JP Morgan analyst Vivek Juneja noted in the latest report that he prefers Bank of America, which should benefit from strong investment banking fees, better trading revenues, and solid wealth management fees, plus net interest income (NII) holding up better than feared. He said Citi is likely to lag peers in trading, and have a noisy quarter with large severance charges plus revenues muddied by Argentina devaluation, along with the continued rise in credit losses. Recent media story raises questions about its progress on regulatory issues, too. Wells Fargo continues to grow its investment banking business strongly, but trading revenue growth is likely to slow sharply from 2023, partly due to some one-time items.

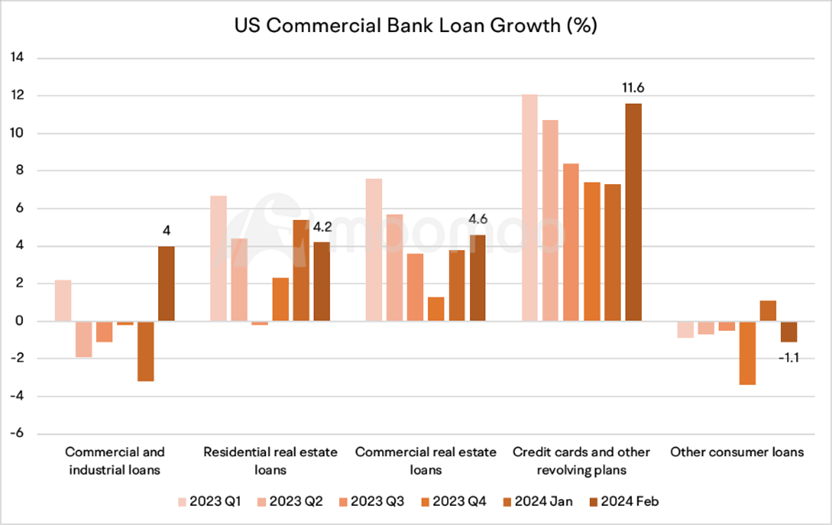

Derpy Trades : "Total delinquent CRE loans stood at $25.26 billion at the close of 2023, up 79% from a year earlier" says it all. Likely to cause the next string of bank failures.