Beneficiary Sectors & ETFs Under Harris Policy Blueprint |Moomoo research

In the complex landscape of global political and economic affairs, Kamala Harris's emergence has undoubtedly drawn widespread attention. As the Democratic presidential candidate, her policy ideas and future plans are becoming key research subjects for markets and analysts.

Harris's background, personal experiences, and her stance on various critical issues will profoundly impact the future political and economic landscape. This article delves into these factors, helping investors better understand and respond to the imminent changes.

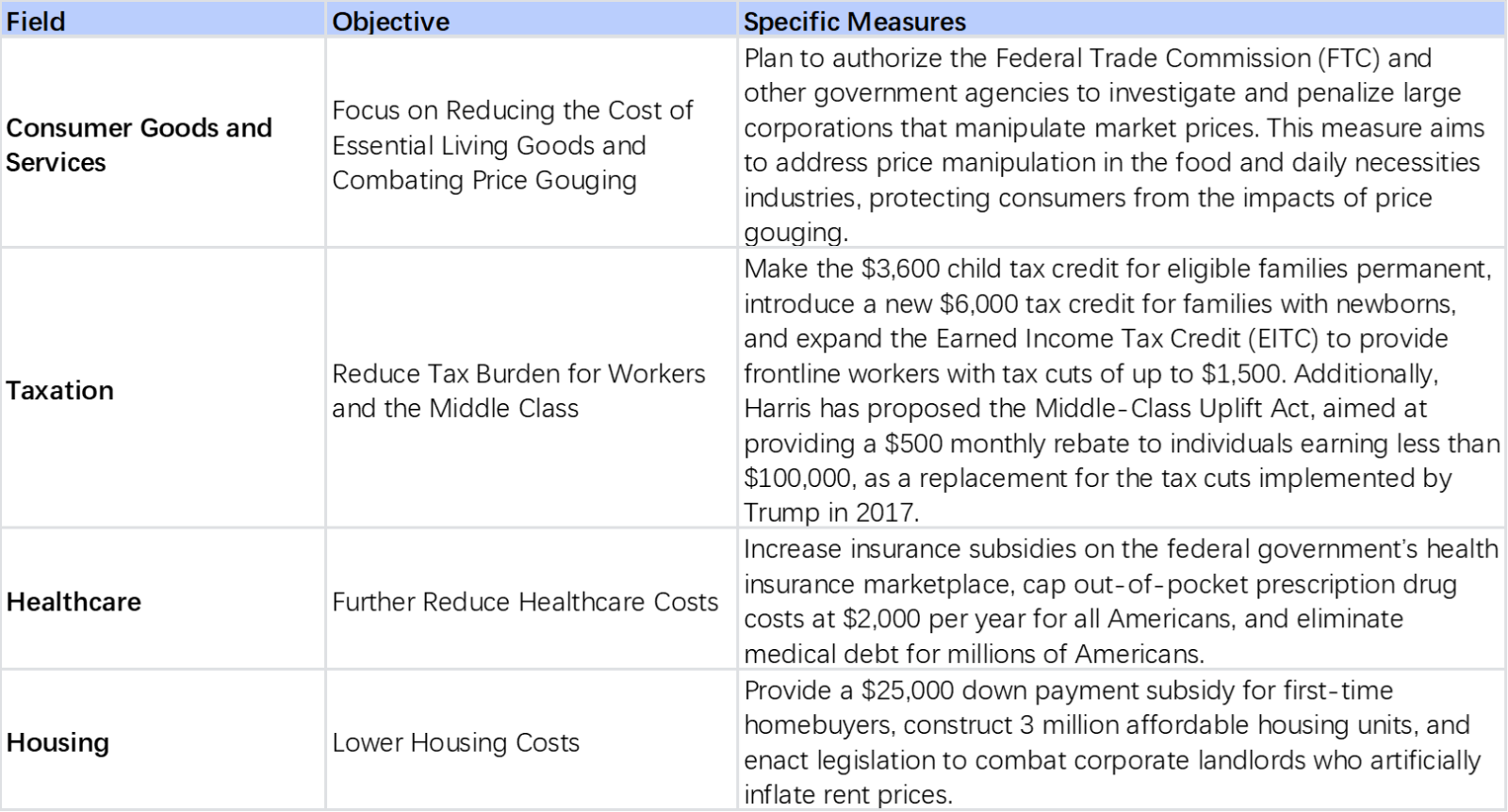

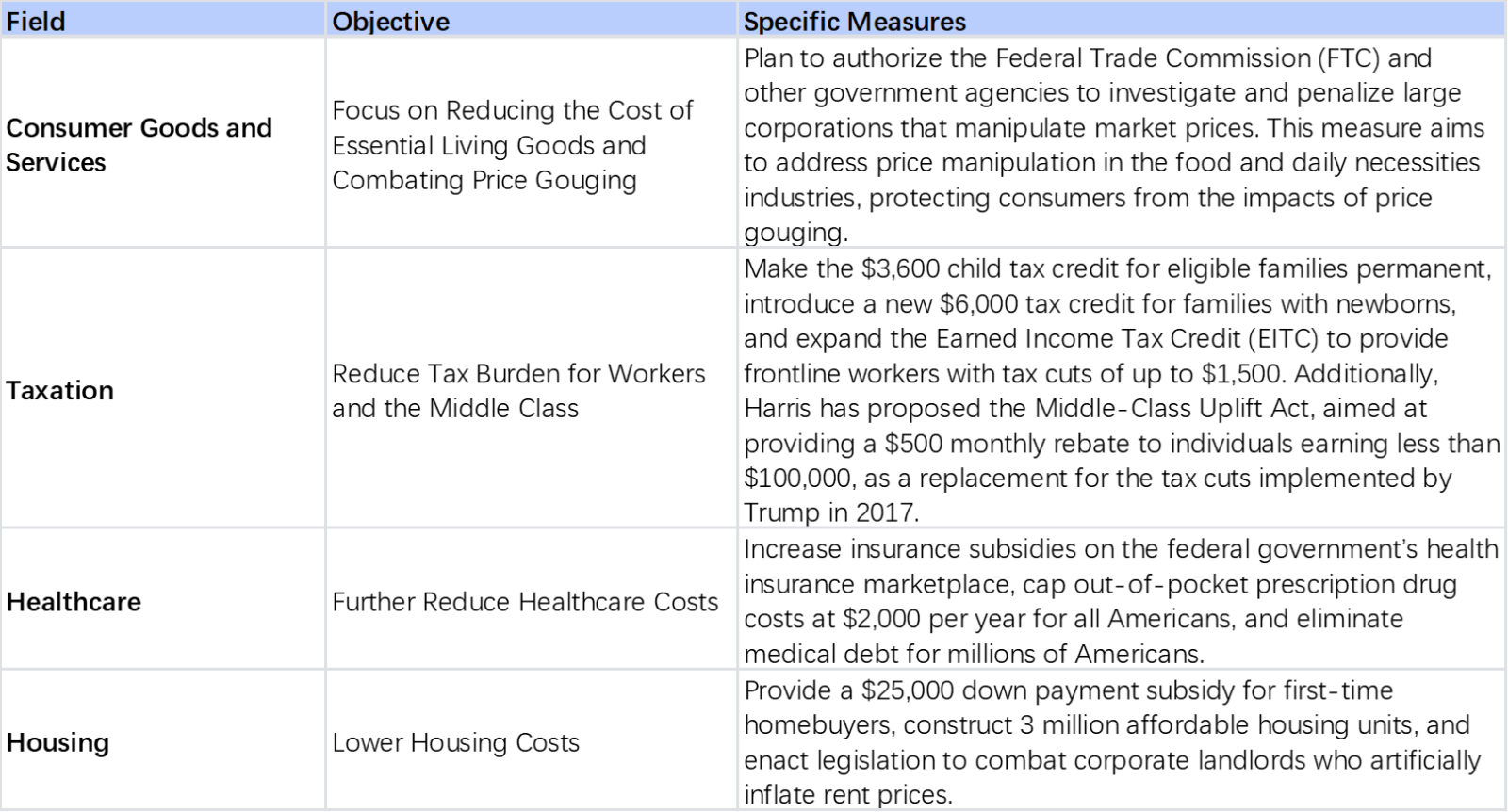

I. Harris's Economic Policy Agenda: A Comprehensive Battle Against Living Costs

On August 16th, U.S. Vice President and Democratic presidential candidate Harris delivered her first economic policy agenda speech at a rally in North Carolina. The speech centered on "reducing the living costs of American families," aiming to build an economy where "everyone can compete and truly have the opportunity to succeed, to create wealth for themselves and their children, rather than just making ends meet."

The core of this agenda is to lower the living costs of American families, with a particular focus on food, taxes, housing, and healthcare. Specific measures include:

II. Harris's "New Agenda" & Investment Opportunities

Next, let's discuss in detail what investment opportunities might arise from these political proposals by Harris.

Clean Energy and Environmental Protection

