At the crossroads of uncertainty, what ETFs you would bet on?

Hey mooers! ![]()

The eagerly awaited U.S. presidential election is set to commence on November 5, likely ushering in a turbulent market period. As the date approaches, investors are preparing for increased volatility. What are the potential effects and strategies you should consider? ![]()

Additionally, as October progressed, Harris's lead in polls diminished, particularly in crucial swing states, leading to a rise in bets on a Trump win on platforms like Polymarket.

Since late September, $Trump Media & Technology (DJT.US)$, a key stock in the "Trump trade," has experienced a significant rebound, with its stock price soaring from under $12 to nearly $55, an increase of over 360%.

So, what's your take on this? ![]()

Key ETFs to consider for long-term investment based on Trump's tax cut policies include:

– For large multinational companies and consumer sectors that benefit from corporate tax reductions and increased consumer spending: $SPDR S&P 500 ETF (SPY.US)$ and $Invesco QQQ Trust (QQQ.US)$.

– For small businesses that will gain from lower tax burdens, enabling growth and higher returns: $iShares Russell 2000 ETF (IWM.US)$ and $Vanguard Small-Cap ETF (VB.US)$.

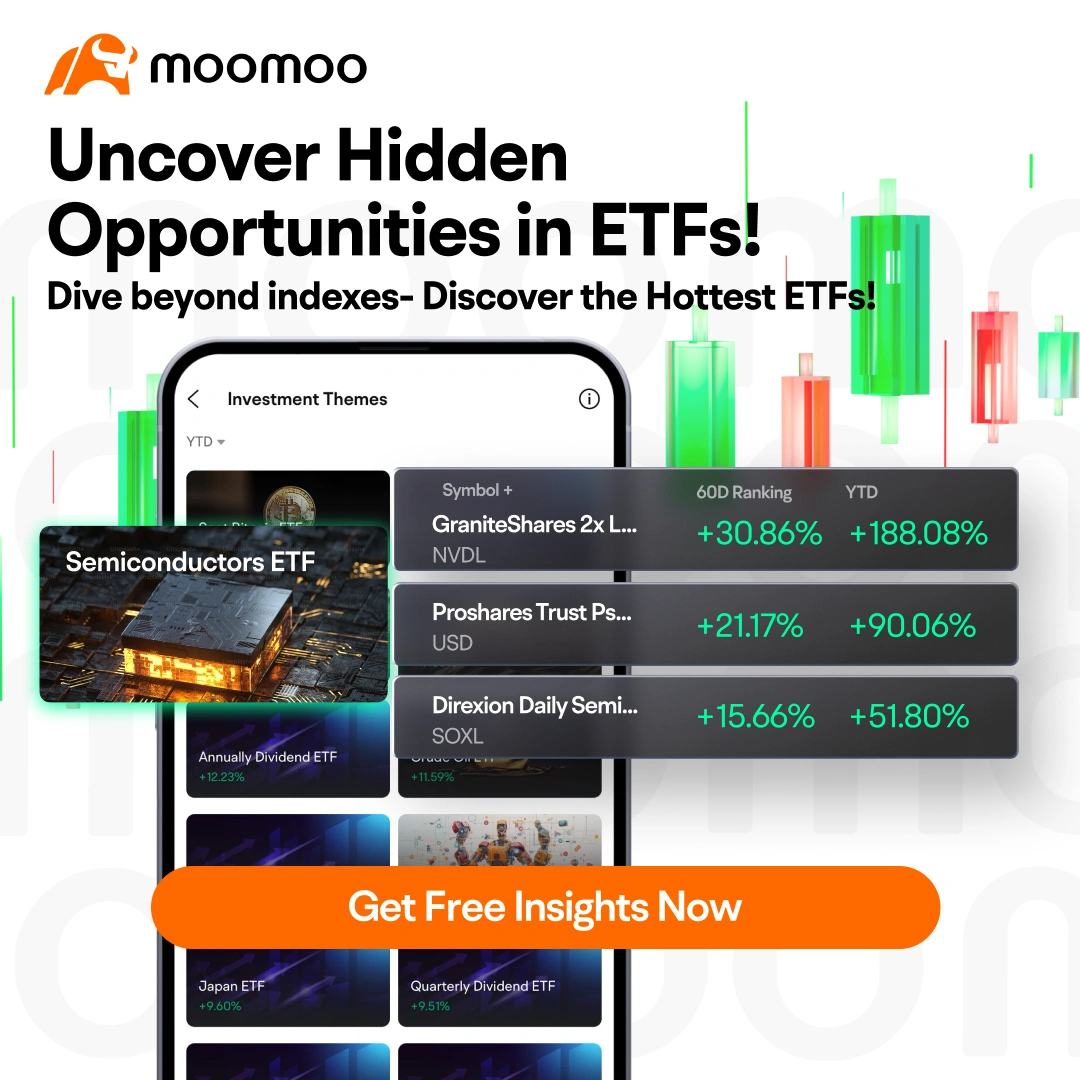

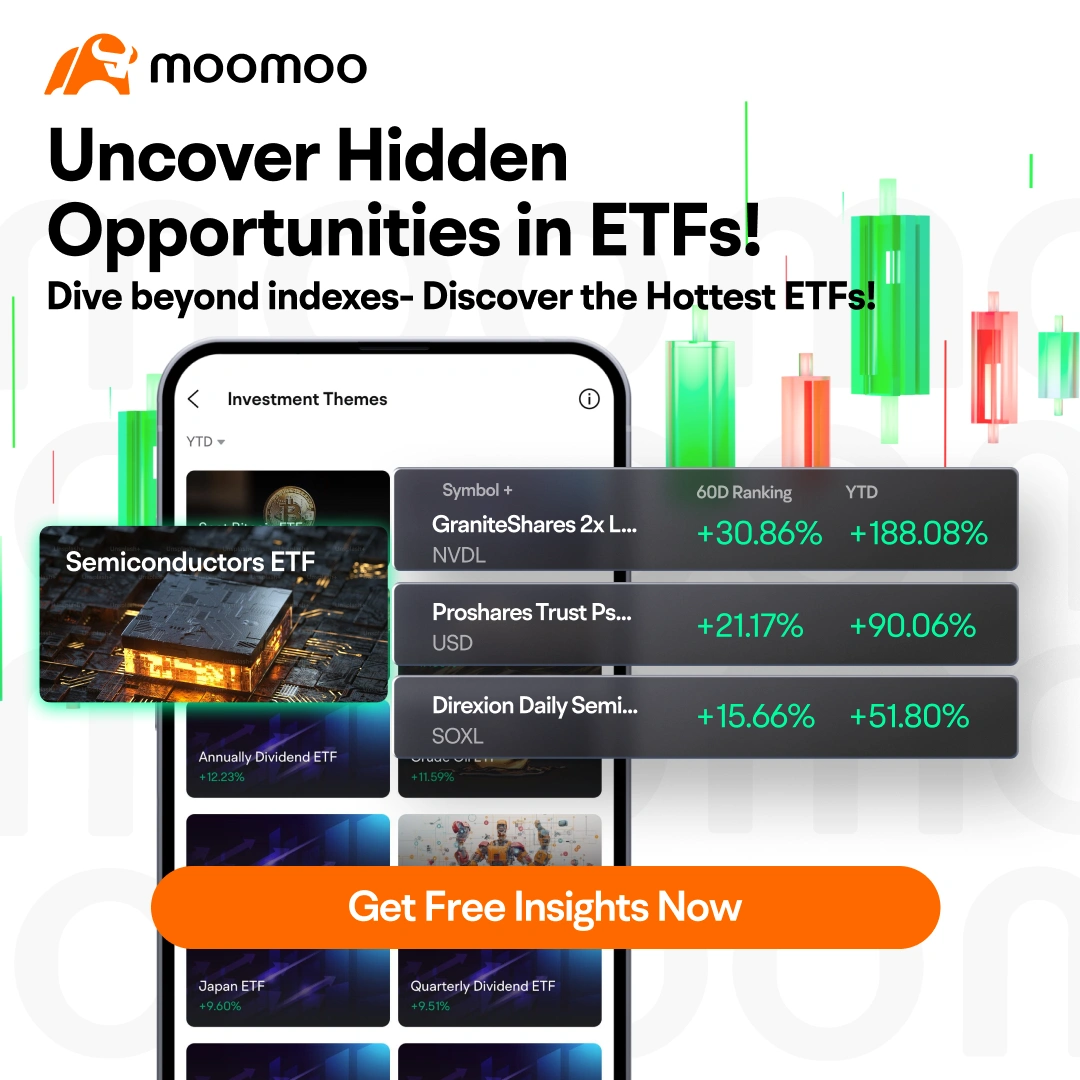

To assist you better find and select related ETFs mentioned above, click here to read and try ETF functions like "Index ETF" and "Thematic ETF">>

- Cryptocurrency:

Trump has shown strong support for cryptocurrencies, pledging to make the U.S. the global hub for cryptocurrency. At the Bitcoin 2024 conference, he promised significant backing for the crypto sector.![]()

Key ETFs to consider:

The Magnificent Seven stocks, outperforming the S&P 500 with a 51.04% gain, highlight their critical role in the investment landscape, particularly for those focused on technological advancements.

As companies like $Alphabet-C (GOOG.US)$, $Microsoft (MSFT.US)$, and $Apple (AAPL.US)$ start earnings week, their move towards designing their own chips could lessen their reliance on traditional chipmakers.

This shift might either negatively impact their stocks if chipmakers falter or boost their stocks if they successfully rival traditional chipmakers with their in-house developments. Read more>>

Does the election matter?

Fundamentals such as earnings, cash flows, and valuations are key drivers of financial asset performance, with the impact of politics often being unpredictable and exaggerated. Historical data from Schwab indicates that the $S&P 500 Index (.SPX.US)$ has only declined during four presidential election years since 1928, due to major crises rather than elections.

J.P. Morgan Chase notes that post-election, the $S&P 500 typically rises as uncertainty diminishes, suggesting that investing in related ETFs could be beneficial. ![]()

Prominent ETFs like the $Vanguard S&P 500 ETF (VOO.US)$ and $SPDR S&P 500 ETF (SPY.US)$ are notable for their liquidity and low costs, with VOO surpassing $1 trillion and SPY over $500 billion in assets.

Key index ETFs to watch:

What's your bet on this election?

What ETFs you would buy under your strategy? (comment and win another 66 points) ![]()

Come and share you wisdom!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

mr_cashcow : Bullish on Trump, just look at how $Trump Media & Technology (DJT.US)$ rallied for the past few week![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I would take a look at $Advisorshares Trust Pure Us Cannabis Etf (MSOS.US)$

102362254 : I'm bullish on Trump. If he wins, it's not just crypto that might get a boost. I’d look at stocks in defense, steel, and banking. For ETFs, I'd go with $Spdr Series Trust S&P Regional Bkg Etf (KRE.US)$

Daring Lu : Democrat will burst the bubbles before 20 Jan 2025?

73569545 : It will end on November 5th, and it will also start on November 5th.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Meme_Short_Queen : 1000% having another Trump administration will bring joy to the world.

Coquinours : I’m bearish in Trump.

Coquinours : I love VOO ETF

louise josee leroux : $ADBE 240913 580.00P$