AU Evening Wrap | ASX 200 Decline Amid Weak Energy and Resources

Market Performance

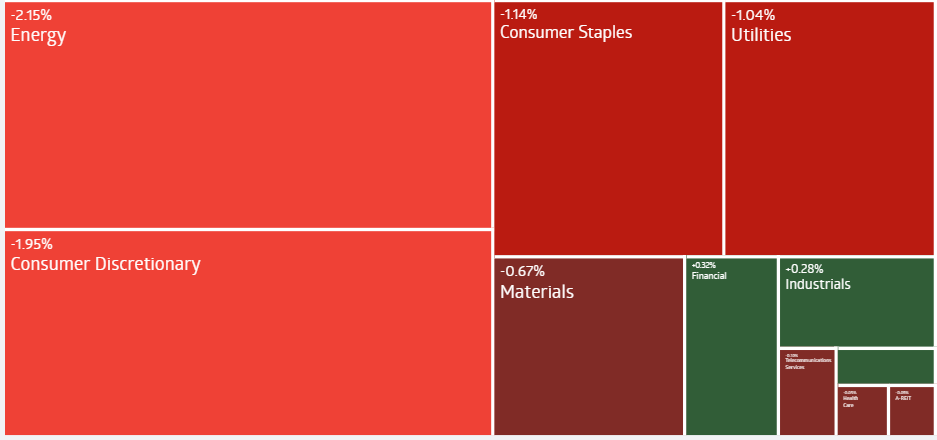

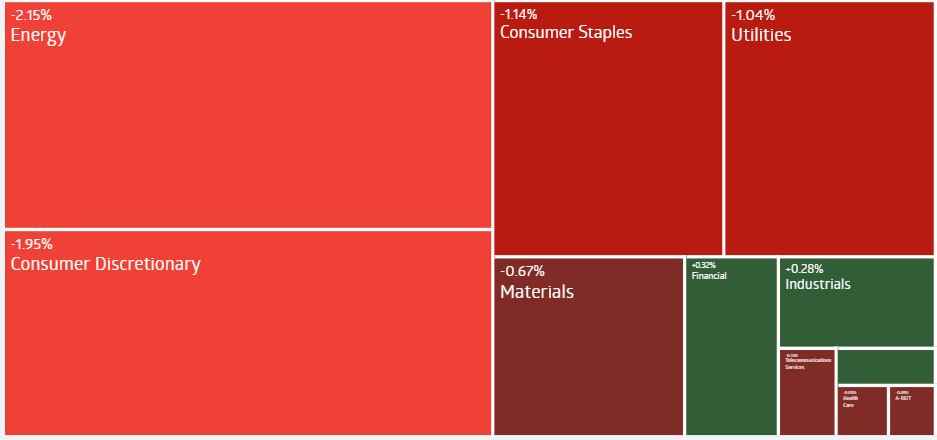

Australia's $S&P/ASX 200 (.XJO.AU)$ dropped 0.3% to close at 8045.1, primarily due to weakness in commodity stocks. The index started the session lower following a negative trend from U.S. equities and remained in the red throughout the day.