Policy Background: Harris proposes a $10 trillion climate plan aimed at accelerating America's transition to a green economy. The plan sets the following targets: zero emissions for all new buses, heavy vehicles, and fleets by 2030; zero emissions for all vehicles by 2035; carbon neutrality for all new buildings by 2030; and a carbon-neutral grid by 2030. Additionally, Harris plans to end subsidies for the fossil fuel industry, stop issuing new fossil fuel leases, strengthen federal regulations to ensure corporate compliance, and implement an escalating fee system on corporate carbon emissions to promote reductions.

Beneficiary ETFs:

Infrastructure&Housing

Policy Background: Harris is likely to continue Biden's infrastructure plans, increasing investments in roads, bridges, public transit, and internet infrastructure. This will help improve the overall level of domestic infrastructure in the U.S., promoting economic growth and employment.

Harris prioritized affordable housing, advocating for the Rent Relief Act, offering tax credits to renters earning under $100,000, aiming to ease housing cost burdens.

Beneficiary ETFs:

Tax Policy

Policy Background: During her campaign, Kamala Harris proposed replacing Trump's tax cuts with a monthly refundable tax credit known as the LIFT the Middle-Class Act, which would benefit individuals earning less than $100,000 per year.

Harris critiqued Trump’s tax cuts, arguing that they favored the wealthy and asserted that while the stock market was thriving, this growth did not translate into benefits for the middle class.If the middle class gets better off, ETFs like $Invesco S&P Smallcap Consumer Discretionary Etf (PSCD.US)$ should benefit.

Marijuana

Policy Background: Kamala Harris urged the DEA in March this year to expedite the rescheduling of marijuana, criticizing its current Schedule 1 classification as "absurd" and "patently unfair." She put stress on the need for swift action and highlighted ongoing efforts toward rescheduling.

