BCE Earnings Preview: Grab rewards by guessing the closing price!

Hi, mooers!

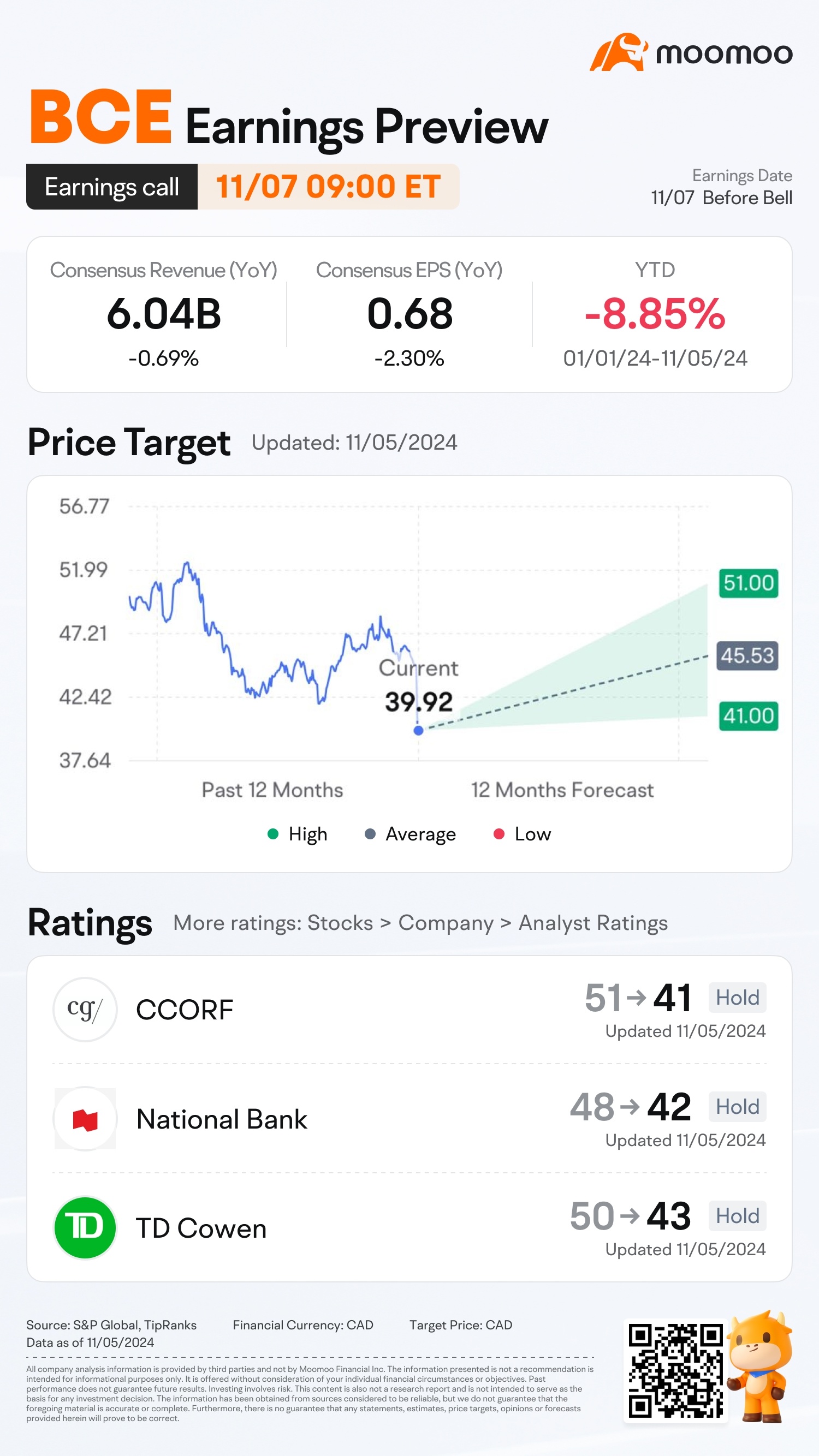

$BCE Inc (BCE.CA)$ is releasing its Q3 2024 earnings on Nov 7 before the bell. Book the conference call: BCE Q3 2024 earnings conference call