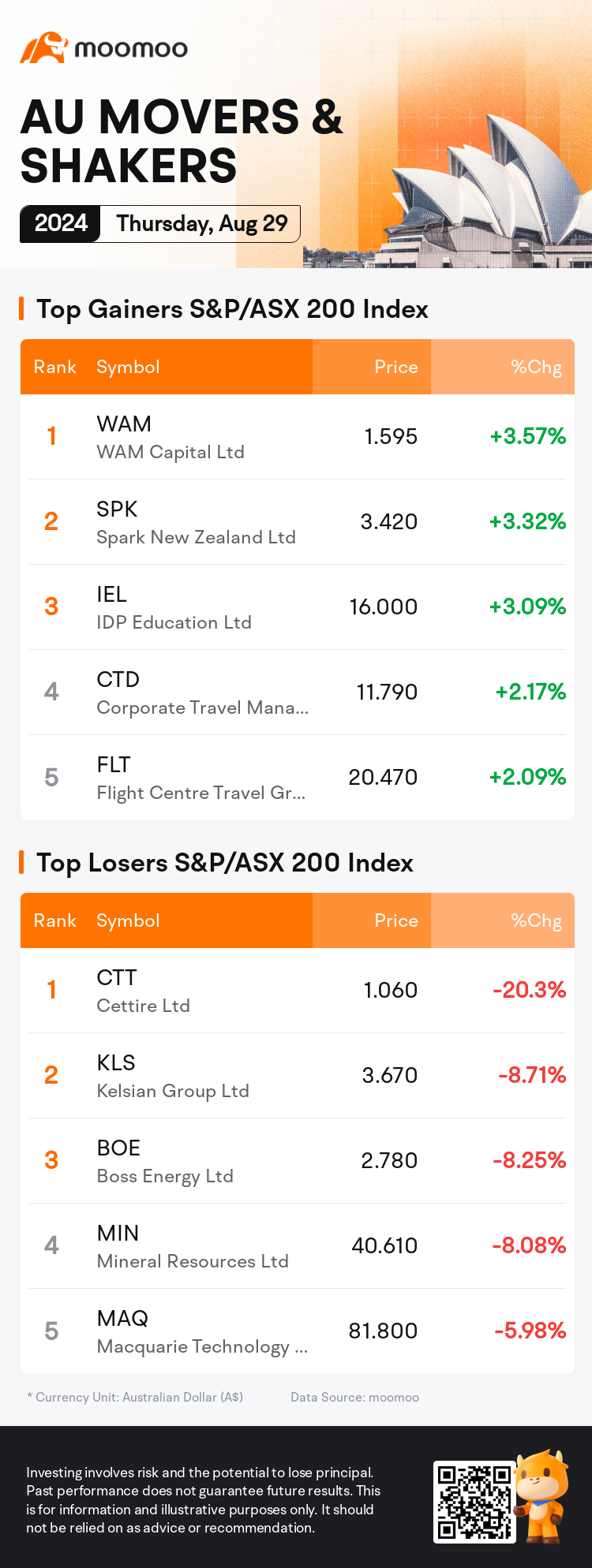

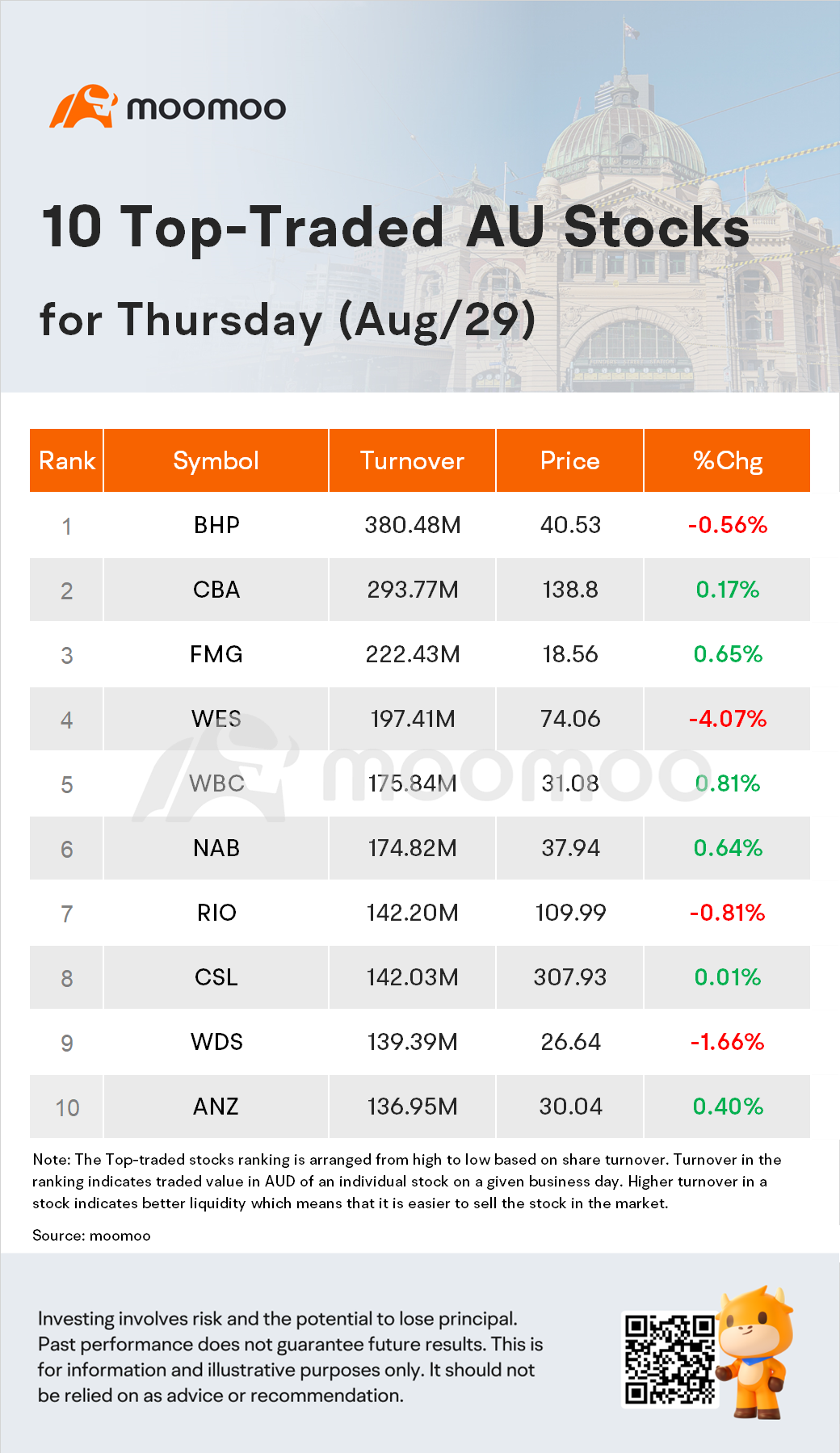

Energy stocks declined amidst falling oil prices, while miners of iron ore, gold, and lithium dragged the materials sector down. Major mining companies $BHP Group Ltd (BHP.AU)$ and $Rio Tinto Ltd (RIO.AU)$ fell 0.6% and 0.8%, respectively, while lithium miners Arcadium Liontown and $Mineral Resources Ltd (MIN.AU)$ saw losses ranging from 3.3% to 8.1%. $Red 5 Ltd (RED.AU)$ led the decline in gold miners, dropping 12% due to disappointing fiscal 2025 guidance. In contrast, $Qantas Airways Ltd (QAN.AU)$ rose 0.8% after announcing a new share buyback. Despite the day's losses, the ASX 200 remains up 0.3% for the week.

Top News

Australia's Economic Outlook Amid High Interest Rates

Moody's Ratings forecasts that Australia's economy will be weighed down by high interest rates, with real GDP growth slowing to 1.5% in 2023. Inflation is expected to cool to the upper end of the RBA's target range by late 2024, but risks remain for higher levels. The RBA is likely to await stable price pressures before easing rates, anticipated to start in the first half of 2025. Job vacancy declines and rising unemployment are expected to dampen consumer sentiment and purchasing power in 2024, with GDP growth rebounding to 2.3% in 2025.

Steepest Decline in Three Weeks for Sharemarket

