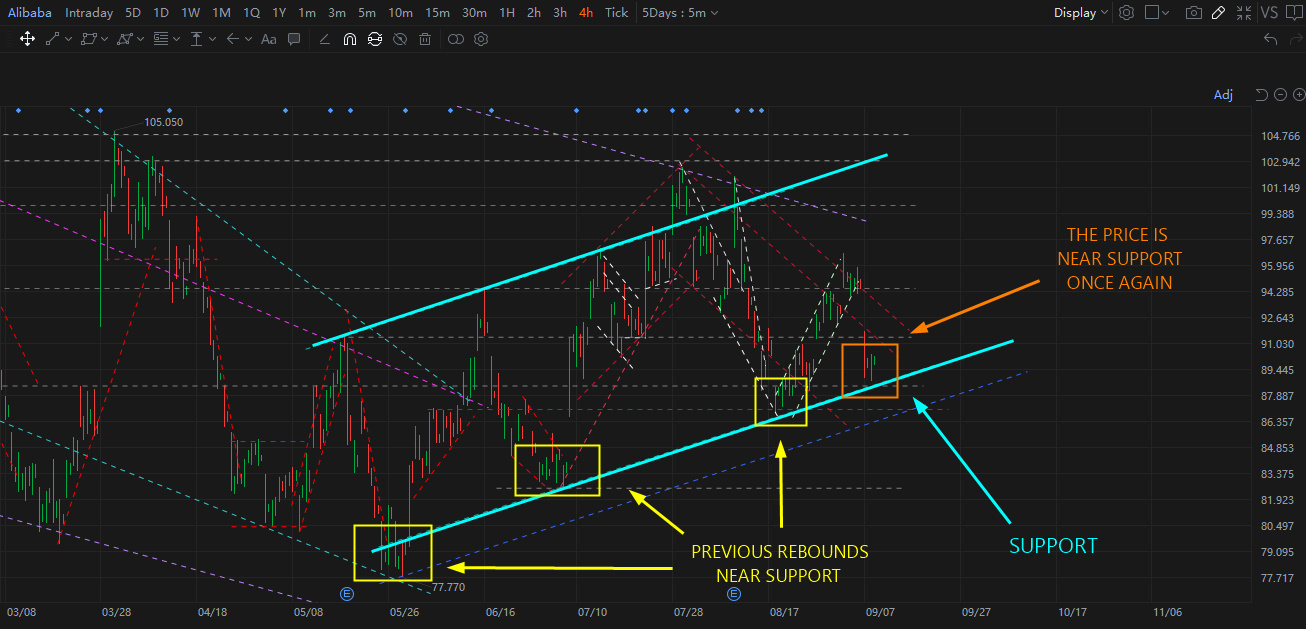

BABA is back at support on once again. Will we see another bounce off of this trending support level? The price action has rebounded a few times in the past at this imaginary line. If the price drops below this trending support level and makes lower lows than mid-August, then the picture will look much more bearish. But as for right now, the short-term trend is still upward.

102640653 : Expecting a new uptrend to be formed testing higher resistance of 120-125 level . May take a while to get there but formation of last few months looked good for a rise to this resistance level accompanied by a better result in august .

SpyderCall OP 102640653 : sounds good to me So far it is still moving upward. below 83$ would worry me

So far it is still moving upward. below 83$ would worry me

SerendipityStockPick : hi SpyderCall, how do you add poll survey on your comment?

102640653 : A nice formation on Alibaba chart . If it hold n bounces up from today low then it’s strong

SpyderCall OP SerendipityStockPick : You can only do it on android or ios. Not PC.

SpyderCall OP SerendipityStockPick :

SpyderCall OP SerendipityStockPick : That is android. Some features on its are slightly different but not much

SpyderCall OP 102640653 : That trend has been holding for quite a while. I don't see any reason why it shouldn't keep holding YET.

SpyderCall OP SerendipityStockPick : maybe you can do it on a Huawei phone. I'm not sure

黄珊 : Alibaba should not be suitable for admission at this time, right?