Beneficiary ETFs:

Cryptocurrency

Policy Background: Since Kamala Harris became the Democratic presidential nominee, the cryptocurrency industry has been hoping for a "reset" with the White House. There are indications that Harris's stance on cryptocurrencies may be more favorable than that of President Joe Biden.

According to the Financial Times, her advisors have begun reaching out to major cryptocurrency firms such as Coinbase, Circle, and Ripple Labs, aiming to mend relations between the Democratic Party and the industry. This effort is intended to bolster her tech appeal and secure the votes of cryptocurrency supporters. However, the exact contours of her potential approach to the sector may remain a mystery for some time. If Harris expresses a clearer pro-cryptocurrency stance going forward, cryptocurrency-related ETFs could stand to benefit.

Beneficiary ETFs:

In summary, Kamala Harris's governance philosophy and policy directions not only extend the core policies of the Biden administration but also demonstrate her unique leadership style and innovative thinking. Whether in environmental protection, infrastructure, or public health, these policies indicate new changes. These policies bring new opportunities for investors, and by deeply understanding and analyzing Harris's policies, investors can better grasp market dynamics and make informed investment decisions.

As a master once said: "The enhancement of cognition comes from insight into the future and the keen capture of changes."

We have previously published an article on the ETF sectors that are expected to benefit under Trump's policy blueprint. Interested investors can click to read.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment