AU Evening Wrap: Australia Shares Close Down 0.6%, But Snap Run of Weekly Losses

G'day, mooers! Check out the latest news on today's stock market!

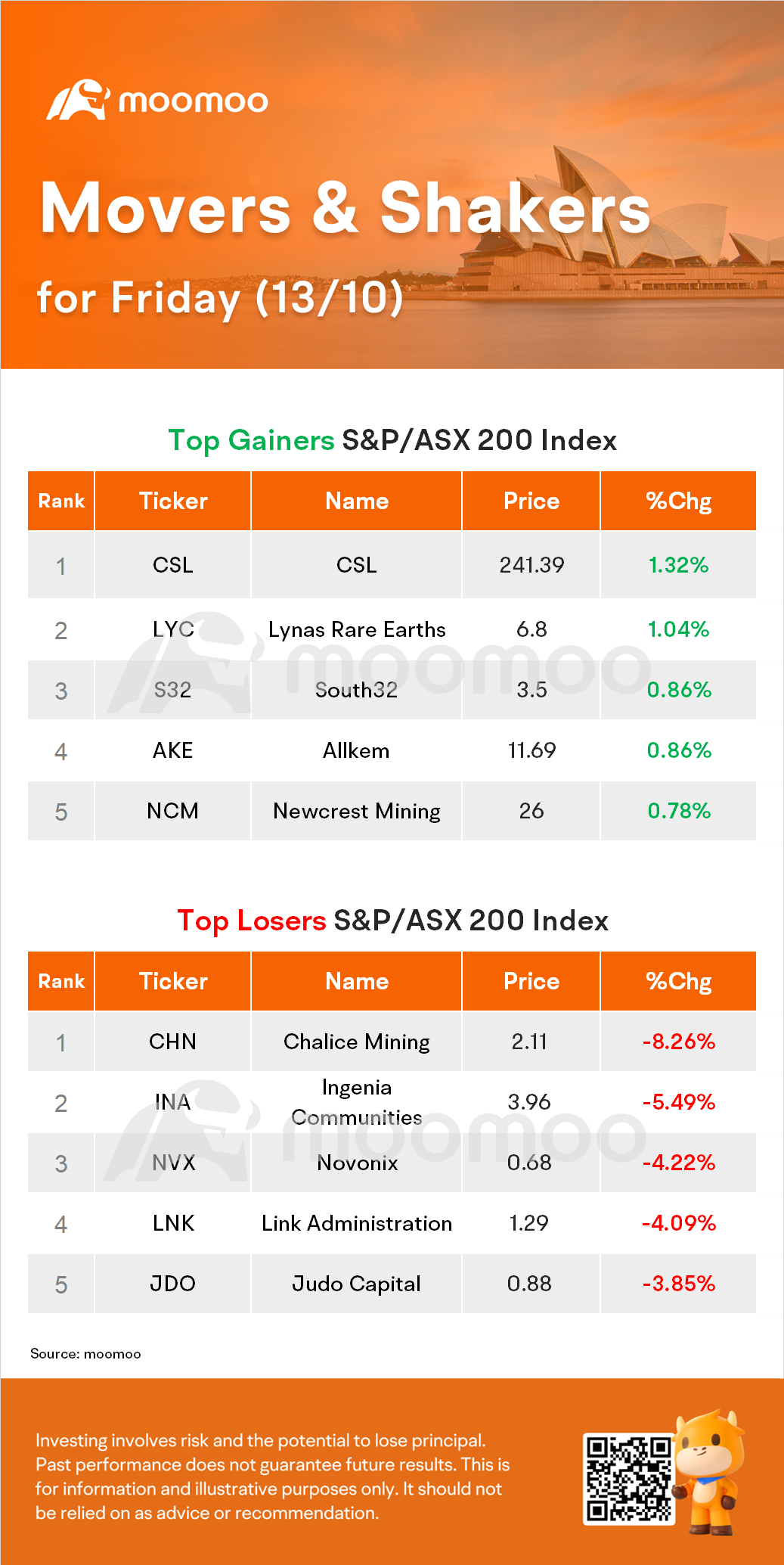

• Top gainers: $CSL Ltd (CSL.AU)$, $Lynas Rare Earths Ltd (LYC.AU)$, $South32 Ltd (S32.AU)$

• Top losers: $Chalice Mining Ltd (CHN.AU)$, $Ingenia Communities Group (INA.AU)$, $Novonix (NVX.AU)$

- moomoo News AU

$S&P/ASX 200 (.XJO.AU)$ closed 0.6% lower at 7051.0, snapping a six-day winning streak but still finishing higher for the week. Nine of the benchmark index's 11 sectors lost ground following a weak lead from equities in the U.S., where traders were unsettled by a pause in inflation's recent decline.

The ASX 200's tech, real-estate and consumer discretionary sectors led the losses in percentage terms, while financial sector--which accounts for more than 25% of the index by market capitalization--shed 0.6%. Major banks $ANZ Group Holdings Ltd (ANZ.AU)$, $CommBank (CBA.AU)$, $Westpac Banking Corp (WBC.AU)$ and $National Australia Bank Ltd (NAB.AU)$ gave up between 0.6% and 0.8%. The ASX 200 rose 1.4% for the week, ending a run of three consecutive weekly losses.

Shareholders in Australia's biggest gold miner, $Newcrest Mining Ltd (NCM.AU)$, overwhelmingly voted in favour of a $26.2 billion merger with US gold mining giant $Newmont (NEM.US)$. Shares edged up 0.8% to $26.

$Perpetual Ltd (PPT.AU)$ jumped 2.8% to $21.31 after news its assets under management had held steady in the September quarter. The struggling money manager pulled in $100 million in inflows during the three-month period, compared to $5.1 billion of outflows in the previous quarter.

$Pact Group Holdings Ltd (PGH.AU)$ held flat at 72¢. The packaging company's board has urged shareholders to reject a buyout offer from majority stakeholder and billionaire businessman Raphael Geminder.

$ResMed Inc (RMD.AU)$ dropped 2.8% to $21.54, nearing a four-year low following an analyst note from brokers at RBC, which downgraded the stock to perform from outperform.

$Bega Cheese Ltd (BGA.AU)$ gained 3.2% to $2.89 after analysts at Bell Potter upgraded the foods business to a buy rating.

$Fletcher Building Ltd (FBU.AU)$ remained in a trading halt. It has accused Western Australia's largest home builder, BGC, of making unfounded allegations over plumbing pipe leaks in 11% of new houses built in the state between 2017 and 2022 that used a Fletcher product. The shares last traded at $4.45.

S&P/ASX 200 Movers for Friday (13/10)

How to find the above information in moomoo app:

1. Open moomoo app

2. Search for and tap on ".XJO"

3. Roll down to see "Constituent Stocks"

4. You can filter the list based on "%Chg"

2. Search for and tap on ".XJO"

3. Roll down to see "Constituent Stocks"

4. You can filter the list based on "%Chg"

10 Top-Traded AU Stocks for Friday (13/10)

How to find the above information in moomoo app:

1. Open moomoo app

2. Tap your finger on "Market" and "AU"

3. Roll down and tap on "Main Board"

4. You can filter the list based on "Turnover"

1. Open moomoo app

2. Tap your finger on "Market" and "AU"

3. Roll down and tap on "Main Board"

4. You can filter the list based on "Turnover"

Source: Dow Jones Newswires, AFR

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment