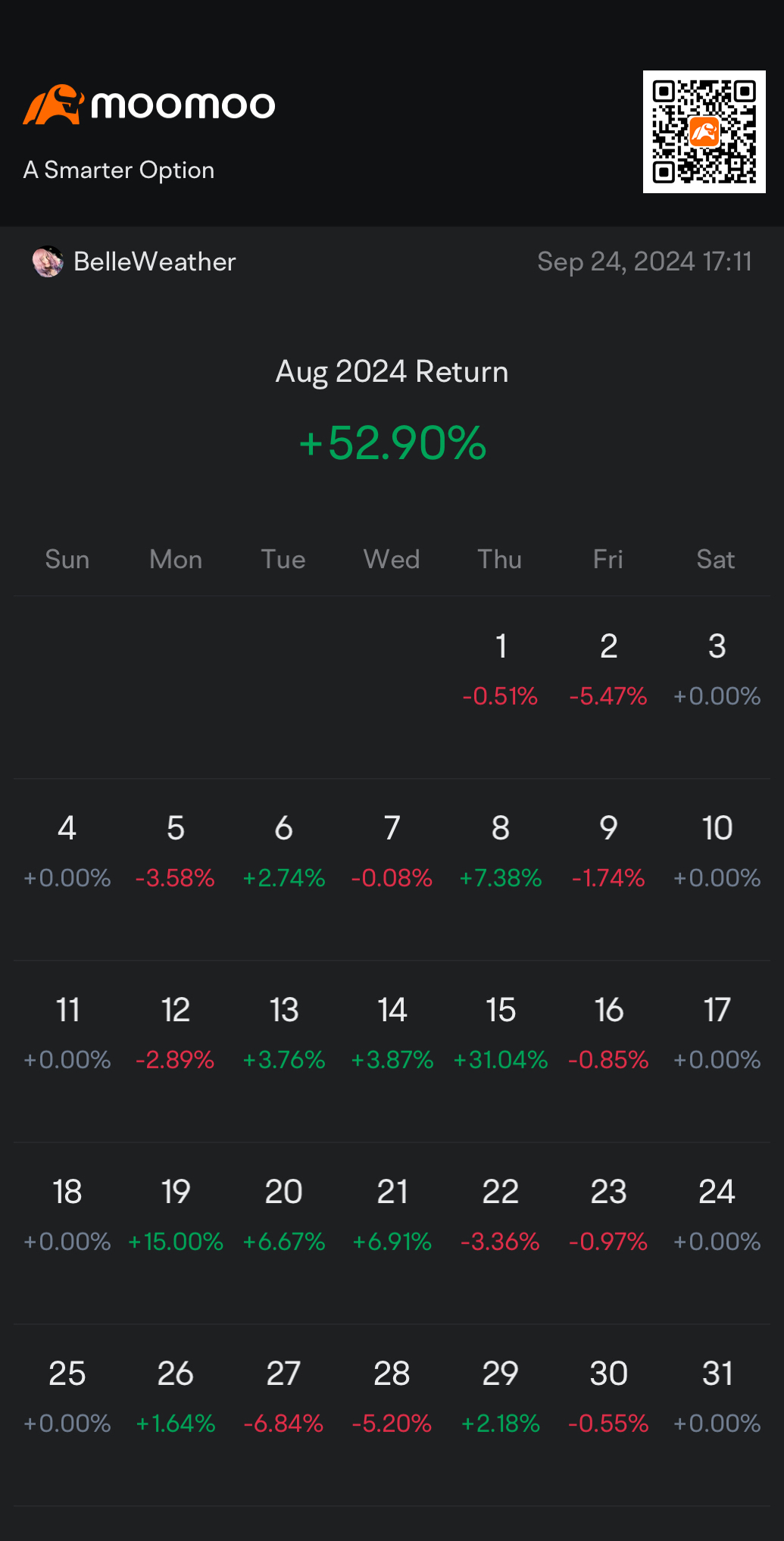

As previously posted, up ~500% this year, with strong runs each quarter. Plenty of volatility, though! In August I started taking positions in longterm bond funds in advance of rate cuts and in the interest of balance. I’ve also added VIX calls for December on low volatility days as a hedge, expecting some wild moments (have already exited and re-entered that position twice in September.) Since the rate cute announcement, I have been pruning my small cap and biopharma holdings as they have brief rallies. And of course manage positions in my favored small caps focused on innovation at a global scale (those companies revolutionizing communications, freight, recycling and transport, as I regularly share.) Of particular interest to me is crypto as it seems bull season is upon us. I have been adding sparingly to my portfolio of alts and regularly DCA into BTC on SATurdays. The biggest change is more active trading of crypto tickers. While I buy and hold alts for a cycle before selling, I hope never to sell bitcoin. I also have long and midterm positions in various companies, particularly MSTR and Galaxy, but trade BITX shares and options on BITO and MSTR on high volatility days such as today (September 24.)

Dan’l : Your gains are no surprise to me (having quickly seen good reasons to follow you), and I think you’re right, esp. for focusing upon small-cap innovators, and being bullish in re BTC as well, buUut…

I’ve done well with it, first by finding my earliest misplaced wallets, and later by exchanging Bitcoin and Ethereum somewhat constantly. Although I’ve accidentally “let it ride” before? I just can’t imagine how doing so intentionally works out better over time, esp. when it’s high in price and volatile (hence my bearishly quitting early once again on MSTR and WULF and BTC after yet another good but hectic ride).

BelleWeather OP Dan’l : Haha, yes! That’s great! I bought twenty bitcoins with a friend a few years ago. Guess what happened? (He had totally disappeared when I sought him out earlier this year - former landlord said he’d bought a new car and a house in Texas. Guh.

