AU Evening Wrap: Australian market sees weekly loss despite final day rebound

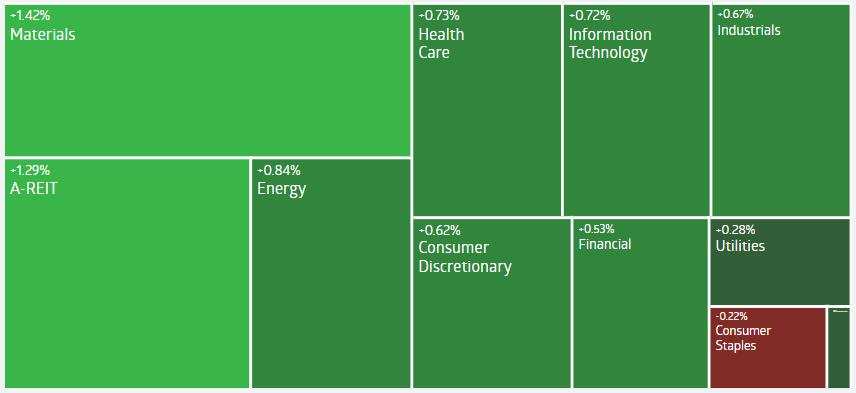

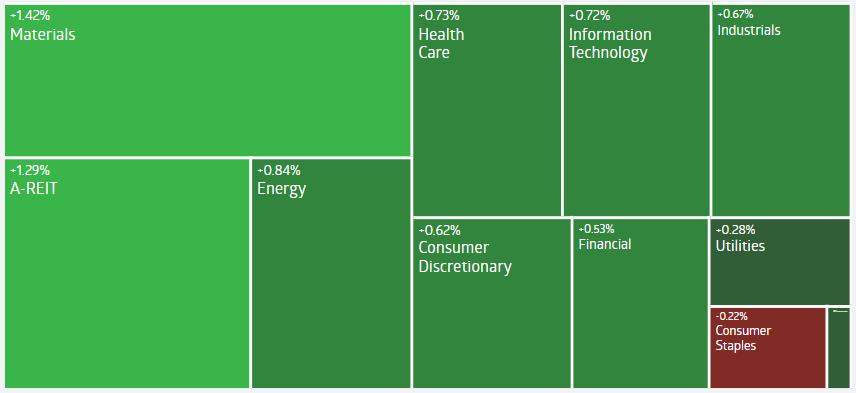

Market Performance

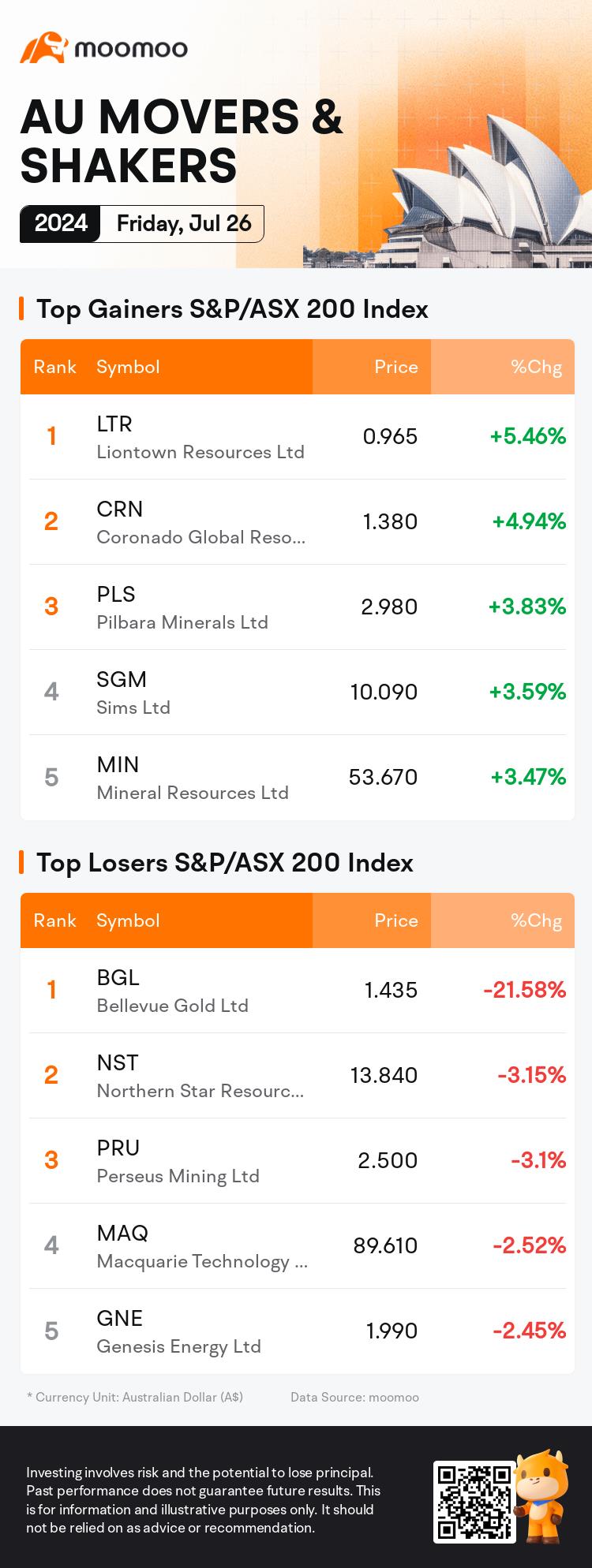

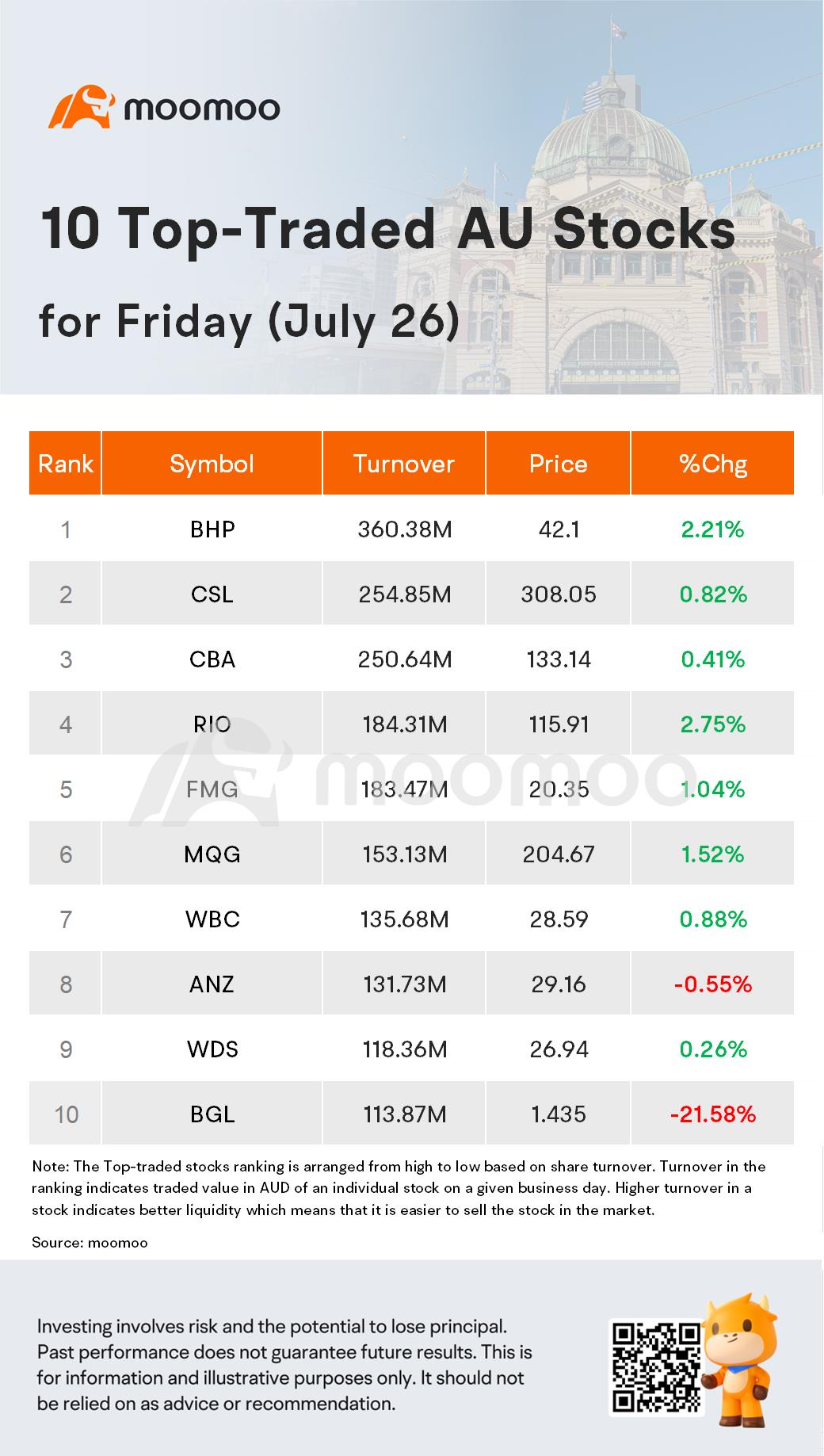

The Australian $S&P/ASX 200 (.XJO.AU)$ Index concluded the week with a robust increase of 0.8%, reaching 7921.3, yet this upswing was not enough to prevent the cessation of its three-week winning streak. Despite the contributions from heavyweight sectors such as banking and mining, the index experienced a net weekly decrease of 0.6%. This decline takes into account the rebound from Thursday's notable 1.3% drop.

Amidst the large-cap entities, the $ANZ Group Holdings Ltd (ANZ.AU)$ stood out as an exception, closing in negative territory amidst ongoing probes into its trading practices and conduct within the domestic markets division. In contrast, its peers in the banking sector, $CommBank (CBA.AU)$, $National Australia Bank Ltd (NAB.AU)$, and $Westpac Banking Corp (WBC.AU)$, witnessed increments ranging from 0.4% to 0.9%.

In the mining sector, iron ore giants $Fortescue Ltd (FMG.AU)$, $BHP Group Ltd (BHP.AU)$ and $Rio Tinto Ltd (RIO.AU)$, reported gains stretching from 1.0% to 2.75%, contributing to the index's partial recovery.

Additionally, real estate and energy shares experienced an uptick, exemplified by $Woodside Energy Group Ltd (WDS.AU)$'s 0.3% rise, signaling a mixed yet resilient performance across various industry groups.

Top News

Mineral Resources Exceeds Annual Lithium Shipment Forecasts

$Mineral Resources Ltd (MIN.AU)$ has announced a commendable performance in its annual lithium shipments, surpassing the anticipated guidance. The company successfully shipped 487,000 dry metric tons of spodumene concentrate over the past 12 months, concluding in June. This figure notably exceeds the forecasted range of 400,000 to 460,000 tons. Additionally, Mineral Resources achieved its projected targets for iron ore, with total shipments reaching 18.1 million wet metric tons. This volume falls comfortably within the provided guidance range of 16.5 million to 18.8 million tons. In a strategic move, the company has recently entered into an agreement to divest a 49% stake in a bespoke haul road associated with an iron ore project located in Western Australia. The deal is valued at 1.3 billion Australian dollars ("US$850 million").

Source: Dow Jones Newswires, AFR, ASX

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment