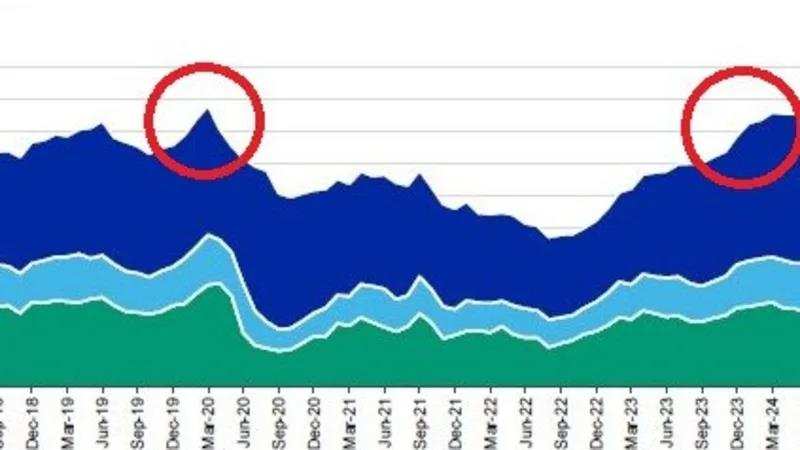

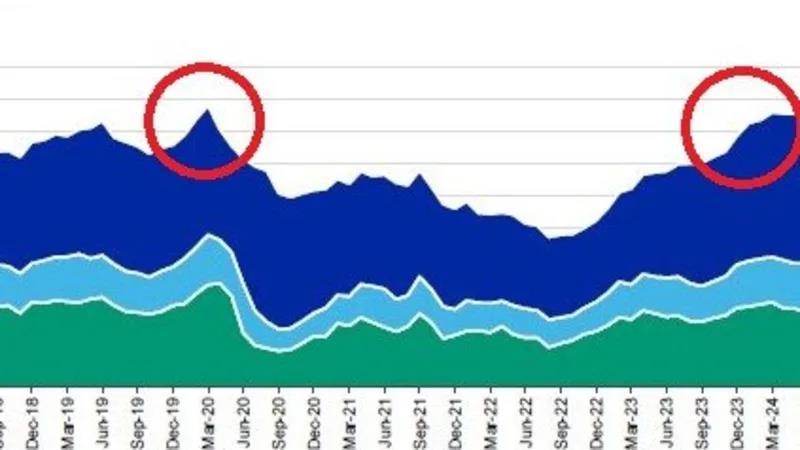

AU Mortgage defaults higher than covid peak

What happens: Mortgage defaults in Australia are set to exceed pandemic peaks, posing risks of forced home sales. High interest rates and persistent inflation are straining households, especially the self-employed, low-income families, and those with high loan-to-valuation ratios, warns Moody's Ratings. Nonconforming and near-prime RMBS delinquencies hit 4.23% in Q2, up from 4.01% in Q1. Prime-quality home loan delinquencies also rose to 1.73%. Major banks saw a rise from 1.65% to 2.25% YoY on mortgage delinquency rate . Expect continued pressure on households throughout 2024.

My ideas: Nonconforming and near-prime RMBS delinquencies are on the rise, indicating stress among borrowers with alternative lending arrangements. Explore opportunities in companies that specialize in alternative lending solutions or fintech firms that offer innovative credit assessment tools. These companies may have better risk management practices and could capitalize on the shift away from traditional lending.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment