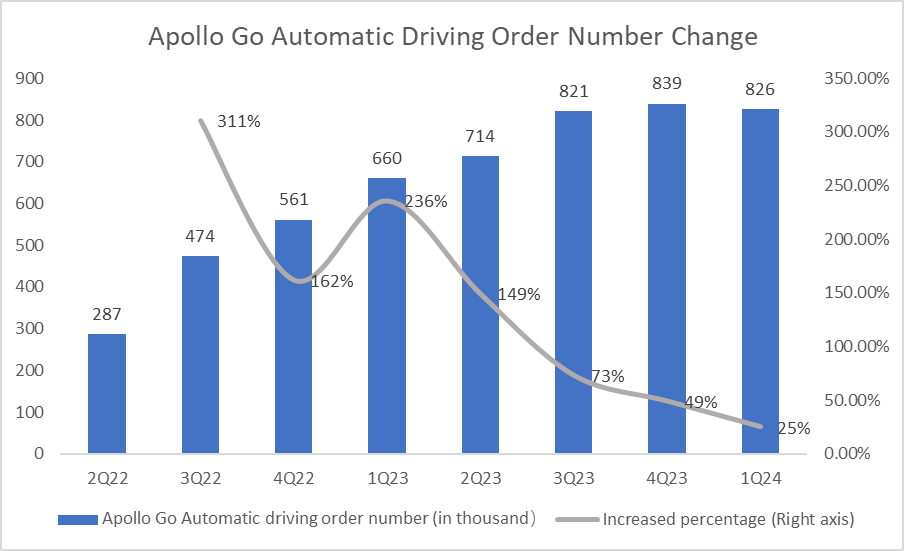

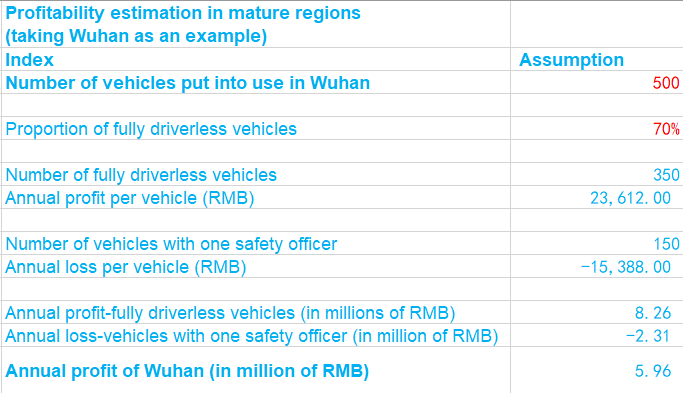

At the end of June, the Beijing Municipal Bureau of Economy and Information Technology issued the "Beijing Regulations on Autonomous Driving Vehicles (Draft for Comments)" and publicly invited opinions from all walks of life. This move further enhanced the market's confidence in investment in autonomous driving-related companies. According to data disclosed by Baidu at the ApolloDay2024 conference, as of April 19, 2024, ApolloGo has processed more than 6 million orders, and its business scope covers 11 major cities including Beijing, Shanghai, Guangzhou, and Shenzhen. In Beijing, Wuhan, Chongqing, Shenzhen, Shanghai and other cities have launched fully unmanned autonomous driving travel services and tests.