Absolutely agree that crypto is for trading. But also think that BTC will take over the space sooner rather than later. At the moment, I don’t have very much. But if other investments pan out in stocks, I’ll funnel gains (or whatever is left, haha, could go either way,) from the alts to BTC. Still not a sure thing, of course. But worth the risk to hold and see where things are in five to ten years at this point, I hope!

(I was awful at trading. Well, didn’t lose money, but would have been better off leaving things alone this spring. Lesson learned. And I am turning into a bit of a maxi…seriously considered selling it all and putting it into BTC this week, but. I kinda wanna see those huge numbers again - but get out with them this go around.)

BLACKLIST00 :

BLACKLIST00 Dan’l :

Dan’l BelleWeather OP : I remember the 2021 ice storms, leaving some Texans that still had power with seven-digit electric bills and one house in particular, alone in a sea of others, that was burning down… his, maybe?

I just can’t imagine giving up the advantages of well-chosen stocks, only to turn it all over to mostly pure chance. Bitcoin faces regulatory pressures that will prevent it from becoming all that it otherwise might, and beyond faith and ecosystem dependencies? No assets… don’t get me wrong: will still exchange, surf the digital tides, buUut, that’s all.

BelleWeather OP Dan’l : One can fantasize! Haha! I think of it more as diversification. I see your point, and am by no means a maxi. But will keep 1-5% in as long as development continues apace. BlackRock has an interest, so… but it is certainly a gamble and also a lot less fun - nothing to research beyond the network and etc.

Dan’l BelleWeather OP : Bingo… little more than throwing the pea into the roulette wheel (even though I do tend to catch a few waves).

BelleWeather OP Dan’l : That’s great - I rely so much on fundamentals that trading crypto made a bit of money, but holding a few has made more for me (I lose patience when it’s basically down to technicals for long stretches.)

Dan’l BelleWeather OP : I’m trying to be more disciplined about starting, and finishing, with a plan… helps to keep me from gettin’ twitchy fingers, and those big dollars signs in my eyeballs (it sorta stings, when those falling knives pop ‘em ~;-)

BelleWeather OP Dan’l : Yes, oh my gosh, yes. I’ve been there a few times. Have learned from it - always take some profits, basically (taxes are going to be messy anyway.)

View more comments...