Wall Street Today | Economists Lift US Growth Forecasts, See Fed Higher for Longer

MACRO

Economists Lift US Growth Forecasts, See Fed Higher for Longer

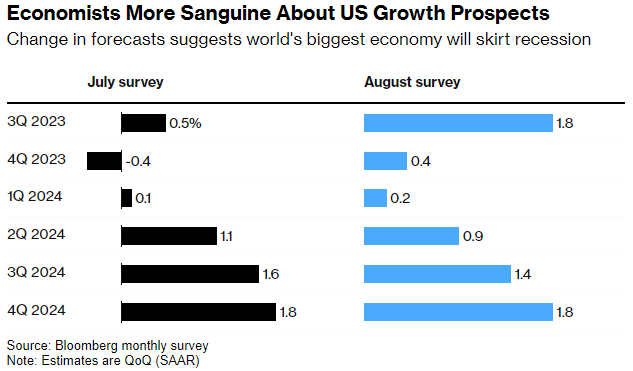

Economists see a stronger US economy into the next year and a smaller rise in unemployment, supporting expectations that the Federal Reserve will keep interest rates higher for longer.

Gross domestic product is expected to advance an annualized 1.8% in the third quarter, nearly quadruple the 0.5% pace projected in July, according to the latest Bloomberg monthly survey of economists. They also see the economy expanding somewhat in the last three months of the year, rather than contracting.

BofA's Warning of a '5% World' Sinks in With Yields Pushing Higher

All around the world, bond traders are finally coming to the realization that the rock-bottom yields of recent history might be gone for good.

The surprisingly resilient US economy, ballooning debt and deficits, and escalating concerns that the Federal Reserve will hold interest rates high are driving yields on the longest-dated Treasuries back to the highest levels in over a decade.

10-Year Bonds Yields Are Highest Since 2007

A selloff in government bonds has pushed the yield on the 10-year Treasury note to its highest level in 16 years, yet investors needn't rush to buy, some experts say.

The 10-year yield hit 4.32% on Thursday as investors digested the possibility that inflation will persist above the Federal Reserve's target rate of 2%.

