AU Evening Wrap | ASX 200 dips slightly; GQG shares plummet after Adani chairman charges

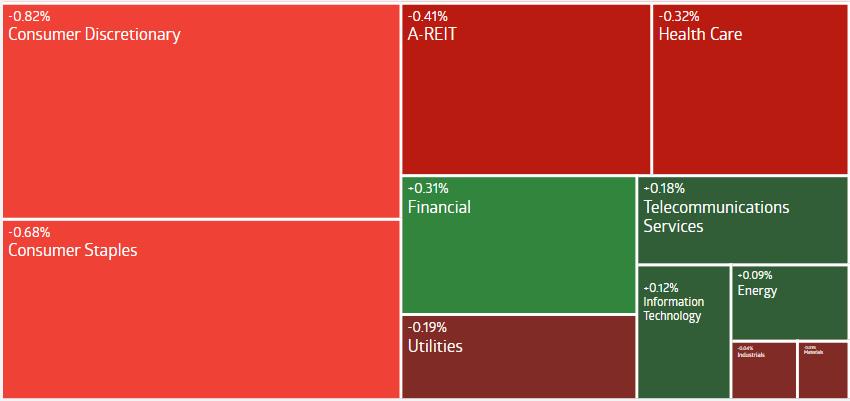

$S&P/ASX 200 (.XJO.AU)$ closed almost flat, dipping by merely 3.3 points to close at 8323. The market started with a gain of up to 0.4% but surrendered those gains by the mid-session.

$Wesfarmers Ltd (WES.AU)$ share price declined 1.4% to A$69.67, dragging down the index and causing consumer discretionary stocks to drop 0.8%, making it the poorest-performing sector out of the 11 sectors on the ASX. The company, which owns Bunnings, was also given a sell rating by Jarden analysts.

$Bitcoin (BTC.CC)$ reached an all-time high of over $97,000, marking a significant rally in digital assets since Donald Trump's election, with investors viewing his administration as supportive of cryptocurrency policies.

U.S. stocks had a mixed performance overnight on Wednesday, ahead of $NVIDIA (NVDA.US)$'s key quarterly report, which was released after the markets closed. The Dow Jones Industrial Average closed up 0.3%, the S&P 500 managed to erase early losses to finish unchanged, and the Nasdaq Composite dipped by 0.1%. In post-market trading, Nvidia's stock fell 2.5% even though its earnings results surpassed most predictions. The chipmaker's shares have soared over 200% since the beginning of the year, making it a key indicator of the growing demand for artificial intelligence technology.

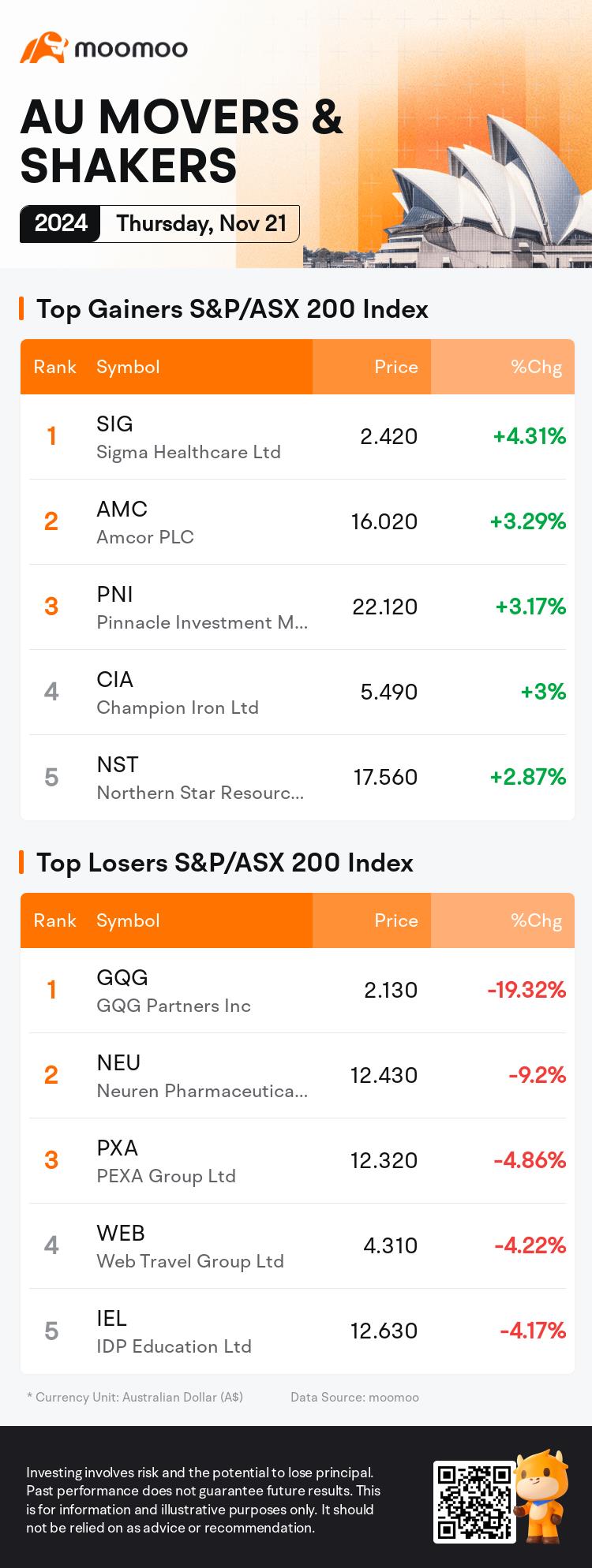

$GQG Partners Inc (GQG.AU)$ sank 19.3% to A$2.13. The Florida-based asset manager placed its large stake in Adani Group companies under review after US prosecutors charged Adani chairman Gautam Adani with helping drive a $250 million bribery scheme.

$Accent Group Ltd (AX1.AU)$ shares dipped 11.1% to A$2.25 after the company cautioned that its gross profit margins were being squeezed as retailers heavily discount their products to lure customers back into stores. This aggressive discounting strategy is taking a toll on Accent Group's financial performance.

$Amcor PLC (AMC.AU)$ rebounded 3.29% to A$16.02 after a previous decline, following the announcement of its proposed $13 billion acquisition of New York-listed packaging company Berry Group.

$Pinnacle Investment Management Group Ltd (PNI.AU)$ hit a new record, climbing by 3.17% to close at A$22.12. The wealth management firm successfully completed a A$400 million capital raise to fund strategic investments in offshore fund managers VSS Capital and Pacific Asset Management.

$IDP Education Ltd (IEL.AU)$ shares dropped 4.17% to A$12.63 after major investor Bennelong Funds Management disclosed late on Wednesday that it had reduced its stake in the international education services provider.

Source: AFR, ASX

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment