Bank of America 3Q23 Earnings Preview: EPS expected to remain stable, while expenses continue to decline

Barclays has issued a preview of Bank of America's Q3 2023 earnings report, which is expected to be released on October 17th.

1. Valuation

Stock Rating: Overweight

Industry View: Positive

Closing Price: $27.38 (September 29th, 2023)

Target Price: $39.00

2. Earnings Preview

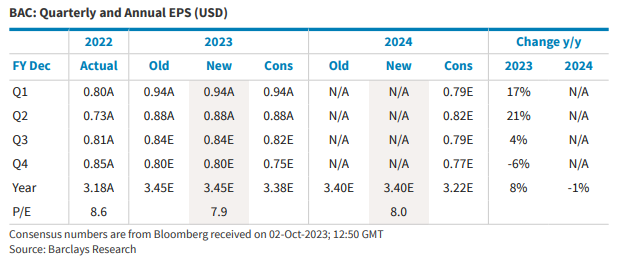

Bank of America's Q3 2023 EPS is expected to be $0.84, while the market consensus forecast is $0.82.

Expected Results: Bank of America's Q3 2023 EPS is expected to be $0.84, higher than the market consensus forecast of $0.82. Net interest income is expected to decline, but credit metrics should remain robust. Costs related to card, brokerage and service fees are expected to increase, while there may be pressure on investment banking and market-making. BAC currently has a CET1 ratio 100 bps above its January 2024 requirement and is expected to continue with share repurchases.

Expected gains/Charges: In 2Q23, BAC had net debit valuation adjustment (DVA) losses of $102mn. It booked a $197mn loss on sales of AFS debt securities, and had a $276mn litigation expense, driven by agreements reached on consumer regulatory matters ($89mn in 1Q23).

Expected Drivers: Relative to 2Q23, Barclays expect modestly lower NII amid soft loan and deposit growth, varied fee income trends, lower expenses as it manages its headcount, a higher loan loss provision though NCOs still benign, a higher tax rate, and a modestly reduced share count.

3. Key Factors to Watch

1. NII: BAC expects net interest income of $14.2-$14.3 billion for 3Q23, $14 billion for 4Q23, and slightly above $57 billion for full year 2023. Credit card business remains strong while commercial demand is slower, and deposit balances are expected to decline slightly.

Deposits: The balance is expected to remain stable or increase. Corporate deposits have become more stable and started to grow, while wealth deposits have also stabilized. Consumer deposits are being impacted by spending.

FeesBAC: expects trading to grow less than single digits year over year, with investment banking fees expected to decline 30-35% year over year but should be slightly better than the approximately $1 billion in 3Q23.

Expenses: Expected expenses for 3Q23 and 4Q23 are $15.8 billion and $15.6 billion, respectively. Total expenses for 2023 are expected to be around $63.6 billion. BAC expects the decrease in expenses for 3Q23 to benefit from reduced headcount in 2Q23.

Capital There may be more room for buybacks in the future, with a CET1 ratio of 11.4% currently, which is almost 100 bps above its minimum requirement, and it's expected to continue with share repurchases. BAC targets a dividend payout of 30%.

4. Preview Analysis Summary

Substantial improvements BAC has made in consumer bank and the benefits of technology investments provide earnings upside potential longer term. Barclays also expect further market share gains in wholesale, as BAC appears well positioned to navigate through uncertain economic environment. Price target is $39 based on 11.5x 2024 EPS estimate of $3.40.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment