$Bakkt Holdings (BKKT.US)$ you have to understand that this ...

$Bakkt Holdings (BKKT.US)$ you have to understand that this information leaked out and it may or may not be true. but I can tell you in an all stock deal he's not going to pay up from a stock that was $10 to 36 he's not going to pay 360% which is the current market price of the stock plus a premium to acquire the company vs where it was yesterday.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

mercyformoney : Why not? Trump is loaded $

mercyformoney : It's like saying no one will ever buy TSLA stock because it's overpriced

10baggerbamm OP mercyformoney : okay both of those statements make no sense. my point is I've done this long enough to understand that if you're going to do a deal it's tight-lipped behind doors you have an NDA signed and nobody says shit if it's leaked out the deal is busted. if you have a stock with a market cap I'm just going to pick a random market cap of a billion dollars and you're thinking okay we'll give you a 20% premium to your Market to acquire your company will pay you 1.2 billion dollars.

and we'll do it as a stock deal for every one share of our stock that closes on this date at $30 you're going to get a percent per share of our price which equates to the acquisition price per share that we agree to.

now you have this story that leaks and the stock goes from 10:00 to $36. I can assure you that the company who stock just went up 360% is not going to be selling at a 20% premium to the price they were trading at before it leaked.

and you the company djt in this example is sure and shit not going to overpay by 340% relative to the current price that it's going up by 360%.

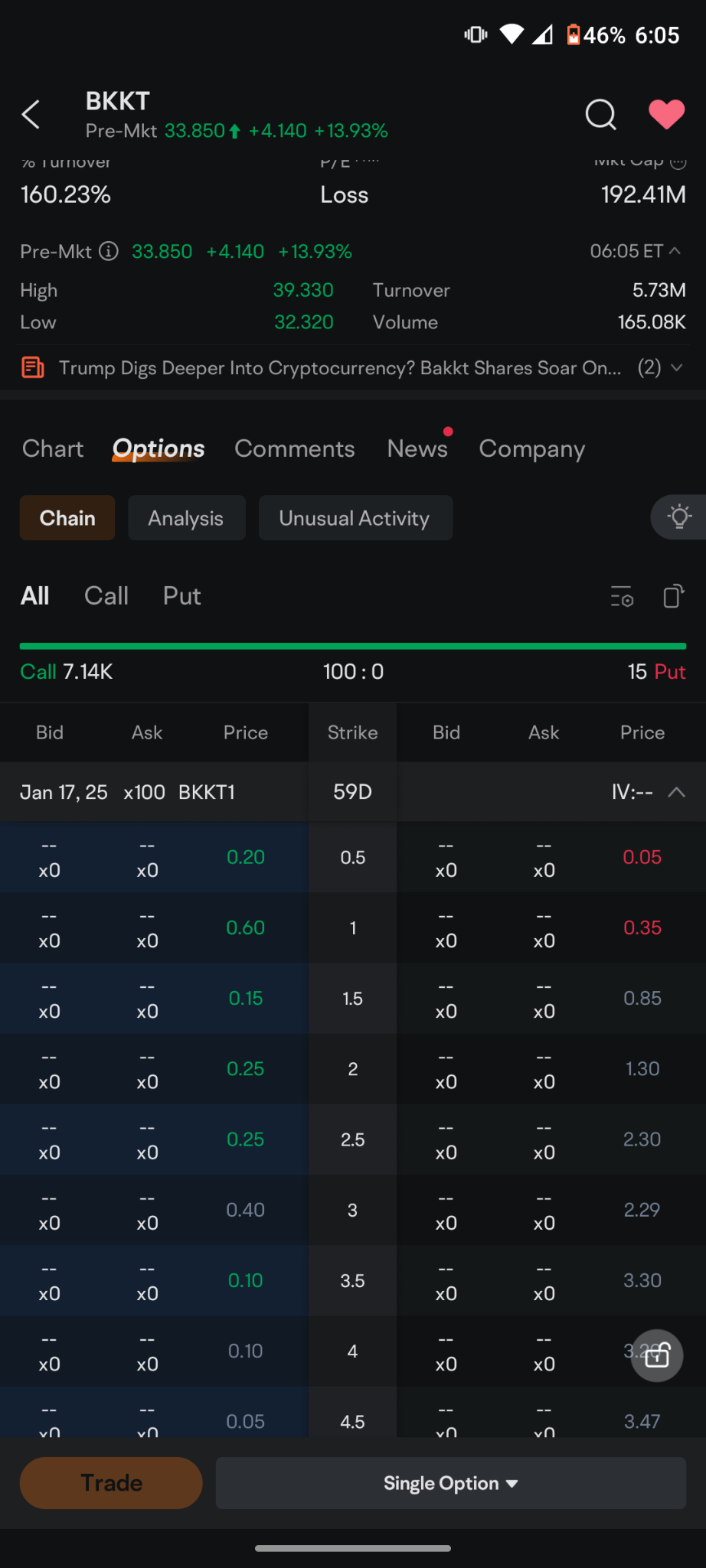

that's why to me this seems really shady and if there were put options available I think the stock's going to crash and burn in the very near future.

mercyformoney : yo look here before saying my statements make no point, while the concerns about leaks and their impact on stock prices are valid, this analysis doesn’t fully account for several key aspects of mergers and acquisitions (M&A) dynamics and stock market behavior, it's true that an acquisition deal is usually based on a pre-determined premium to the stock’s price before negotiations become public. however, market participants often speculate on leaked information, causing stock prices to rise sharply. this doesn’t necessarily invalidate the original deal. so in many cases, the acquirer adjusts its offer to reflect the new market realities, but this isn’t always a drastic change. often, if the acquirer believes in the long-term strategic value of the acquisition, they may proceed with a slightly adjusted premium. the acquirer’s management will typically weigh the short-term price spike against the expected synergies and benefits.

the assertion that a company “will not overpay” assumes rational actors and ignores strategic motives. acquirers sometimes pursue deals even at a higher valuation if the target company holds unique assets, market share, or intellectual property essential to their strategy. this is especially true in industries like technology or pharmaceuticals.

while leaks are undesirable and often against NDAs, they are not necessarily deal-breakers. sophisticated investors know how to distinguish between speculative price movements and fundamental value. regulatory bodies (e.g., the SEC) also monitor leaked deals, and companies may continue negotiations under tighter confidentiality.

mercyformoney : the idea of shorting or buying puts on the acquirer’s stock assumes the stock will crash and burn due to overpayment or failed negotiations. however, this outcome is not a given. the stock might stabilize once the market assesses the strategic value of the deal. moreover, if the leak inflates prices temporarily, the market could correct naturally without catastrophic consequences for the acquirer.

so, while leaks complicate deal dynamics, they do not inherently doom the deal or guarantee poor outcomes for the acquirer. the value of the deal, market perceptions, and strategic rationale must all be carefully weighed before concluding the stock will “crash and burn.”

The Real Wojak mercyformoney : I’ve never bought any. It is overpriced and that’s been the case for years. Lots of people made money but I stay where I’m comfortable and that’s buying stocks that are below fair value not above

Ken Griffin Charity mercyformoney : Make it less obvious that you’re using chatgpt![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

10baggerbamm OP : something very fishy here,

Jeffrey C. Sprecher, who is the Founder, Chairman, and CEO of Intercontinental Exchange (ICE), is affiliated with Bakkt as an officer.

Trump djt would not be the one leaking information out it would be the other side of the party because you have a stock that's dead that's potentially in discussions and now sores 360%.

I find it hard to believe that djt is going to make the same offer two days ago and be accepted as it would be today due to the inflated stock price. I have seen deals that are take unders go through over the years it's not often but I've seen deals that were a stock runs up and the deal is already inked and it winds up being a take under the current market price.

so play at your own peril is the only thing I'm going to tell you

Ken Griffin Charity 10baggerbamm OP : weird. I post something like this in the DJT comments and you show up all the time crying about it. Now here you are being “negative” about BKKT. Ever heard of hypocrisy?

10baggerbamm OP Ken Griffin Charity : oh and by the way I bought 3,400 shares of just over $12 yesterday and had an average sale price in the upper 27 range yesterday what have you done lately?

View more comments...