SECTORS

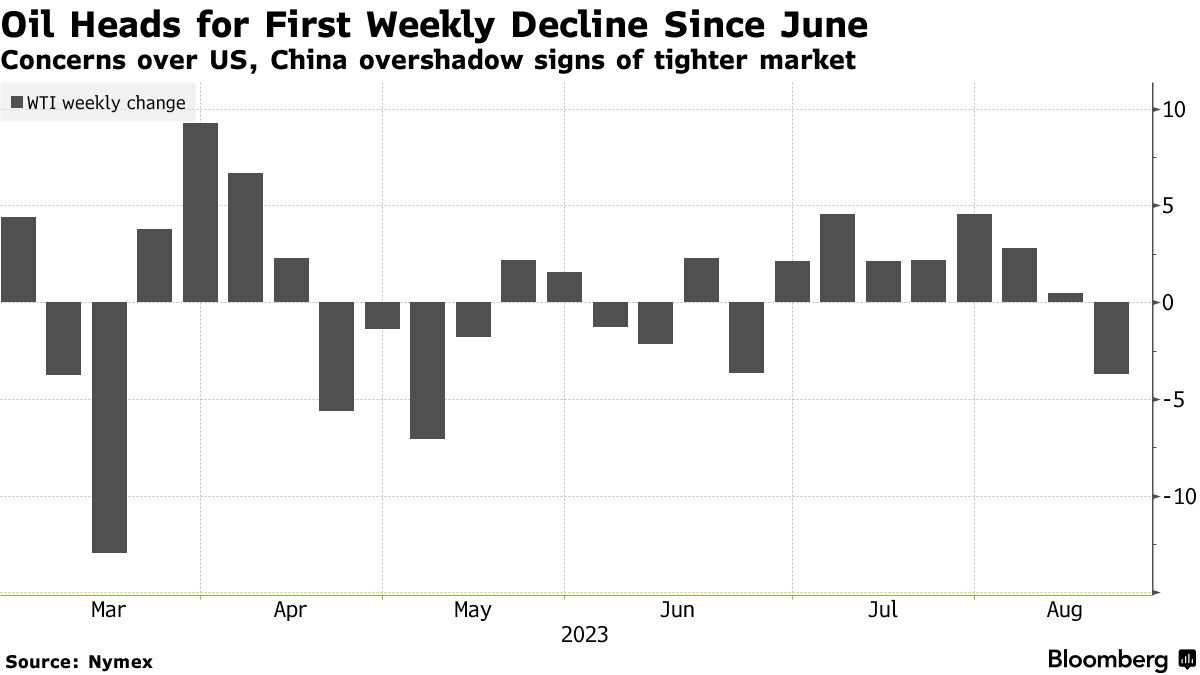

Oil Snaps Weekly Winning Streak as Focus Shifts to Economic Woes

Oil posted its first weekly loss since June as low trading volumes left the market vulnerable to macroeconomic concerns, overshadowing signs of a tight physical environment.

West Texas Intermediate settled just above $81 a barrel, down nearly $2 for the week, as poor economic data. The gloom has eclipsed signs of a tighter crude market, including US stockpiles that declined to the lowest level since January.

COMPANY

XPeng Stock Tumbles. Something Other Than Earnings Is Leading It Lower

$XPeng (XPEV.US)$, the Chinese electric-vehicle maker, beat second-quarter bottom-line earnings estimates. Guidance for the third quarter also was pretty good, but it wasn't enough to boost the stock price.

XPeng reported a second-quarter per-share loss of 22 cents from sales of $700 million, while Wall Street was looking for a loss of 31 cents a share from sales of $707 million. A year ago, XPeng reported a 46-cent loss from $1.1 billion in sales.

Lyft CEO David Risher Says His Stock Buy Is 'Best Investment'

$Lyft Inc (LYFT.US)$ has been playing second fiddle to its larger ride-hailing rival, but new CEO David Risher bought a large block of stock backed by his optimism for the company.

Lyft stock cratered 74% in 2022, far worse than the 41% drop in $Uber Technologies (UBER.US)$ stock. Both have recovered in 2023, but that has been lopsided, as well, with Lyft stock rising 1% compared with Uber stock's 80% surge.

These Institutional Investors Have Increased Their Positions in AMC

Jane Street Capital and National Bank Financial have increased their positions in $AMC Entertainment (AMC.US)$, according to FactSet data.

AMC's top institutional holder is The Vanguard Group Inc., with almost 9.6% of shares outstanding, followed by BlackRock Fund Advisors , with almost 3.6%, according to FactSet data.

X Will Remove Block Feature, Musk says, Setting Up Possible Showdown With Apple and Google

Elon Musk's declaration on Friday that he would remove the block feature on X, the social-media platform formerly known as Twitter, could jeopardize its spot on $Apple (AAPL.US)$'s App Store and $Alphabet-C (GOOG.US)$'s Google Play.

Source: Bloomberg, Dow Jones, CNBC, Financial Times

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101814969 : An interesting article that is 'contradicting' in terms of the contrasting economists' outlook on the 'growing' economics vis a vis depressing oil price due to persisted poor outcome of the same economy based on some poor data.

So, which is which? Confusing, isn't it?

This is a good example of reporting without analysing whether it is actually helping the readers or confusing them if they read with a thinking cap. In another words, it helps if the writer don't just cut and paste without adding comments on any contradiction.

Perhaps, some may blame it on the market place as it's never perfect! So, for these guys, there's opportunity to make money in the oil sector if the economists are correct but we never know as they're prone to go wrong too.

So, more confusing than ever? Think about it!

Enjoy your weekend while you ponder a little about the outlook, maybe over a cuppa tea or coffee, before we start another week. Good luck!

lightfoot : I am fearful that Washington is misleading facts on the economy. They are overdoing high interest rate increases. Predicated on my analyses, we are entering a CRASH situation. The economy is not growing. We rely on estimates not Applied Science. We are again putting liberal politics ahead of Applied Science. DANGER ZONE

一路有你相伴 101814969 : Some of the economists' theories are probably entirely for Wall Street. Think about the 2008 subprime mortgage crisis

Cypher : The article on the Lyft stock section said and I’m

paraphrasing, Lyft has lost 74% in 2022 but in 2023 it has “recovered.” For it to recover it will need to rally about 185%, which obviously hasn’t been the case. Lyft is flat year to date. What kind of poor article is that?