastic opportunity to learn from each other, explore different strategies, and navigate these financial waters together.

So, don't hold back—let's dive into the conversation and help each other uncover the potential that lies within these market trends and movements!

For mooers who comment, we will give you 33 points rewards. For mooers who have more than one comment or comment on others ideas, we will give you 11 points rewards on EVERY additional comment! ![]()

![]()

![]()

Here are some questions for your reference in case you don't have a clue what to talk and discuss:

– How do you evaluate which ETFs might be the most resilient or profitable during periods of expected rate cuts?

– Have you adjusted your ETF holdings in anticipation of market volatility, and what was your strategy?

– What role do leveraged or inverse ETFs play in your investment portfolio amid fluctuating interest rates?

– Which sector-specific ETFs do you think offer the best opportunities given the current economic indicators?

How to grab the next opportunity?

Missed the latest investment wave? Don’t fret – the key is to focus on upcoming opportunities. Moomoo Learn is here to equip you with actionable trading strategies to help you spot and capitalize on future investment prospects.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Avaliye : When it comes to expected rate cuts, bond ETFs and growth stock ETFs are the stars of the show! They tend to shine the brightest, offering potential resilience and profitability.

They tend to shine the brightest, offering potential resilience and profitability.

Lauren_investement : I consider valuation, economic cycles, policy shifts, and industry trends. Plus, I gotta keep an eye on liquidity and fees. It's like a puzzle, but I love solving them!

EugeneB : For some weird reason redittors always shit on 3x leveraged ETFs. But my biggest gains have been on TQQQ, SOXL and Spxl.

sdfrgfhjj EugeneB : This works until it REALLY doesn’t.

john song : ok

73851529 : TLT is not very good but not bad in future