August Nonfarm Payroll Preview: Incoming Data is Expected to Confirm the Labor Market's Cooling Down

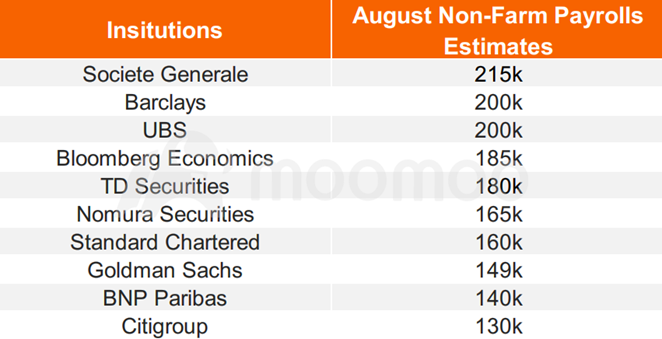

August's nonfarm payrolls report will be released at 8:30 ET this Friday. JOLTS data released on Tuesday and ADP private payrolls on Wednesday already surprised the market with lower than expected employment data, stimulating market gains this week. The market expects the median non-farm payrolls in August to be 170k.

■ Job vacancies continue to decline across industries

Excess labor demand continued to dissipate through July far more rapidly than anticipated. The number of job openings that dropped to 8.83 million from 9.17 million prior brought the vacancy-to-unemployed ratio down to 1.5 (vs. 1.6 prior), which is mostly good news for a Federal Reserve attempting to lean against labor demand.

Looking carefully at the number of job vacancies in various industries, the vacancy rates of manufacturing, education and health services, mining, and construction industries are declining, while the vacancy rates of information industries are rising due to the recovery of the technology industry this year.

■ Jobless Claims were overall steady:

The number of Americans filing for unemployment benefits stood at 230,000 on the week ending August 19th. The four-week moving average for initial claims, which removes week-to-week volatility, edged 2,250 higher to 236,750.

■ Looming US Jobs Revisions Add to Softening Labor-Market Data

The BLS's preliminary benchmarking process confirms the view that headline payroll figures have overstated labor market strength. Even as the anticipated downward revision was smaller than expected, the data take some shine off the high-skilled industries that have driven US job growth over the past year.

■ Other data to watch

According to Bloomberg, the headline unemployment rate likelyheld steady at 3.5%.

Average hourly earnings likely grew0.3% month on month. However, a decline in hours worked has stunted growth in workers’ take-home pay, muddying the read-through from wages to inflation.

■ Rate hike expectations:

In general, the softening of the labor market is evident on multiple fronts: slower hiring and decelerating wage growth, persistent downward revisions to the monthly payroll estimates, and now this preliminary re-benchmarking.

Following suit, the Fed is likely to take a more cautious approach on policy rates, initiating a prolonged pause at the current 5.25-5.50% target range at the Sept. 19-20 FOMC meeting, before starting to cut interest rates toward the middle of next year.

CME FedWatch Tool showed the probability of keeping the current interest rate rose to 90.5%, higher than 80% one month ago.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

amicable Elk_6351 : Market will pump tomorrow. Period

intuitive Jackal_354 : pump in the morning and sell-off in the afternoon

Yangon bull amicable Elk_6351 : I don’t think so.How do you approve your suggest? Look at AVGO for AI future

amicable Elk_6351 : From reading books and studying , there is nothing new under the Sun. Most data is made up to follow agenda. Agenda is for market to go higher.