The Australian sharemarket experienced its steepest decline in three weeks on Thursday, influenced by a weak lead from Wall Street and a sharp 9% drop in Nvidia’s stock after disappointing guidance. The S&P/ASX 200 Index fell 0.3%, or 26.3 points, to 8045.1, retreating from a record high earlier this month. The All Ordinaries also decreased by 0.3%. Out of 11 sectors, only three ended in positive territory, with financials leading the gains. The big four banks rose, led by Westpac, which increased by 0.8% to $31.07. Local investors also analyzed profit results from companies including Qantas and Wesfarmers.

Consumer Stocks and Earnings Woes Hit ASX

Consumer-related stocks suffered, with Wesfarmers dropping 4.1% to $74.06 despite announcing higher 2024 profits and dividends. The stock's high valuation, at 31 times next year's earnings, makes it more expensive than major tech giants. Hugh Dive of Atlas Fund Management expressed satisfaction with the results but acknowledged some investor disappointment. Online fashion retailer Cettire plunged 20% to $1.06 after warning of continued soft trading and delayed auditor approval, following a prior earnings warning. Mineral Resources fell 8% to a three-year low of $40.61 after skipping its final dividend due to weak lithium prices. Contrarily, IGO rose 1.3% to $5.32 despite halving its dividend and reporting a significant profit drop.

Source: Dow Jones Newswires, AFR, ASX

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment