Big bank earnings results coming up: What signals to expect?

Big bank earnings results coming up: What signals to expect?

Views 40K

Contents 46

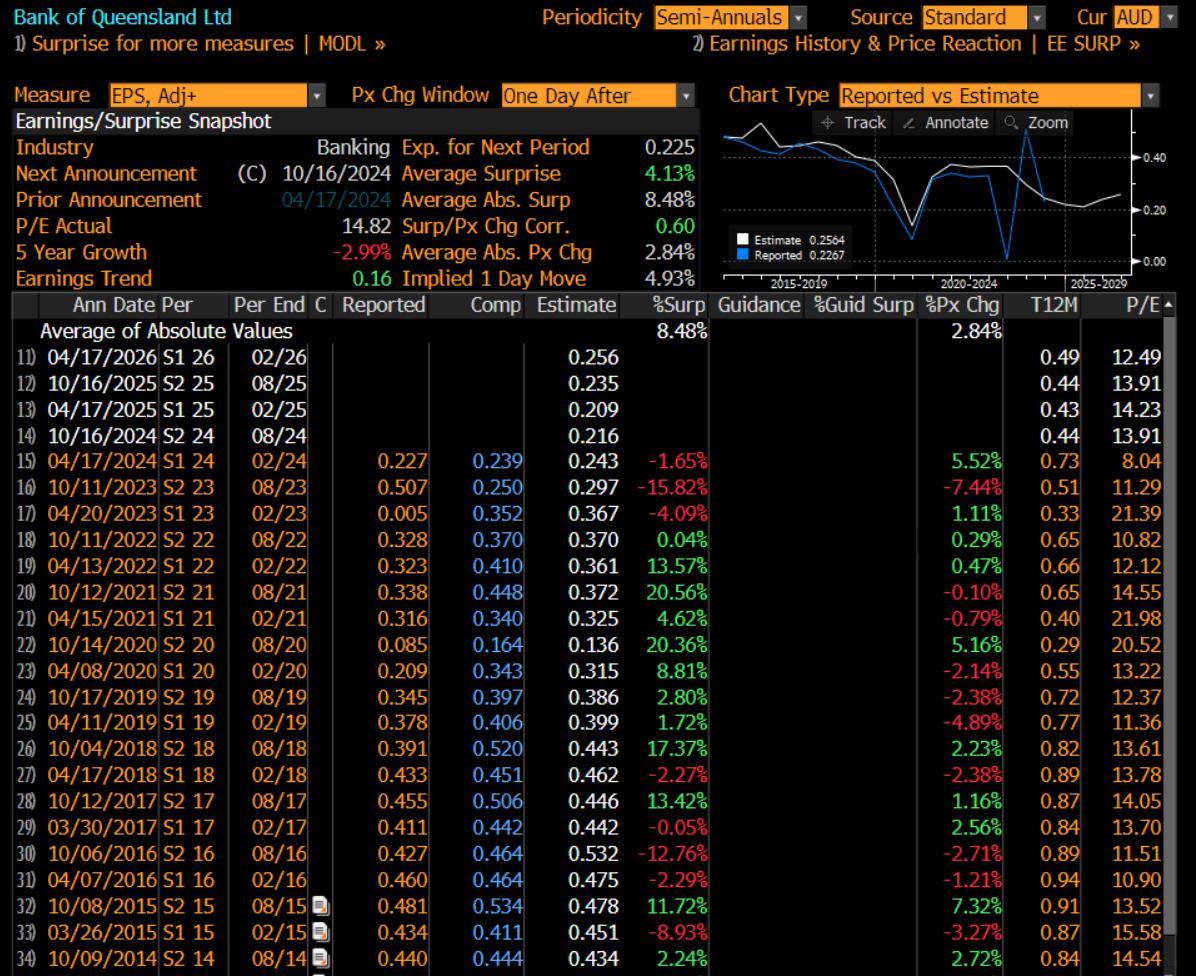

Bank of Queensland shares jump 6%, the most since October 2022 on reporting a better than expected DROP in profit. Banks generally deliver better than expected results

BOQ

$Bank of Queensland Ltd (BOQ.AU)$ shares jumped 6% after it reported cash profit for the first half-year that beat the average analyst estimate. It fell 33% y/y, to A$172 million, vs the estimate A$164.8 million. As the numbers were 'less bad than feared', its shares are rallying. And this highlights what I have been saying, and a theme that's not only likely to dominate the US earnings season, but the Australian quarterly earnings season too.

And that is...that earnings expectations for companies have been set so low, that the hurdle is easier to jump over, and we should probably see more earnings beats, which supports company's shares popping higher.I also cover that Banks generally deliver better than expected results. This reflects that maybe consensus is wrong, but also that banks earnings, are an opportunity for traders.

_________________________________________________________________

Based on its outlook and consensus estimates and comparing it to its historical average, BOQ shares seem more expensive.

So I think there are better opportunities in the market, such a commodities and defense stocks that have a lot more positive tailwinds such as fiscal spending and rising demand.

Back to BOQ... BOQ has a history of delivering better than expected results, but so too does CBA, WBC. So what does this tell you? The Australian earnings expectation bar is always low for banks. And banks generally report surprises. And thus their shares rally. Next question pleaase.

BOQ's key profit metric - why did it decline?

Its cash net fell 33% y/y driven by lending competition, higher funding costs, inflation and investment in technology.

But BOQ says it's considering additional ways to deliver FY26 ROE and CTI targets, it's seeking to address potential structural margin decline.

Another bad sign BOQ's pain is NOT over?

BOQ says it's continue to see a home lending contraction while returns remain below cost of capital. It also sees revenue and margin pressure to moderate in 2H and it sees low single digit costs growing in the second half.

But it says it's evaluating additional ways to achieve FY26 <50% CTI and >9.25% ROE targets, with less dependence on home lending margin recovery.

But in a good news, it says the Australian economy is resilient supported by strong fundamentals despite growing below the long run average.

- Statutory profit grew to A$151 million vs. A$4 million y/y

- Interim dividend per share A$0.17 vs. A$0.20 y/y

- Net interest margin on cash basis 1.55% vs. 1.79% y/y

- ROE on cash basis 5.8% vs. 8.4% y/y

- Common equity Tier 1 ratio 10.8% vs. 10.7% y/y

- Total income on cash basis A$795 million, -12% y/y

- Net interest income on cash basis A$725 million, -13% y/y

- Operating expenses on cash basis A$524 million, +5.9% y/y

What do you need to know about ratings for BOQ?

Well BOQ has 2 buys, 1 hold, 13 sells

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 18

18