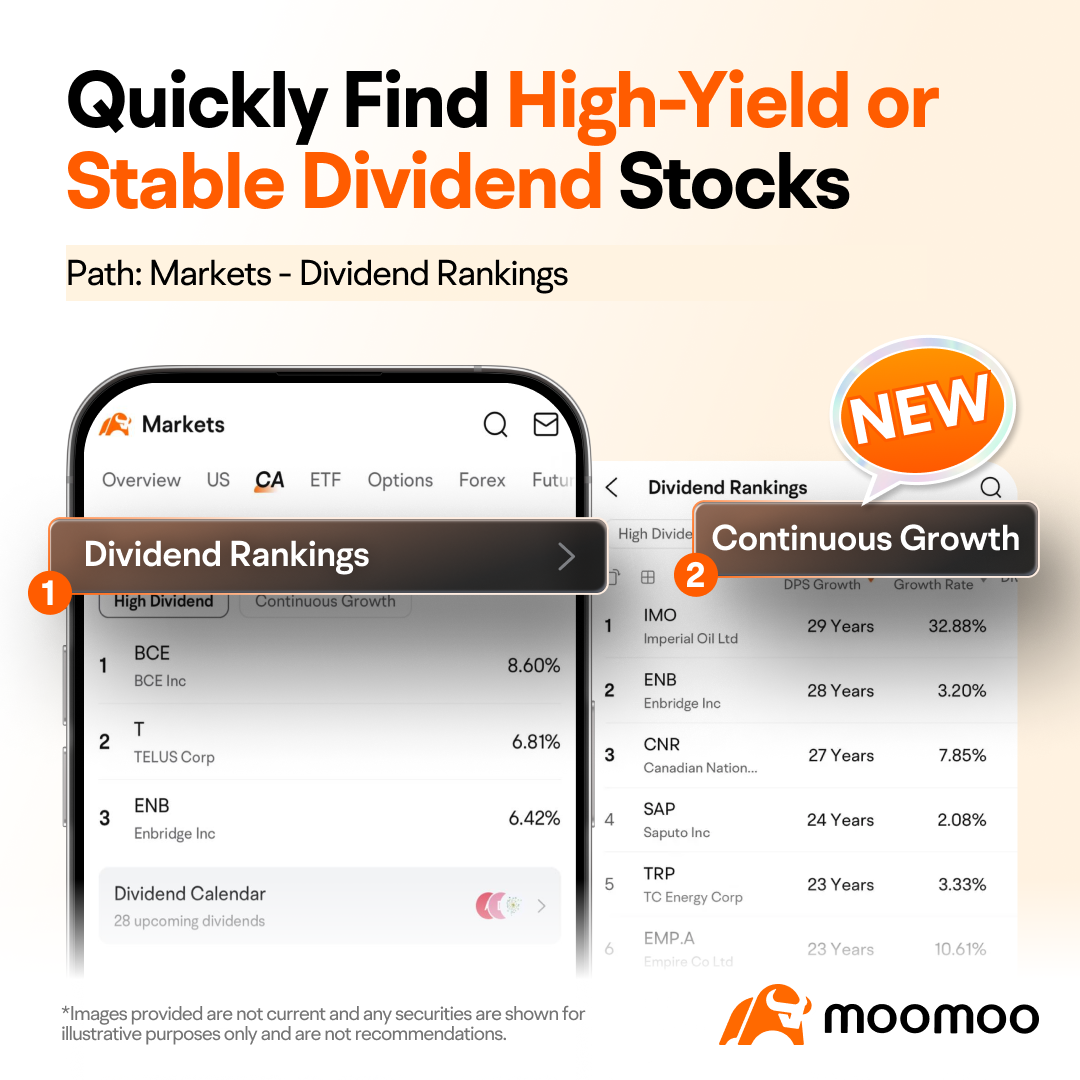

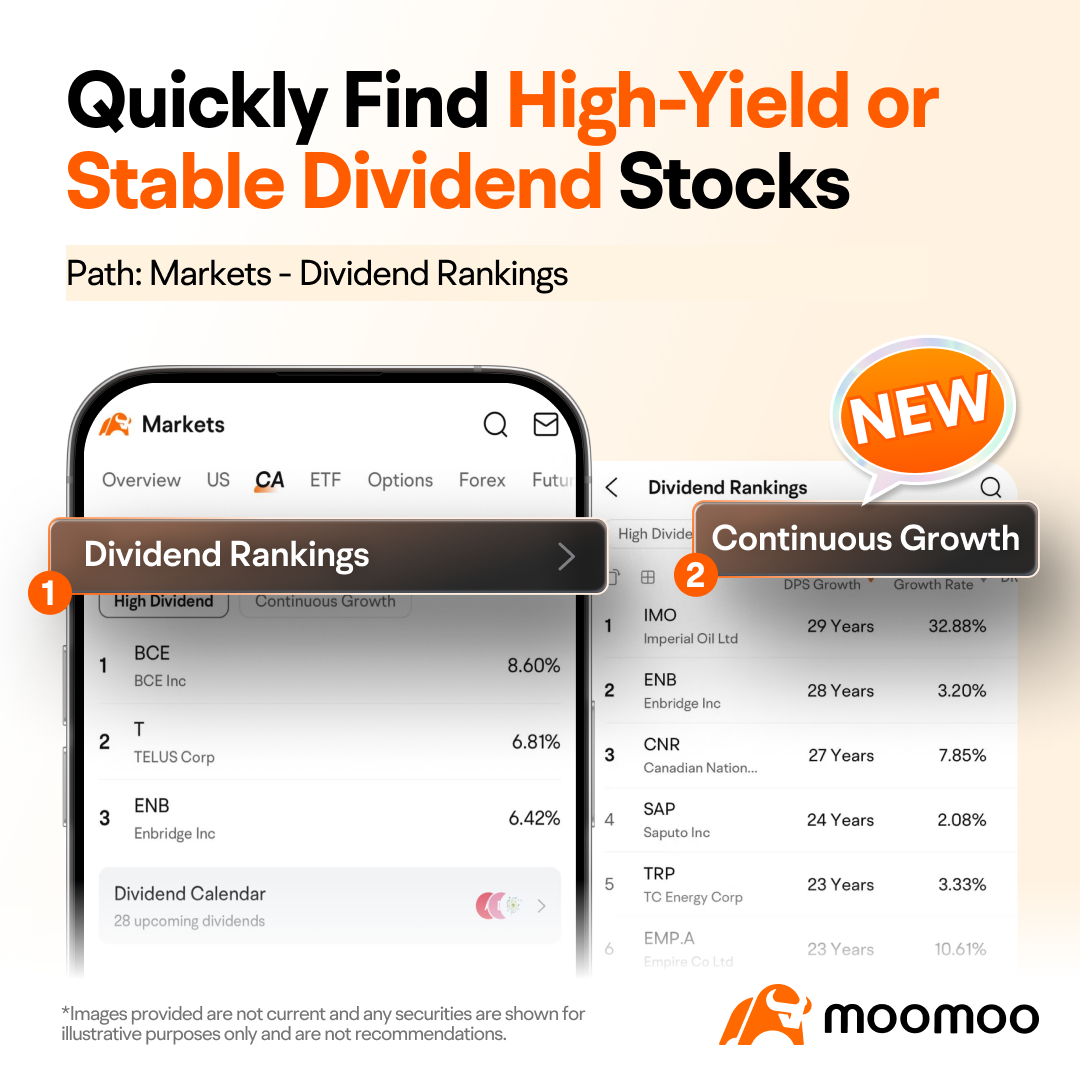

If you're interested in focusing on high-dividend stocks like this, try out Consecutive Growth feature here:

How will the market react to the upcoming results? Make your guess now!

Rewards

🎁 20 points: For mooers who correctly guess the price range of $BCE Inc (BCE.CA)$ 's closing price at 16:00 PM ET Nov 7.

(Vote will close on 15:59 ET November 7)

🎁 Exclusive 300 points: For the writer of the top post on analyzing $BCE Inc (BCE.CA)$ 's prospects.

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Skyrye7 : BCE Inc., a leading Canadian telecommunications and media company, has shown positive earnings prospects due to several key factors. The company has reported steady growth in revenue and profitability, largely driven by strong performance in its wireless and broadband services. The expansion of BCE’s 5G network and its focus on digital media and content have bolstered its position in a competitive market, with increased customer demand for reliable high-speed connectivity post-pandemic contributing significantly to revenue streams.

Additionally, BCE’s strategic investments in fiber-optic infrastructure and its partnerships with media platforms are expected to enhance customer acquisition and retention, supporting long-term revenue growth. Cost optimization efforts and a stable dividend policy further contribute to positive investor sentiment. These factors make BCE a potentially attractive investment for those seeking steady returns from a mature telecom player with robust growth avenues in Canada. However, risks related to regulatory changes and market saturation should be considered.

Lucas Cheah : $BCE Inc (BCE.CA)$ - Earnings Prospects

1. Strong Position in Telecommunications

BCE Inc., one of Canada’s largest telecom providers, benefits from its stable revenue base in wireless, broadband, and media services. The demand for high-speed internet and data services supports consistent revenue growth, especially as 5G adoption expands.

2. Expansion in 5G and Fiber Networks

BCE’s investments in 5G infrastructure and fiber optic networks are expected to enhance its competitive edge and support future revenue growth. These upgrades improve service quality, positioning BCE to capture more market share as demand for high-speed connectivity rises.

3. Attractive Dividend

BCE is known for its high dividend yield, supported by steady cash flows from its telecom services. This makes it attractive to income-focused investors, though continued dividend growth depends on earnings stability and managing capital expenditures effectively.

4. Regulatory and Competitive Risks

BCE faces regulatory pressures and competition from other telecom providers. Additionally, high capital expenditures for 5G and fiber expansion could pressure margins, especially if economic conditions tighten.

In summary, BCE has solid earnings prospects due to its stable telecom revenue, 5G and fiber network expansion, and attractive dividend yield. However, regulatory challenges and capital expenditure demands present potential risks to profitability.